- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Vantage Score - should I be concerned?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Vantage Score - should I be concerned?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vantage Score - should I be concerned?

I noticed on my CO card site, and on CK, that my vantage score is almost 100 points less than my fico 8 scores. 590 vs 685. Are there a lot of places that use this score? I am especially concerned about obtaining an auto loan in the next couple of months. The factors according to CK is # of credit inquiries, and age of credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

@Anonymous wrote:I noticed on my CO card site, and on CK, that my vantage score is almost 100 points less than my fico 8 scores. 590 vs 685. Are there a lot of places that use this score? I am especially concerned about obtaining an auto loan in the next couple of months. The factors according to CK is # of credit inquiries, and age of credit.

I've never heard of any place that uses them.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

My CK score matches my FICO 08 scores. My FICO 08 is around 748 and CK is 758.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

@Anonymous wrote:My CK score matches my FICO 08 scores. My FICO 08 is around 748 and CK is 758.

^^^^This is very weird. They are different algorithms from different vendors measuring different things![]() The fact that they are similar is coincidental. And, as the others above have stated, no one uses Vantage scores to determine credit worthiness - at the moment.

The fact that they are similar is coincidental. And, as the others above have stated, no one uses Vantage scores to determine credit worthiness - at the moment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

@StartingOver10 wrote:

@Anonymous wrote:My CK score matches my FICO 08 scores. My FICO 08 is around 748 and CK is 758.

^^^^This is very weird. They are different algorithms from different vendors measuring different things

The fact that they are similar is coincidental. And, as the others above have stated, no one uses Vantage scores to determine credit worthiness - at the moment.

Mine are also pretty close, TU and EX anyway.

Vantage 3.0

TU - 800

EQ - 795

EX - 793

Fico 8

TU - 779

EQ - 754

EX - 780

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

@StartingOver10 wrote:

@Anonymous wrote:My CK score matches my FICO 08 scores. My FICO 08 is around 748 and CK is 758.

^^^^This is very weird. They are different algorithms from different vendors measuring different things

The fact that they are similar is coincidental. And, as the others above have stated, no one uses Vantage scores to determine credit worthiness - at the moment.

Some lenders have trialed it, I did get my Chase Freedom pre-recon underwritten on it (or at least that was the score Chase disclosed to me).

That said I don't know any that are currently using it, though it's harder to say now with so many single APR products and fewer denials; I suspect if we get another downturn we'll be surprised at how many lenders might be using it, but in general I wouldn't worry about it either. VS appears to weigh recent data much more substantially... I had an inquiry on TU that dropped me 70 points, and 2 months later I got the 70 points back, and was likely in confluence with the factor that I had a recent 30 day late on that bureau as I did not get the same behavior on any FICO algorithm, nor did I get the same behavior on EX/TU VS 3.0 where I didn't have the late reporting and that's just one difference off one file between the algorithms.

In broad strokes improving one's FICO will improve VS as well so simply create the pretty file (or put as much lipstick on the pig as possible in my case) and go on with life.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

@Anonymous wrote:

@StartingOver10 wrote:

@Anonymous wrote:My CK score matches my FICO 08 scores. My FICO 08 is around 748 and CK is 758.

^^^^This is very weird. They are different algorithms from different vendors measuring different things

The fact that they are similar is coincidental.

Mine are also pretty close, TU and EX anyway.

Vantage 3.0

TU - 800

EQ - 795

EX - 793

Fico 8

TU - 779

EQ - 754

EX - 780

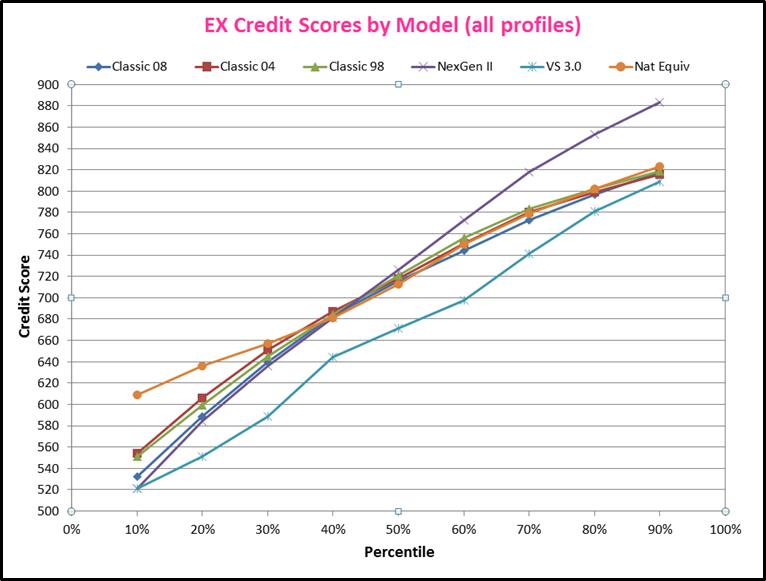

Actually, Fico and VantageScore models do look at the same factors for the most part. That's why studies between the two typically have a correlation coefficient of .90 give or take .02. Of course, there are some severe outliers but, by and large they relate - although curves are quite different with VS scores typically being 20 to 30 points below Fico 08. [see paste below of Experian data based on al profiles].

My VS3 scores generally fall between my Fico 08/09 scores and Fico 04 scores.

| 3B Report Data | March 25, 2016 Scores | ||

| Cards reporting | 3 of 6 | 3 of 6 | 3 of 6 |

| Card reporting % | 50% | 50% | 50% |

| Inquiries under 12 mo | 0 | 0 | 0 |

| AG UT | 2.1% | 2.1% | 2.1% |

| Classic Scoring Model | EQ | TU | EX |

| Fico Classic 09 | 850 | 850 | 850 |

| Fico Classic 08 | 850 | 850 | 850 |

| Fico Classic 04 | 809 | 823 | 830 |

| VantageScore 3.0 | 827 | 828 | 830 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

@Anonymous wrote:Are there a lot of places that use this score?

That's not what matters for any scoring model. What matter for any model/CRA combo is whether or not you have creditors/products that use a given model/CRA combo or if you intend to apply with one. Don't rely on "most". Consider each specific creditor product. Figure out which model /CRA is used in the decision and then go pull that specific score.

@Anonymous wrote:I am especially concerned about obtaining an auto loan in the next couple of months.

Do any of the auto lenders you intend to use base their decision on a TU or EQ VantageScore 3.0? I'm not aware of any but you need to do your due diligence versus relying on things like my memory.

@RM21 wrote:

I would not worry about any Vantage score. Overall most lenders do not use them. The Fico's are what's important.

Don't rely on such oversimplifications. Consider specific creditors and products, not "most". If a given creditor doesn't use a FICO then FICO's will not matter to that creditor. Even if the creidtor uses a FICO then only the specific FICO model and CRA used by that creditor will matter. FICO doesn't have just one model and they don't all evlauate data the same way or even have the same scoring ranges. Don't just assume that you can rely on one FICO model for all creditors.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage Score - should I be concerned?

I often wonder if people ever get tired of posting the same exact thing, multiple times per day, day after day after day...