- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Why are FICO 9 scores so much lower than 8?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why are FICO 9 scores so much lower than 8?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Anonymous wrote:

@Revelate wrote:Does beg the question how FICO is determining whether a collection is medical or not; if we're sorting users between paid and unpaid collections though, it wouldn't surprise me in the slightest if paid (should have been unpaid, mea culpa) were more heavily weighted under FICO 9 to TT's point.

Not fully sure I understand what you mean. Paid collections are not counted at all under FICO 9, right?

That would be a classic typo by yours truly that I didn't catch on my revisions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Thomas_Thumb wrote:

@Anonymous wrote:Well my past credit really isn't an issue. 3 years ago I went to buy a new car and found out I was a "ghost". In general I've usually used cash for things under $20k, but I decided to go for a new car over the 3yo used I normally buy. I had not had active revolving accounts or loans in so long (at least 5 years) that everything was off my report and I had no score.

I ended up getting financed with a high interest loan and set about building a score again to refinance. Grabbed a couple secured cards to start. Over the past 3 years I refied the car loan and had a personal loan for 2 years, just paid off early. I also opened a few more major cards and couple store cards, mainly because my # of accounts was low and showing as a negative.

So I have a relatively short history now. 11 accounts (1 car, 8 revolving, 2 closed). 100% on time payments. 3-5 inquiries depending on the bureau. One 2 year old collection (medical-$700). Credit utilization is usually under 10%. Total credit around $15k. Sometimes it might spike to 25-30% if I forget to pay something by the grace period, but it's paid in a week or two. I have a decent income ($100k+) and really don't need to use cards, just do for rewards, so balances have never been an issue.

That's my credit in a nutshell. The easy answer would be to say it's the collection, but here's my problem with that. I'm sure I'm already taking a 30 point hit or more for that collection on FICO 8. So if that really is it, that would mean FICO 9 dings 60-70 points for one sub $1k collection, which I'd still consider bull**bleep** and a scam to keep scores lower and help the lending industry. That's just too much for 1 single collection when all other parts of the report are pretty decent.

Thoughts?

Is your medical collection paid? If not, I suspect the difference relates to the unpaid medical collection.

Fico 8 treates medical collections over $100 the same regardless of paid/unpaid. In Fico 9 paid medical collections don't count against you. The model was tweaked to provide an incentive to pay up. Conversely, unpaid medical collections mayy be treated more harshly.

Ive read that all paid or settled collections are ignored in FICO09 scoring.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 813 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

mine are much higher

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

My Enhanced Fico 9 scores are, as a general rule, lower than my Enhanced Fico 8 scores. I have one open installment loan, a 15 year mortgage - at about 30% B/L, four open revolving credit cards, one open charge card, one open AU card. On file: No closed mortgages (they aged off), two closed store cards and no inquiries. Clean file.

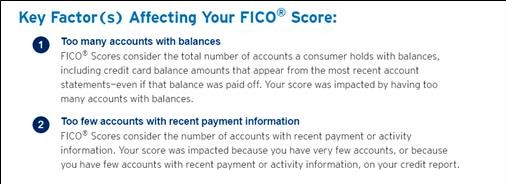

I strongly suspect Fico 9 deducts more points than Fico 8 for thin files - files that lack a critical mass of open accounts as these profiles typically result in "too few accounts with recent payment history". The other downside of a thin file that may be treated more harshly in Fico 9 is: Too many accounts with balances if, like me you allow charges to report on statements and then PIF the reported balance. I typically report a balance on over 50% of my open accounts.

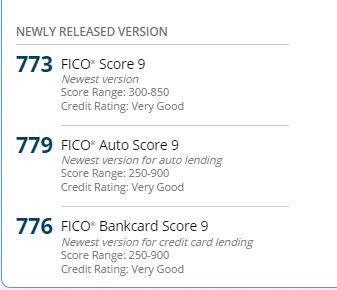

Here is what Citi reports from Fico about my EQ file.

Here is how my Fico 8 and Fico 9 scores compare:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@elim wrote:mine are much higher

Mine too on EX/EQ, by 40-50 points sometimes, well depending how badly I've beaten like a rented mule my EX with inquiries.

