- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- trying to break 800

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

trying to break 800

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

trying to break 800

Hi ,

i've had alot of sucess thanks to this form and CB's. started at 498 and now have over 720's fakos are all 750-760 ish. So ive done ALOT of hard work but i want to break 800 fico, thats where i need your help and advice. all bad items from my reports have been removed. only positive trade lines are on my credit reports. I just added 2 new CC's for a total of 5 , 4 of which are credit unions , i utilize 2 percent total on one card. i have a mortgage 80/10/10. and a car note which i aim to pay off in 4-9 months well ahead of schedule. all my paid tradelines are in good standing and green. So what do i need to target other than continue paying my bills and paying off the loans that I hold?

my only goals currently are to pay off debts and not open new debts, potentially CLI the CC's i hold that will require HP's but not new accounts so that will maintain my AAOA , i know that just dropped due to the new cards I opened but it was worth it. I aim to only garden at this point. for the life of me i feel like im stuck at 730's on all three and need to figure out what i can do to boost them more.

Thanks in advance.

5/14/14 Equifax – 673 Experian – 744 Transunion – 722

already bought the house! closed with a great deal all thanks to information i learned here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

@spydergto wrote:Hi ,

i've had alot of sucess thanks to this form and CB's. started at 498 and now have over 720's fakos are all 750-760 ish. So ive done ALOT of hard work but i want to break 800 fico, thats where i need your help and advice. all bad items from my reports have been removed. only positive trade lines are on my credit reports. I just added 2 new CC's for a total of 5 , 4 of which are credit unions , i utilize 2 percent total on one card. i have a mortgage 80/10/10. and a car note which i aim to pay off in 4-9 months well ahead of schedule. all my paid tradelines are in good standing and green. So what do i need to target other than continue paying my bills and paying off the loans that I hold?

my only goals currently are to pay off debts and not open new debts, potentially CLI the CC's i hold that will require HP's but not new accounts so that will maintain my AAOA , i know that just dropped due to the new cards I opened but it was worth it. I aim to only garden at this point. for the life of me i feel like im stuck at 730's on all three and need to figure out what i can do to boost them more.

Thanks in advance.

I know it makes no sense, and I hate to rain on your parade...but your score may very well drop a little when you pay off the car. Hey I know that is counter intuitive, but most of the posts I've seen that has been the case if it is the only installment account besides your mortgage....Please do not get mad at me, I'm just the messenger!

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

no worries why would i get mad lol i came here once more seeking the wisdom of others. yea according to the spreadsheet from bobwang over on CB's loans such as car and mortgage will only provide the maximum amount of benifit to a credit score once the total of the loan is below 50 % of the original. I have paid off two other veichles so i have experienced that already. its not a significant drop. I currently also have sallie mae student loans which are in good standing but the 2nd to last thing I am stratagizing to pay off and or down. those are reflected as well. 5 cc's 2 student loans and 2 mortgages. I will have to look to see what else is positive trade line but i think its only 8 lines or so. usually i am on top of the ball on this but have been slightly slacking. closed the paid accounts and switched to free accounts credit karma and credit seasame.

Im also left wondering what other factors effect credit score ive learned people in relationsheep's who have credit scores within 50-60 points of each other are ususaly higher credit scores. is being married , with good credit between the two couples relavant ? I am not married with no immediate plans of ever getting that way. i think that would be un fair tactics towards gauging someones credit.

all of my trade lines are positive, My next set of goals is to pay off and down as much as possible while continuing to save money.

I am just trying to figure out if i may be doing something in the wrong direction that i can alter to make better my scores. i feel they have stagnated , with only a few years left until the 7 year mark and a perfect clean slate record i do not under stand why im at 730 's

5/14/14 Equifax – 673 Experian – 744 Transunion – 722

already bought the house! closed with a great deal all thanks to information i learned here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

Personal relationships, job, salary and such have absolutely nothing to do with score. Neither does employment status. All of these might be considered in a lending decision, but are barred by law from affecting a credit score. Credit scores are obtained solely based on how you handle debt, make payments, low utilization, good credit mix etc. Even DTI ratio cannot be considered because that would involve income. That is why creditors ask for income information...it is not on your credit report.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

