- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Vantage score says it is declining?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Vantage score says it is declining?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vantage score says it is declining?

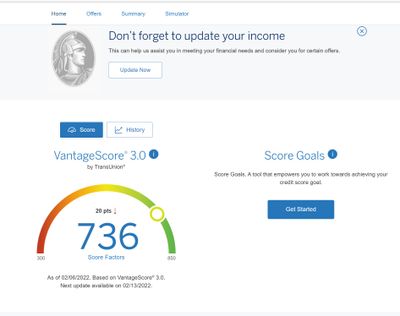

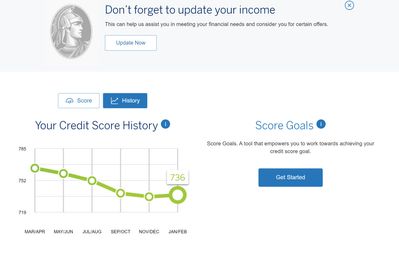

I got an email from AMEX that my credit report has changed. Logged in to check MyCredit Guide, and the Vantage 3.0 score is at 736. The history of this Vantage score seems to be a steady decline, which is odd. We added a HELOC nearly a year ago, and I've got one new account in November. Other than that balances have been reasonable for overall utilization, so I'm puzzled by how Vantage could be so far apart.

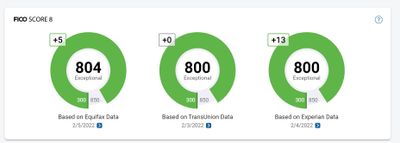

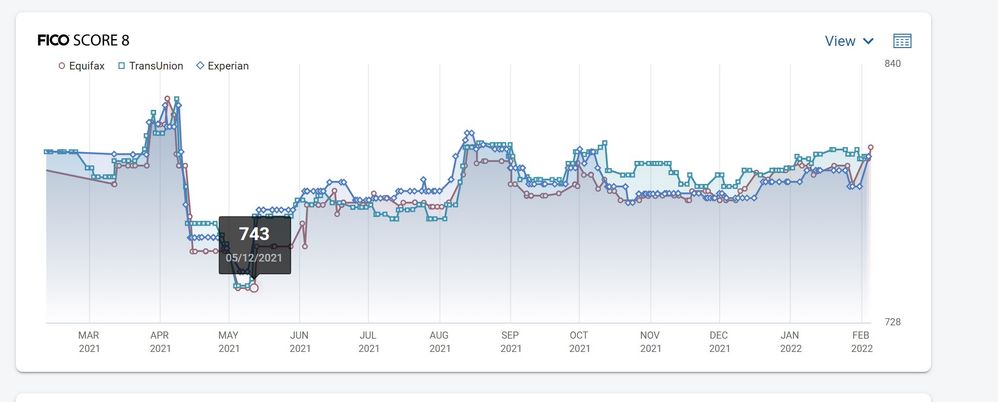

Checked my FICO 8 and they all bumped up over 800 with the start of February, so that's reassuring ![]()

I used the Your Credit Score Progress to set a Vantage 3.0 goal of 802, but all they can suggest is keeping individual cards below 10%? Overall card utilization even on Vantage is 6%, so I'm not sure how this is going to boost my Vantage score.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

We also bought a new house a year ago, and the sorting of the mortgages ( closing out my house mortgage, taking on a new joint mortgage, and the HELOC ) caused some gyration in FICO 8. I'll wonder if the Vantage 3.0 is taking longer to digest the new mortgage, and the new HELOC?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

Do you have a Credit Karma account? It will have a "See What Changed" button and it will say why the increase or decrease. TU updates everyday.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

don't understand those vantage scores, my FICO says 838 while vantage reads 809 presently

tranunion 823, Vantage 789

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

@babbles wrote:don't understand those vantage scores, my FICO says 838 while vantage reads 809 presently

tranunion 823, Vantage 789

FICO is the real deal. Vantage was created by all the CRA's. Really dont mean a thing. Dont take them into account. Use sites that use Vantage for their report monitoring and thats about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

@FireMedic1 wrote:

@babbles wrote:don't understand those vantage scores, my FICO says 838 while vantage reads 809 presently

tranunion 823, Vantage 789

FICO is the real deal. Vantage was created by all the CRA's. Really dont mean a thing. Dont take them into account. Use sites that use Vantage for their report monitoring and thats about it.

While mostly true , there is an uptick in using vantage for credit related activities , most importantly synchrony the issuer of your Lowe's card uses vantage 4.0 as the way to approve and manage your account . So although not majorly important yet there is an uptick and have been presented that score in approvals and declines before . So it's more ymmv with vantage scores and lenders.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

For the most part, the only scores that "count" are FICO scores. I like MyFico---but I'm not merely promoting it when I say this.

It's pretty rare for any credit entity to make use of Vantage Scores when assessing worthiness for a loan or credit card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

@donkort wrote:For the most part, the only scores that "count" are FICO scores. I like MyFico---but I'm not merely promoting it when I say this.

It's pretty rare for any credit entity to make use of Vantage Scores when assessing worthiness for a loan or credit card.

Yet snchrony uses it for all their cards and they don't seem to be a very small or a rare issuer . Choose whatever path serves you best .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

@Goos wrote:

@donkort wrote:For the most part, the only scores that "count" are FICO scores. I like MyFico---but I'm not merely promoting it when I say this.

It's pretty rare for any credit entity to make use of Vantage Scores when assessing worthiness for a loan or credit card.

Yet snchrony uses it for all their cards and they don't seem to be a very small or a rare issuer . Choose whatever path serves you best .

@Goos Sync pulled TU when I got the Loews card. And it was in the letter who they used with the score from FICO 8 last June.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage score says it is declining?

@FireMedic1 wrote:

@Goos wrote:

@donkort wrote:For the most part, the only scores that "count" are FICO scores. I like MyFico---but I'm not merely promoting it when I say this.

It's pretty rare for any credit entity to make use of Vantage Scores when assessing worthiness for a loan or credit card.

Yet snchrony uses it for all their cards and they don't seem to be a very small or a rare issuer . Choose whatever path serves you best .

@Goos Sync pulled TU when I got the Loews card. And it was in the letter who they used with the score from FICO 8 last June.

Remember that the legal requirement when using data from credit scores is to report one, if that data resulted in denial or less than best terms offered. A lender can pull data from everywhere they can, generate 200 different scores, including proprietary ones, and tell you the result and source for just one of them. Sophisticated lenders use all the data they can figure out how to use, not just a raw score from a third party. (and even non-sophisticated lenders (of which there are not many) use data not on your credit report, like you income.