- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- WalletHub scores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WalletHub scores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WalletHub scores

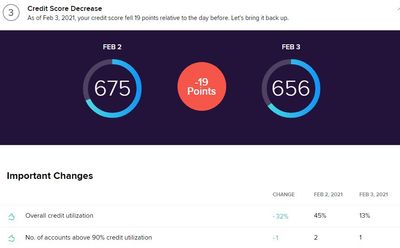

Geez, I know these aren't FICO scores but who would've thought that paying off a line of credit and bringing utilization down significantly would impact this the wrong way lol (meanwhile EX FICO 8 went up 12 points to 714 for the same reason).

From what I read on WalletHub, this is actually TU VantageScore 3. I think all of these 3rd party scores should be banned since they really give people the wrong impression about where they're at. TU FICO 8 is 695 (so a 40 point difference).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WalletHub scores

It seems you know that's a TU VS3 score and definitely not a Fico score, so definitely no reason to pay it any mind.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WalletHub scores

@Anonymous wrote:It seems you know that's a TU VS3 score and definitely not a Fico score, so definitely no reason to pay it any mind.

It does seem like some banks (can't remember off the top of my head) are switching over to VS scores (aside from Sync using VS4), so I am thinking it is time to start paying attention to them, at least for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WalletHub scores

@Anonymous wrote:

@Anonymous wrote:It seems you know that's a TU VS3 score and definitely not a Fico score, so definitely no reason to pay it any mind.

It does seem like some banks (can't remember off the top of my head) are switching over to VS scores (aside from Sync using VS4), so I am thinking it is time to start paying attention to them, at least for me.

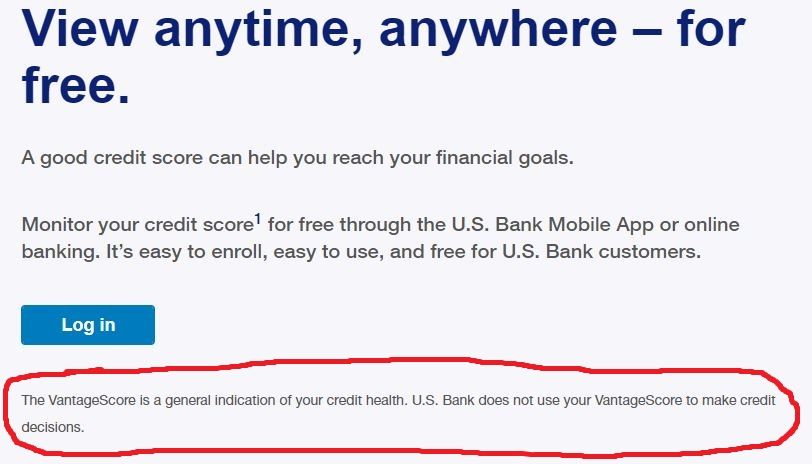

There are plenty of banks that provide VS scores but that doesn't mean they will ever use them. I like US Bank's statement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WalletHub scores

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:It seems you know that's a TU VS3 score and definitely not a Fico score, so definitely no reason to pay it any mind.

It does seem like some banks (can't remember off the top of my head) are switching over to VS scores (aside from Sync using VS4), so I am thinking it is time to start paying attention to them, at least for me.

There are plenty of banks that provide VS scores but that doesn't mean they will ever use them. I like US Bank's statement.

So True! Most Credit cards will give you a Vantage score but they also state it is not the score they use when managing your account.

But I like services like Credit Karma and Wallethub because of the more detailed actions (and tips) and Extra Info provided that occur with your accounts.