- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: authorized user judgements

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

authorized user judgements

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

authorized user judgements

I am trying so desperately to get my credit back in shape. I feel like its an uphill battle. I have paid the balance on negative account on my credit report with the exception of two accounts. My brother had me as an authorized user on his capital one and his chase freedom card. He ran into some financial trouble and wasn't able to make payments anymore and the card went down the tubes. The capital one card went into a judgement for 577.00 in 2006. Because i was an authorized user, it is showing up on my account and is stopping me from being approved for credit. The chase freedom card is showing up on my credit report and has been there since 2007. Is there a way I can dispute this and both accounts be removed from my credit report since it wasn't actually my card?!

Please help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

@ddiamond wrote:I am trying so desperately to get my credit back in shape. I feel like its an uphill battle. I have paid the balance on negative account on my credit report with the exception of two accounts. My brother had me as an authorized user on his capital one and his chase freedom card. He ran into some financial trouble and wasn't able to make payments anymore and the card went down the tubes. The capital one card went into a judgement for 577.00 in 2006. Because i was an authorized user, it is showing up on my account and is stopping me from being approved for credit. The chase freedom card is showing up on my credit report and has been there since 2007. Is there a way I can dispute this and both accounts be removed from my credit report since it wasn't actually my card?!

Please help

Welcome to the forums.

You have the right to have yourself removed from these accounts. Simply dispute with the CRA's that these accounts are "not mine".

From a BK years ago to:

EX - 9/09 pulled by lender 802

EQ - 7/06-663, 3/10-800

TU - 8/10-772

You can do the same thing with hard work

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

Make sure that the status does show as authorized user rather than joint on your reports. Let's hope he didn't use your SSN etc to open it as joint. ![]()

Since it seems like you already have some credit reports, print them out. You don't want to have the ownership suddenly start reporting as joint, allowing the CCC's to come after you. I get paranoid about this sort of thing.

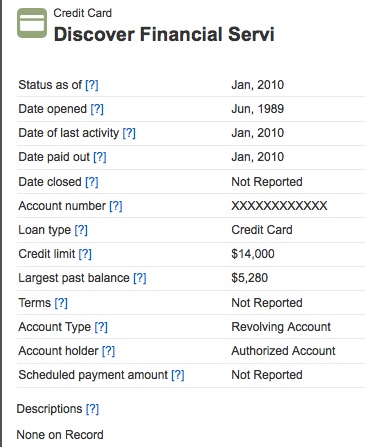

Here's how it looks on a myFICO score report under "Account Holder," down toward the bottom. It will display differently on reports from other sources, but look for something similar:

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

Thanks, I really appreciate the help, I did check the accounts on and one account does state that I am an authorized user on the account. Where do I go from here, do i dispute to all three bureaus to have it removed due to the fact that im a authorized user? Will they remove it? On the other hand the other account is a judgement and it doesn't say anything accept for the county court and the amount owed and the date it was filed. What should I do next about this account? Should I just wait until the SOL expires.It was filed in 2006 so I will be waiting a long time for the statue of limitations to expire.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

The first one shouldn't be a problem. Just dispute as "not mine." It looks like at least one of your reports shows you as an AU, so it should be OK.

As to how you, as an AU, got included in a judgment, that's way beyond what I know. I would have thought that a judgment would have involved some sort of confirmation of joint ownership, but I honestly don't know how the process works. This was also on a CC, right?

Anyone here know how they verify who belongs on an account that goes all the way to a judgment?

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

@haulingthescoreup wrote:The first one shouldn't be a problem. Just dispute as "not mine." It looks like at least one of your reports shows you as an AU, so it should be OK.

As to how you, as an AU, got included in a judgment, that's way beyond what I know. I would have thought that a judgment would have involved some sort of confirmation of joint ownership, but I honestly don't know how the process works. This was also on a CC, right?

Anyone here know how they verify who belongs on an account that goes all the way to a judgment?

I'd be a little confused over how an AU -- who is not a spouse -- could end up with a judgment against them. I wonder if OP actually can find a judgment reporting in the public records section of his credit report.

Assuming there really is a judgment against him and he is, in fact, only an AU, I can only think of a few possible scenarios that do not involve error / creditor fraud:

1. AmEx & AmEx wannabes. American Express and a growing number of other credit card issuers have terms that hold an AU responsible for their individual use of an account should the account go south and the primary cardholder go belly-up.

2. Husband & Wife (or, to be politically correct: Spouse & Spouse). Some states hold a spouse liable for debts incurred by the other spouse either in general or when the debts are for specific allowable concepts.

The account tradelines should be easy to have removed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

Thanks, I'm a little confused myself as to how i'm including in the judgement when I was just an authorized user. I have not been served with any papers and my brother said he too has not been served with any papers and it was filed in 2006.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

@ddiamond wrote:Thanks, I'm a little confused myself as to how i'm including in the judgement when I was just an authorized user. I have not been served with any papers and my brother said he too has not been served with any papers and it was filed in 2006.

You might want to contact the court which rendered the judgment and get a copy of all documents -- especially the proof of service. You may have a chance to get the judgment vacated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

Excellent post, O6, Not something I was aware of.

Are creditors really issuing initial contract terms for their credit cards that can legally obligate non-signatory, non-spousal parties to future legal obligations?

I was not aware that they could pre-specify obligation of any future authorized user to be responsible for legal obligation for debt. Wow!

Is that at condition that is initially imposed upon initial contract, or is that an added contract amendment that they impose as a condition for grant of AU status to another? Has this ever been litigated?

Interesting legal question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: authorized user judgements

@RobertEG wrote:Excellent post, O6, Not something I was aware of.

Are creditors really issuing initial contract terms for their credit cards that can legally obligate non-signatory, non-spousal parties to future legal obligations?

I was not aware that they could pre-specify obligation of any future authorized user to be responsible for legal obligation for debt. Wow!

Is that at condition that is initially imposed upon initial contract, or is that an added contract amendment that they impose as a condition for grant of AU status to another? Has this ever been litigated?

Interesting legal question.

Although we seldom hear about specific cases, AmEx has been doing this for a long time. In their cardholder agreement they specify that if the account goes into default, both the primary cardholder and the AU are liable for all charges made with the AU card. AmEx has sued people (and won) and they have blacklisted AUs over this.

There is a certain logic behind this, I agree, but on the other hand it seems really underhanded. Still, since it is part of the cardholder agreement, it holds up.

Without going through all my credit card agreements, I do remember that there is at least one non-AmEx credit card where the issuer holds AUs liable on their use of the card if things go south. I am positive there is at least one, but I am not certain which credit card company it is. I would like to say it is either USAA, Nationwide and / or Chase, but I am not 100% positive.