- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: US Bank Reserved Line of Credit question...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US Bank Reserved Line of Credit question...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

US Bank Reserved Line of Credit question...

i opened a free US bank GOLD checking eariler this month and notice i was preapproved for $2,000 Reserved Line of Credit. I accidently declined and went to try to grab it again calling US Bank but hesitate it would be a hard pull. Opening a checking account was soft and thought maybe having that line of credit was a great advantage being soft pull approved. Should i close my existing checking account and open a new one and see if they offered me this Line of Credit ? i don't need it but wouldn't it not become DOORMAT like most of my credit cards if i don't use it ? That's why i thought i should take it if it was offered to me without a hard inquiry. If it would reserved my credit and credit score when i dont use my credit cards. When my Capital One went doormat my score dropped by 100 points until i started using it. So if ii add a PLOC or Reserved Line of Credit will it keep myFICO active ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

pretty sure pre-approved or not if you had clicked to take it they would have HP for that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

Creditaddict wrote:pretty sure pre-approved or not if you had clicked to take it they would have HP for that.

no its not. that is why i wished i've taken it. i thought i did but accidently said yes i like the reserved line of credit to cover any overdraft fee but then i accidently clicked no i dont want the reserved line of credit.

Under terms & conditions it says: ''If you accept the offer of a Reserve Line (overdraft protection) feature for your checking account, you agree to the terms below.'' it also states they will periodically check your credit (soft obviously, all banks do) but there was no hard pull upon accepting it opening a checking account.

CREDIT REVIEW

We may periodically review your creditworthiness. In doing so, we may review your credit reports and any other credit information that we believe to be relevant. We may request, and you agree to provide, any information regarding your financial condition that we believe appropriate for purposes of this review. We reserve the right to periodically re-evaluate your account and, based on our credit criteria for determining the likelihood of repayment, increase or decrease your credit limit.

'' I really have no need for these funds, but since there were no pulls of any kind involved I took him up on this offer. BTW, there were no pulls for the checking account either, not even Chexsystems.'' http://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/USBank-Reserve-Line-of-Credit-Questions/td-p/...

i've opened a checking with US bank during their promotion

- $125 when you complete the following requirements:

- Open a new U.S. Bank consumer Silver Checking Package, Gold Checking Package or Platinum Checking Package

- Complete one or more direct deposits totaling at least $500 or complete two or more Bill Pay transactions (enrollment in Online and/or Mobile Banking is required)

- You’ll also be entered into the U.S Bank $50,000 sweepstakes,

- You can fund up to $500 with a credit card

- Soft pull to open

- Direct deposit is optional

U.S bank has three checking products which qualify for this promotion:

- Silver Checking Account

- Gold Checking Account

- Platinum Checking account

Probably the easiest way to keep this fee free is to open the Gold Checking account, if you have a U.S Bank credit card or any product such as a reserved line of credit then the monthly fees on this account are waived. (which why i feel stupid not taken it)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

hopefully someone can chime in from US Bank because i would think its a hard pull too--the disclosure there does not apply to the line of credit only the checking account.

line of credit for personal is a bit rare, and i know us bank offers it still, while many other banks have pulled out of doing so.

it is like being preapproved for a cc, they do soft inquiries to be able to say theres a good chance..but they won't know until you consent and when you do that is when the hardpull comes through.

did you ask the rep when you called in whether that agreement to go for the CL will be a hard inquiry or soft?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

@Anonymous wrote:hopefully someone can chime in from US Bank because i would think its a hard pull too--the disclosure there does not apply to the line of credit only the checking account.

line of credit for personal is a bit rare, and i know us bank offers it still, while many other banks have pulled out of doing so.

it is like being preapproved for a cc, they do soft inquiries to be able to say theres a good chance..but they won't know until you consent and when you do that is when the hardpull comes through.

did you ask the rep when you called in whether that agreement to go for the CL will be a hard inquiry or soft?

I didnt call. Someone else on this forum called us bank to sign up for checking and was offered a reserved line of credit. I posted the link to the forum in my previous reply before this reply. I applied for checking onkine and saw the reserved line of credit offer. It says i was approved not ore-qualified. Then i realized i didnt accept it and i contacted us bank about it and they said there was no way i could reverse it aftet being offered online. They said i had to call and apply so i said no thanks.. because i knew then it would be a hard inquiry. So i thought maybe close the checking account and open a new one to see if im offered again to avoid the monthly fee by either having a us bank credit card (which i dont) a loan or line of credit with us bank which i saw was offered signing up for checking. If i can get that then i wont need to apply for a us bank credit card and waste a hard inquiry so if i can sign up again and be approved for line of credit i think it would be well worth it without a hard inquiry and an increase of available credit and no fee gold checking with us bank. Thats only reason i should have taken it. I thought i did but didnt

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

At US Bank isn't a Reserved Line of Credit nothing but their version of overdraft protection?

