- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Self Lender slow to update with credit bureaus

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Self Lender slow to update with credit bureaus

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self Lender slow to update with credit bureaus

As the title states, I haven't seen my credit profile be updated monthly as expected. Experian was last updated in December and I've made three payments since then. EQ and TU were last updated in January. Kinda frustrating, as it affects my score and I'm trying to buy a house, so any little bit helps right now. Anyone experienced this with Self?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

I had that experience constantly with Self. They were inconsistent in reporting to all three bureaus, and even on occasion skipped a month or two. I had to write their CEO on several occasions to get the reporting sorted out. While I don't regret using them when I did, I don't know that I can really recommend them. The SSL from NFCU is far superior.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

Mine was last updated on Experian in December as well. I don't actively monitor the the other credit bureaus though, so no idea when they updated. The only reason I got the Self lender loan was to improve the payment percentage. So, I don't think that will be affected even if they report infrequently. Even if it updates in April, it should show on-time payments for January, February and March then. But you'd expect better reporting on a credit product most people only use for the reporting.

First goal (December 2020): 580 (TU)

Second goal (August 2021): 670 (TU)

Current scores: 679 (TU), 665 (EQ), 658 (EX)

Current goal: All three bureaus over 670

Declined credit cards: First Premier Bank, Verve, Self, Credit One, Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

@rbentley wrote:I had that experience constantly with Self. They were inconsistent in reporting to all three bureaus, and even on occasion skipped a month or two. I had to write their CEO on several occasions to get the reporting sorted out. While I don't regret using them when I did, I don't know that I can really recommend them. The SSL from NFCU is far superior.

Good to hear that so I don't get overexcited again and snag Self because it's easy to get when what I want is to add the SSL from NFCU next. Even though it's small and completely self-funded in its being secured, I'm giving it a few weeks before my next HP having 😢😜 overdone it in the past few weeks. I'm trying to wait for my two new Secured Cards totaling $2K to be reported and then reflected in my CS. Then apply fir the SSL w NFCU. 🤩🤩🤩

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

@Anonymous they usually update at the end of the month and the bureaus will process updates at the beginning of the following month. And they do two updates. They update that you made a payment and then update the balance/"green check mark" later. So I guess it depends on where you are looking? The payment history table? I would worry the least about that and look at the meat of the account info instead.

It never failed for me or my SO to update twice a month. He finished his Self Lender in Feb (last month) and it updated with zero issue, every month. I finished my Self Lender last August. It was also nice with the slight delay because that last month you can enjoy the under 10% util longer and it won't just close and drop off straight away...dropping your scores down for having a closed installment loan and no more low util on installment loan... so consider it a gift later on. It depends on your due date, but mine was the 2nd and his was the 5th of the month. When is your due date?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

My payment is the 2nd of every month. I've been looking at my reports and though I'm 9 months in, Experian last reported my December payment. If I'd paid better attention, I would've done the ssl with navy. Being so close to getting a house, though, that won't be necessary once I'm done w self. I'd just like it update so my score could see a bump leading up to closing on a house.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

Hi there!

We compile your credit data at the end of every month, and report it to all three credit bureaus at the start of the following month. It is up to the individual credit bureaus when they will post the data, but it will typically appear in the second half of the month. For example, your February credit data will likely appear on your credit report in the second half of this month! We also recommend using a combination of personal finance tools to maintain an updated picture of your overall credit health.

If you have any questions or concerns about your account, feel free to reach out to us directly at help@self.inc. We'd be happy to take a look into the situation for you to ensure accuracy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

I also just sent them an email with the same problem. Especially experian not reporting since Dec. I need it to report. My Discover It Sec should be coming up for review after this months statement.

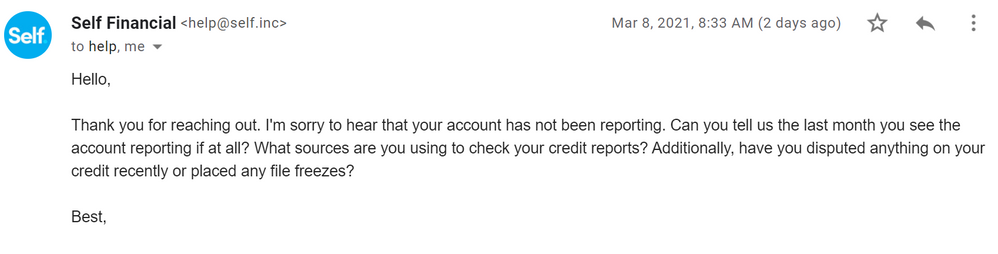

Here was their reply on Mar 8 2021

"Hello,

Thank you for reaching out. I'm sorry to hear that your account has not been reporting. Can you tell us the last month you see the account reporting if at all? What sources are you using to check your credit reports? Additionally, have you disputed anything on your credit recently or placed any file freezes?

Best,"

I answer, no disputes-no freezes and sources as MyFico 3B reports, Experian.com website and Credit Wise.

No reply back yet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

@Anonymous wrote:Hi there!

We compile your credit data at the end of every month, and report it to all three credit bureaus at the start of the following month. It is up to the individual credit bureaus when they will post the data, but it will typically appear in the second half of the month. For example, your February credit data will likely appear on your credit report in the second half of this month! We also recommend using a combination of personal finance tools to maintain an updated picture of your overall credit health.

If you have any questions or concerns about your account, feel free to reach out to us directly at help@self.inc. We'd be happy to take a look into the situation for you to ensure accuracy!

I also have the same descrepency for the EXACT same months. I already sent an email and here was the reply from self.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Self Lender slow to update with credit bureaus

@Anonymous wrote:My payment is the 2nd of every month. I've been looking at my reports and though I'm 9 months in, Experian last reported my December payment. If I'd paid better attention, I would've done the ssl with navy. Being so close to getting a house, though, that won't be necessary once I'm done w self. I'd just like it update so my score could see a bump leading up to closing on a house.

I mean, you will not get a score bump until the final month, really, since that is when the account is under 10% util, *if* this is your only installment loan.

You may get a small score bump if you go under 60% util.

Are you crossing one of those thresholds? Being 9 months in, I do nit think you are crossing either of those thresholds.

You may have made 3 payments since December, but there is no way March will report before next month. Feb, may not even report until the end of this month, abd you are really certain Jan has not reported?

Again, are you looking just at the calander payment history section or the meat of the account details? The "check marks" are not the important part, you need to look at the actual account info above it.

Starting Score: 502

Starting Score: 502