- myFICO® Forums

- Types of Credit

- Mortgage Loans

- mortgage with auto repo question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

mortgage with auto repo question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage with auto repo question

Ugh, had an entire post typed out then accidentally hit back and erased it. So here's the short and sweet.

We're getting pre approved for a home loan. My girlfriend has an auto repo with her ex husband from years ago.

The repo still shows her as having the monthly payment as monthly debt and it's decreasing our borrowing amount by 50k.

Lender says it has to be added in unless we can get it to say, or provide something that says she isn't responsible for that monthly payment. We're not sure what to do as this came at us as a surprise; we knew about the repo but not that it's counted as monthly debt still.

Did anyone have any ideas, comments or tips to try and resolve this? We're really looking forward to buying a house and this is throwing a wrench into it right now. Thanks.

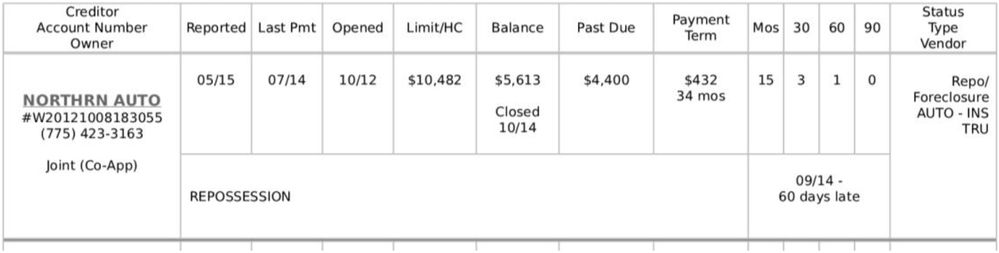

I'll also add a screen shot of the loan info if it helps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

If she was the joint account holder on the loan or a co-signer, she is legally responsible for the debt until it is discharged.

The statement that she has a repo with her ex husband implies that she was a responsible party to the loan and its remaining debt.

What you would likely need is some statement from the creditor for that loan that acknowledges she is not, in fact, a responsible party.

That would appear unlikely on their part unless they are willing, for some reason, to cancel the debt........

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

Maybe I didn't explain it well enough, we're not trying to make her not responsible for the entire loan, it's about the reported monthly payment. Her credit report shows it as closed and no payment due but the lender shows it as a repo with a continued monthly payment. Now if that's just how repossessions are, then we'll live with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

As set forth in the common credit reporting manual used by the big-3 CRAs, the payment terms code simply stores the amount of the monthly regular payment that was agreed to under terms of the account agreement that created the loan. It is provided, along with the agreed number of payments and amount of the loan, as information that may be of interest to prospective lendors.

If the account is now closed and the creditor is now demanding full payment, to be determined via the repossession process, that info is separate, and the now-due debt is even higher. It is initially the remaining balance on the loan, and will eventually, once they dispose of the vehicle, be offset by what they recoup via sale of the securing vehicle.

The reporting appears to be in full compliance with CRA reporting policy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

@Anonymous wrote:Ugh, had an entire post typed out then accidentally hit back and erased it. So here's the short and sweet.

We're getting pre approved for a home loan. My girlfriend has an auto repo with her ex husband from years ago.

The repo still shows her as having the monthly payment as monthly debt and it's decreasing our borrowing amount by 50k.

Lender says it has to be added in unless we can get it to say, or provide something that says she isn't responsible for that monthly payment. We're not sure what to do as this came at us as a surprise; we knew about the repo but not that it's counted as monthly debt still.

Did anyone have any ideas, comments or tips to try and resolve this? We're really looking forward to buying a house and this is throwing a wrench into it right now. Thanks.

I'll also add a screen shot of the loan info if it helps.

I would pull all 3 CRs from annual credit report for free.

If the DoFD is in 2014 (last payment shows 7/2014), it should age off the reports soon and she may be able to request EE from 1 or 2 bureaus or it may age off on it's own on short order.

TU will list "estimated date of removal"

EX will list "on record until"

And

EQ will list "date of first delinquency"

Come back and let us know the dates and maybe we can help you with it further.

Other than it aging off soon, there is little to be done about it. If there is a debt owed, it will be counted against your DTI.

Lastly, once this is gone, it may also improve her scores.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

Two great responses here, in short, contact the credit bureaus or the lender. There is no changing the specifics of what they're reporting. Your best option is removal by either of the methods mentioned above.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

Thank you for the responses. We'll look into the dates more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

So, she called all three of the bureaus. Two of them said they had no active record of the amount being reported, as if it aged off her report, and one (i don't remember exactly which one, equifax I think) wouldn't let you talk to a person at all. The only option online or over the phone was to report fraud or open a dispute; we opened a dispute.

He annual credit report reflected this info as well. I did forget to have her get dates of the one reporting so we have to wait a week (acr is going weekly for now instead of yearly).

So I guess for now we wait and see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: mortgage with auto repo question

You can order all three of those Credit Reports right here on this website and get the answers you need without waiting.