A premiere line of credit is their personal line of credit (PLOC) product.

By the way, there is a fee for the gold checking unless for example you link or have a cc or PLOC woth them; you may also perhaps have direct deposit or maintain some minimum to avoid the fee (check the website)

I have a gold checking and a savings but my PLOC with them is why they charge and then automatically reverse the monthly fee on my gold checking account on each monthly statement

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

@youdontkillmoney wrote:At US Bank isn't a Reserved Line of Credit nothing but their version of overdraft protection?

A premiere line of credit is their personal line of credit (PLOC) product.

By the way, there is a fee for the gold checking unless for example you link or have a cc or PLOC woth them; you may also perhaps have direct deposit or maintain some minimum to avoid the fee (check the website)

I have a gold checking and a savings but my PLOC with them is why they charge and then automatically reverse the monthly fee on my gold checking account on each monthly statement

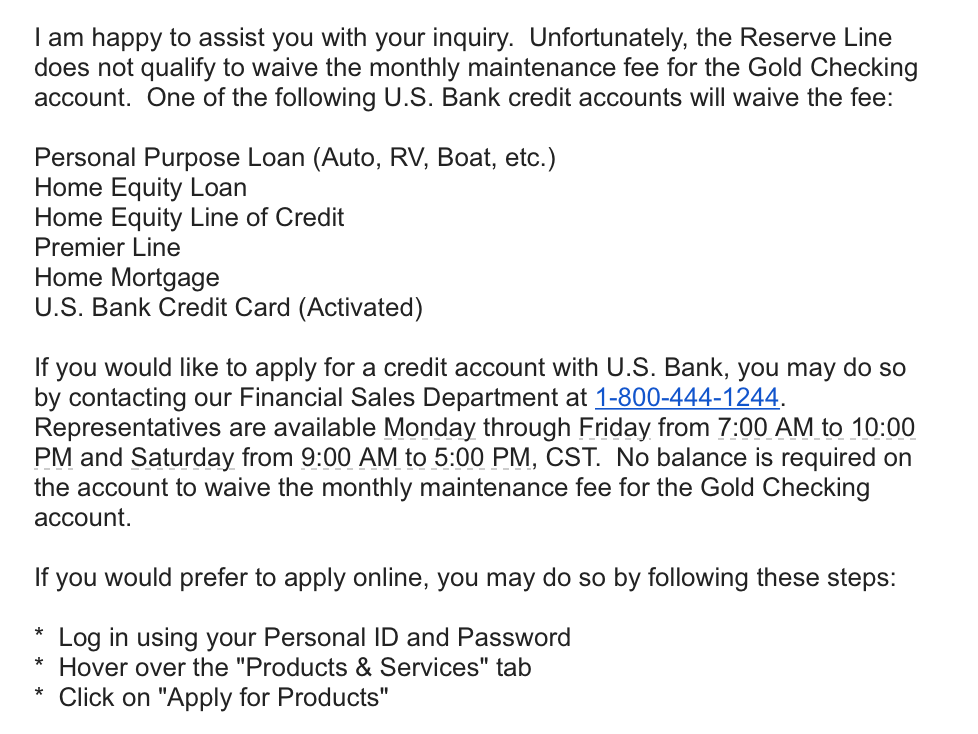

CONFIRMED RESERVED LINE of CREDIT DOES NOT WAIVE THE MONTHLY MAINTENANCE FEE FOR THE GOLD CHECKING.

im glad i didn't go back and apply for it ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

Ron.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

@Anonymous wrote:

@youdontkillmoney wrote:At US Bank isn't a Reserved Line of Credit nothing but their version of overdraft protection?

A premiere line of credit is their personal line of credit (PLOC) product.

By the way, there is a fee for the gold checking unless for example you link or have a cc or PLOC woth them; you may also perhaps have direct deposit or maintain some minimum to avoid the fee (check the website)

I have a gold checking and a savings but my PLOC with them is why they charge and then automatically reverse the monthly fee on my gold checking account on each monthly statement

CONFIRMED RESERVED LINE of CREDIT DOES NOT WAIVE THE MONTHLY MAINTENANCE FEE FOR THE GOLD CHECKING.

im glad i didn't go back and apply for it

Can I just point out that in the items that DO qualify, it says Premier Line. This Email conflicts itself.

