- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Score increase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score increase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score increase

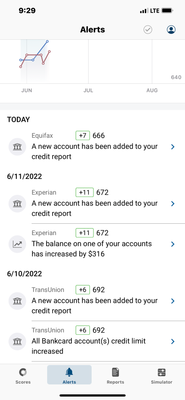

In the last 2 months i have applied and been approved for 9 cards, my discover just reported and it cause my Experian score to jump 11 points how does that happen? Reporting $0 balance with 6k cl On that card alone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase

@Murph5065 wrote:In the last 2 months i have applied and been approved for 9 cards, my discover just reported and it cause my Experian score to jump 11 points how does that happen? Reporting $0 balance with 6k cl On that card alone.

It doesn't.

Something else caused the score to jump.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase

It could be that your overall utilization went down as a result of having 9 new accounts with presumably 0 balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase

@SouthJamaica wrote:

@Murph5065 wrote:In the last 2 months i have applied and been approved for 9 cards, my discover just reported and it cause my Experian score to jump 11 points how does that happen? Reporting $0 balance with 6k cl On that card alone.

It doesn't.

Something else caused the score to jump.

I have had balance increases on the cards i use high balance on all and still 2 baddies reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase

Even then with an understanding of the Scoring Primer, you will have many other changes in the near future with the other 8 accounts populating onto your CRA reports.

I would say attempting to wait and see how these various changes shake out over the next week or two.

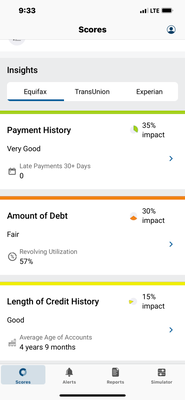

At the least, in the long term, adding many account all at once with the intention of keeping them open as long as possible, you could affect your AAoA in such a positive way that years done the line when adding a newer account once in a while will not dramatically drop the AAoA scoring factor thus retaining more FICO points.

All of the being a given, I have no idea what your current average age of accounts is but I would to say...

Congratulations on your many approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase

@Credit4Growth wrote:

@Murph5065Honestly, a more indepth and detailed explanation and review of your profile is needed to determine which changing factor caused the increase.

Even then with an understanding of the Scoring Primer, you will have many other changes in the near future with the other 8 accounts populating onto your CRA reports.

I would say attempting to wait and see how these various changes shake out over the next week or two.

At the least, in the long term, adding many account all at once with the intention of keeping them open as long as possible, you could affect your AAoA in such a positive way that years done the line when adding a newer account once in a while will not dramatically drop the AAoA scoring factor thus retaining more FICO points.

All of the being a given, I have no idea what your current average age of accounts is but I would to say...

Congratulations on your many approvals!Here is the averages of all 3 from my fico