@spydergto wrote:Hi ,

i've had alot of sucess thanks to this form and CB's. started at 498 and now have over 720's fakos are all 750-760 ish. So ive done ALOT of hard work but i want to break 800 fico, thats where i need your help and advice. all bad items from my reports have been removed. only positive trade lines are on my credit reports. I just added 2 new CC's for a total of 5 , 4 of which are credit unions , i utilize 2 percent total on one card. i have a mortgage 80/10/10. and a car note which i aim to pay off in 4-9 months well ahead of schedule. all my paid tradelines are in good standing and green. So what do i need to target other than continue paying my bills and paying off the loans that I hold?

my only goals currently are to pay off debts and not open new debts, potentially CLI the CC's i hold that will require HP's but not new accounts so that will maintain my AAOA , i know that just dropped due to the new cards I opened but it was worth it. I aim to only garden at this point. for the life of me i feel like im stuck at 730's on all three and need to figure out what i can do to boost them more.

Thanks in advance.

Now...to try and answer your question. When you opened those two new cards and now have 5 cards, you most likely lowered your average age of account considerably. Seven years is not very long in the credit score game. You also added 2 new accounts (a negative) and had 2 hard pulls. The fact that your scores did not drop a good bit is a good thing. Read the part above that says learn about scores. On the bright side...those extra cards will age in time, and help insulate you from new credit apps lowering your AAoA as much in the future. If you had just 1 credit account for 2 years and then you opened a new account you would instantly change your AAoA from 2 years to 1 year.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

I only opened new cards because i found the thread here about how to get into navyfed and penfed, both new cards are with them , both cards almost doubled my CC's in my wallet , utilization dropped from 4 percent to 2 percent thanks to them , it was to good to be true i had been trying to find a way into navy federal forever! yea im aware of the AAOA , it was a risk i had to take my primary credit union's credit card is already at the maximum limit they will give me , and i had already upped the other credit union card i use. i plan to let these accounts age and i have no intrest in getting more credit cards now i think i have what i need, but now i have 3 with credit unions that are not maxed limits with their respective unions and i can work on CLI them later once the HP's fall off, i only have 2 hard pulls the one for penfed and navy , everything else was a blank slate before i pulled for them , the accounts are relocked i only un froze them for 7 days a piece ,

i know that credit cards are a 2 edged sword creating history , up to me if positive or negative , and utiliation of credit cards so these 2 factors from one part can influcene up to 60 percent of a credit score.

is there anything else i should look into as types of credit that could assit in getting higher scores ? or should i just focus on paying down the current debts im holding as much as possible? i have them stacked in a excell file tree like by intrest rates , then by amounts, unfortuantly its not in direct order of what i want to pay off the 2nd item i intend to pay off after the car has the higher intrest rate, my car is at 1.99 percent im not loosing any money making that payment each month but the other loan i am ,

I want to figure out how to approach these debts in the best way possible to maximize the results , Im left wondering how much influence id see by paying the student loan to less than 50 percent.

i do not have things like store credit cards, their intrest rates are atrocious , my main credit card is 4.95 percent apr. i feel like im wasting money trying to pay these debts but if im going to i want to get the maximum influence to the score , i was hoping to have broken 800 fico by now ,

5/14/14 Equifax – 673 Experian – 744 Transunion – 722

already bought the house! closed with a great deal all thanks to information i learned here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