Though I did lose points when my tax lien came off EX temporarily on FICO 9 (not by much, like -12) which suggests explicit bucketing event so the paid tax lien did count, and different bucket score ranges. Incidentally I gained 16 on FICO 8.

Certainly appears to have a much higher high-end for my FICO 9 scorecard than my FICO 8 ones with the lien and delinquencies there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

My friend pulled their 3Bs and his Experian FICO 9 score is 100 points higher then his 08. No medical collection on file. Has a paid and unpaid collection and a few paid CO. Other then that we can't figure out the wide variance.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 813 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

Agree with your premise. This is a Credit Industry and they are in business to make money. It will never change - just make the best deal you can make and either accept or reject the offers. If you feel desperate - then you will undoubtedly pay more interest. If you can walk away from an offer or generate more offers – you may find competitive rates. BUT you can self-finance, I saw my parents build 3 family homes in the 1950s – 1960s, and my Dad was a mechanic and my mother was a secretary (so they were not wealthy). My Dad always said bankers only lend money to people who don’t need it.

Back to your point about FICO 9 versus FICO 8 – I too receive complementary scores from credit card companies. One uses FICO 9 and the other FICO 8. FICO 9 has me at 721 and FICO 8 has me at 762. I have no delinquencies (i.e., zero). The FICO 9 explanation is that I owe too much on my home – (i.e., I haven’t paid it down since financing). What they don’t take into account is that the account has been refinanced several times for better terms and has been paid down in the process. The original purchase was $300k+, refinanced for $200k 7 years ago, now $160k currently owed. On top of that, the property value has appreciated to $500k+! These guys are hacks and they are owned and operated by the Credit Industry.

I would say the following: 1) learn to save and self-finance; 2) quit viewing your FICO scores – it only empowers these hacks; 3) don’t need to borrow money; 4) if you do need to borrow money just make the best deal you can by price shopping and go with the best deal. Regards, Max

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@sjt wrote:My friend pulled their 3Bs and his Experian FICO 9 score is 100 points higher then his 08. No medical collection on file. Has a paid and unpaid collection and a few paid CO. Other then that we can't figure out the wide variance.

If the unpaid collection is under $100 and the paid collection is over $100 that could account for a majority of the point spread. As mentioned above, Fico 9 ignores all paid collections. Fico 8 does not ignore paid collections but ignores them if under $100. Not sure how charge offs are treated F8 vs F9.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Thomas_Thumb wrote:

@sjt wrote:My friend pulled their 3Bs and his Experian FICO 9 score is 100 points higher then his 08. No medical collection on file. Has a paid and unpaid collection and a few paid CO. Other then that we can't figure out the wide variance.

If the unpaid collection is under $100 and the paid collection is over $100 that could account for a majority of the point spread. As mentioned above, Fico 9 ignores all paid collections. Fico 8 does not ignore paid collections but ignores them if under $100. Not sure how charge offs are treated F8 vs F9.

Slight tweak to what TT just said. FICO 8 ignores collections, whether paid or unpaid, if under $100.

I am guessing that FICO 9 counts unpaid collections under $100, but it's possible that FICO 8's policy was inherited in the new model.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Anonymous wrote:

@Thomas_Thumb wrote:

@sjt wrote:My friend pulled their 3Bs and his Experian FICO 9 score is 100 points higher then his 08. No medical collection on file. Has a paid and unpaid collection and a few paid CO. Other then that we can't figure out the wide variance.

If the unpaid collection is under $100 and the paid collection is over $100 that could account for a majority of the point spread. As mentioned above, Fico 9 ignores all paid collections. Fico 8 does not ignore paid collections but ignores them if under $100. Not sure how charge offs are treated F8 vs F9.

Slight tweak to what TT just said. FICO 8 ignores collections, whether paid or unpaid, if under $100.

I am guessing that FICO 9 counts unpaid collections under $100, but it's possible that FICO 8's policy was inherited in the new model.

Im also thinking that Fico 9 puts more emphasis on payment pattern and utilization then Fico 8. That could be the reason for the score variance.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 813 / EQ: 825 / TU: 818