Edit: I just totally mind gapped. The question was on the reserve line. Carry on.

EX FICO (AMEX): 728 (4/29/17) | TU FICO (Discover): 737 (4/7/17) | EQ FICO (Citi): 746 (3/28/17)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Reserved Line of Credit question...

@14Fiesta wrote:

@Anonymous wrote:

@youdontkillmoney wrote:At US Bank isn't a Reserved Line of Credit nothing but their version of overdraft protection?

A premiere line of credit is their personal line of credit (PLOC) product.

By the way, there is a fee for the gold checking unless for example you link or have a cc or PLOC woth them; you may also perhaps have direct deposit or maintain some minimum to avoid the fee (check the website)

I have a gold checking and a savings but my PLOC with them is why they charge and then automatically reverse the monthly fee on my gold checking account on each monthly statement

CONFIRMED RESERVED LINE of CREDIT DOES NOT WAIVE THE MONTHLY MAINTENANCE FEE FOR THE GOLD CHECKING.

im glad i didn't go back and apply for it

Can I just point out that in the items that DO qualify, it says Premier Line. This Email conflicts itself.Edit: I just totally mind gapped. The question was on the reserve line. Carry on.

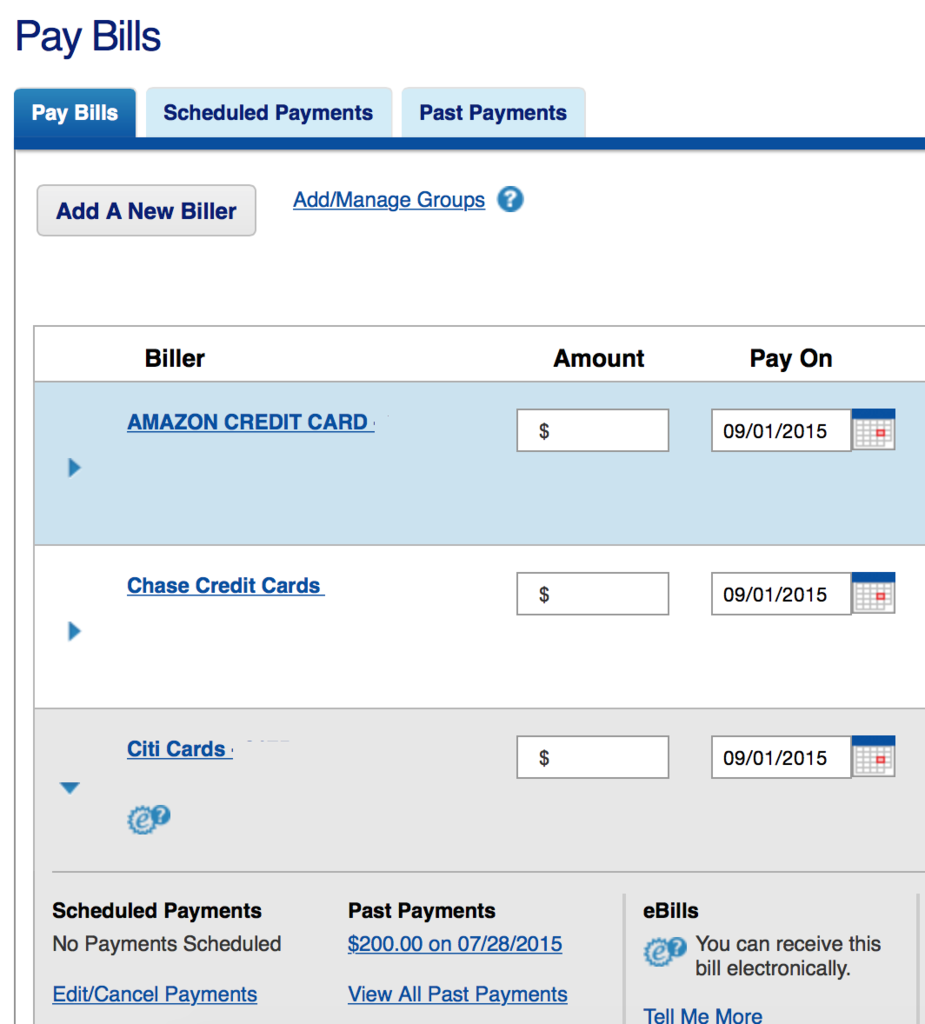

somebody please help me here ... i made 2 online bill pay directly from my us bank account ''Pay bills'' tab... now they sent me this after i asked when im getting my $125 bous for opening a checking account.