spydergto,

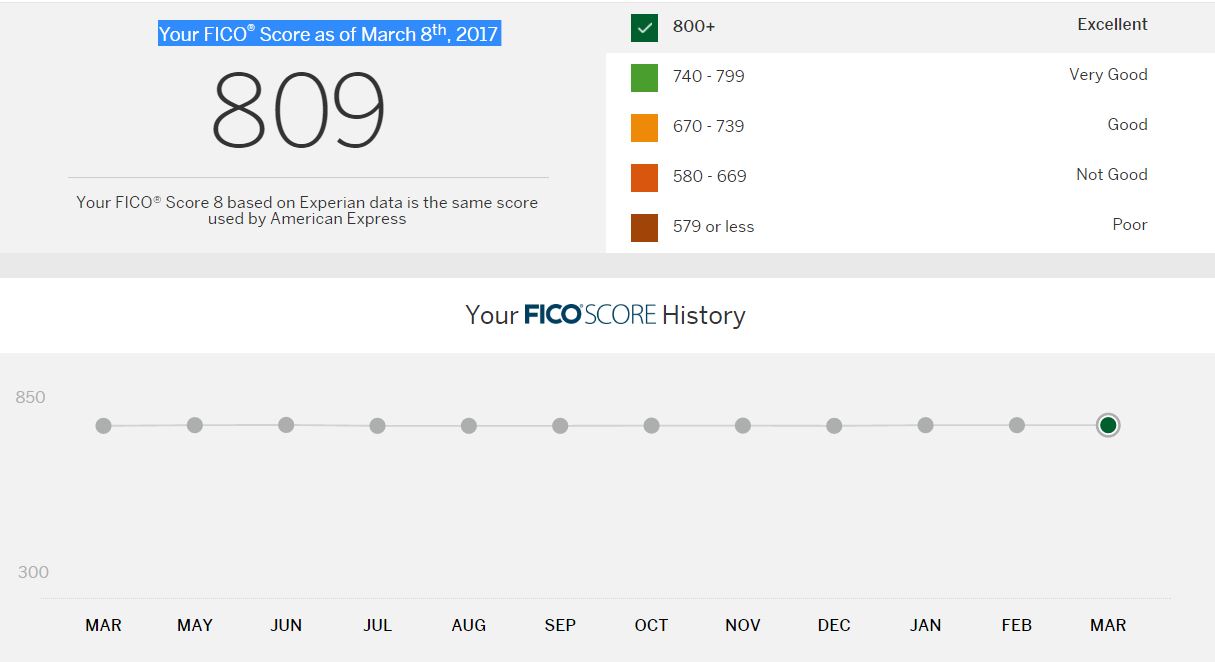

You are probably a few years away from 800+...the higher you go the slower it climbs. I will include an image of how much my experian score moved in 12 months...looks like a straight edge. Paitience is definately needed here.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

Hello SpyD! Can you clarify for us one more time what your plans are with respect to your loans?

In your initial post, you say that you will soon be paying off all your loans. I assume that this means paying them off in entirety and that you are including the mortgage.

Later in the thread you describe your plan being one of paying "down" your loans (rather than paying them off).

What are your plans? If you pay off your mortgage that will hurt your score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

i have my loans staggered in my excel spreadsheet based on 2 seperate rows , intrest , and amounts , as much as I would like to target the one at the top of the intrest first i am targeting the lowest first , which is my auto loan , i have auto loan , 10 % house loan 2nd , student loan at 26k , then primary 80 percent mortgage below 80k i believe. id love to pay them all of lol but i dont have the funds for that. so by studying the spreadsheet by bobwang over on CB's ive learned that the maximum effect loans have on credit score come when the loan is paid below 50 % of the starting value, I intend to pay the car down / off in 4-9 months then focus on the 10 percent loan on my house. it has 6.25 percent intrest and i feel its to high on intrest rate and want to get it paid off. I currently have my mortgage through BBVA compass and can not nor wish to go into details about how much i dispise them and or all "banking" institutes.

After paying off / down to an extremely low balance the car note, i intend to make much haste and damage on the 10 percent loan. thats the only thing i really have in sight at this time. i want these two paid off/ down , then i plan to work on the student loan as its the 3rd , next up the list balance wise, and also the primary mortgage however that will take a few years as that is a huge pile of cash for my condo ![]() but well worth it i love that place. and i got it thanks to the advice i found here and my dad!

but well worth it i love that place. and i got it thanks to the advice i found here and my dad!

my dad insists that i should just keep my primary mortgage with bbva as it would cost me a sum to move it, it is at 4.75 percent apr and i am not happy with the way that worked out i feel like bbva is hustaling me for as much cash as they can fleece from me. I would like to , at the end point of the car and 10 percent loan , try to move it to my credit union's shared mortgage broker, i feel like i would get a better deal and at that point i am tempted to buy alot of points in an attempt to get the intrest rate as low as possible.

but to get to that point , i need to farm now ! and get my scores as high as possible so in 3-4 years this can happen. i dispise bbva and all of this will probably end up being reposted in a few years time when i get to that point and try to make these moves a reality.

So , is there anything else i can do finance wise and put into effect now in regards to boosting my score later ? i am currently making 2-4 car payments a month depending on what my finanaces allow and 2 payments on the 10 pecent loan.

credit diversity was mentioned earlier, are there any other forms of credit that exsits that i dont hold that would be benificial and worth considering ? i am pretty stingy about unlocking my credit reports for a hard pull , those 5 points mean a **bleep** lot to me and i wont unlock it without being 100 percent sure im gonna get what im after.

i was day dreaming about a 4 wheeler and new dirt bike in a few years , potentially finance a ktm just to have the trade line , even though i could pay outright... id do it for a positive trade line only.

i just found out the other guy im working with on this rig has better credit than i do ![]()

5/14/14 Equifax – 673 Experian – 744 Transunion – 722

already bought the house! closed with a great deal all thanks to information i learned here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: trying to break 800

@spydergto wrote:i have my loans staggered in my excel spreadsheet based on 2 seperate rows , intrest , and amounts , as much as I would like to target the one at the top of the intrest first i am targeting the lowest first , which is my auto loan , i have auto loan , 10 % house loan 2nd , student loan at 26k , then primary 80 percent mortgage below 80k i believe. id love to pay them all of lol but i dont have the funds for that. so by studying the spreadsheet by bobwang over on CB's ive learned that the maximum effect loans have on credit score come when the loan is paid below 50 % of the starting value, I intend to pay the car down / off in 4-9 months then focus on the 10 percent loan on my house. it has 6.25 percent intrest and i feel its to high on intrest rate and want to get it paid off. I currently have my mortgage through BBVA compass and can not nor wish to go into details about how much i dispise them and or all "banking" institutes.

After paying off / down to an extremely low balance the car note, i intend to make much haste and damage on the 10 percent loan. thats the only thing i really have in sight at this time. i want these two paid off/ down , then i plan to work on the student loan as its the 3rd , next up the list balance wise, and also the primary mortgage however that will take a few years as that is a huge pile of cash for my condo

but well worth it i love that place. and i got it thanks to the advice i found here and my dad!

my dad insists that i should just keep my primary mortgage with bbva as it would cost me a sum to move it, it is at 4.75 percent apr and i am not happy with the way that worked out i feel like bbva is hustaling me for as much cash as they can fleece from me. I would like to , at the end point of the car and 10 percent loan , try to move it to my credit union's shared mortgage broker, i feel like i would get a better deal and at that point i am tempted to buy alot of points in an attempt to get the intrest rate as low as possible.

but to get to that point , i need to farm now ! and get my scores as high as possible so in 3-4 years this can happen. i dispise bbva and all of this will probably end up being reposted in a few years time when i get to that point and try to make these moves a reality.

So , is there anything else i can do finance wise and put into effect now in regards to boosting my score later ? i am currently making 2-4 car payments a month depending on what my finanaces allow and 2 payments on the 10 pecent loan.

credit diversity was mentioned earlier, are there any other forms of credit that exsits that i dont hold that would be benificial and worth considering ? i am pretty stingy about unlocking my credit reports for a hard pull , those 5 points mean a **bleep** lot to me and i wont unlock it without being 100 percent sure im gonna get what im after.

i was day dreaming about a 4 wheeler and new dirt bike in a few years , potentially finance a ktm just to have the trade line , even though i could pay outright... id do it for a positive trade line only.

i just found out the other guy im working with on this rig has better credit than i do

I think you have an adequate mix if you have 3 credit cards...I would say that credit diversity is not always good...I would definately avoid any that would report as consumer finance account. It just takes time along with good credit habits to get your scores real high. People on these forums recommend 3 credit cards with 1 reporting <9% overall utilization..remeber though it is a point in time metric...and 1 installment loan, and I'll add if possible 1 mortgage. These recommendations are not pulled out of thin air, as these forums give some the ability to ask those with 850 scores their credit profiles and what they may have changed to cause a slight drop. Some here have even entered user info into a spreadsheet or database. Fico does not release it's proprietary info, so this is the best info we have, based on evidence. I do believe the 3 cc, 1 il with only 1 reporting to be accurate.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20