- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Do credit unions verify/prove your eligibility...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Do credit unions verify/prove your eligibility when you join via roommates?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do credit unions verify/prove your eligibility when you join via roommates?

I joined UWCU (University of Wisconsin credit union)

So I live in a house with my older sister and her boyfriend in the Minneapolis, MN area. Her boyfriend is from Wisconsin and most of his family is living in Wisconsin. I actually learned of UWCU from him even though he has never banked there or been a member before but has told me he has friends who do and they highly recommend them.

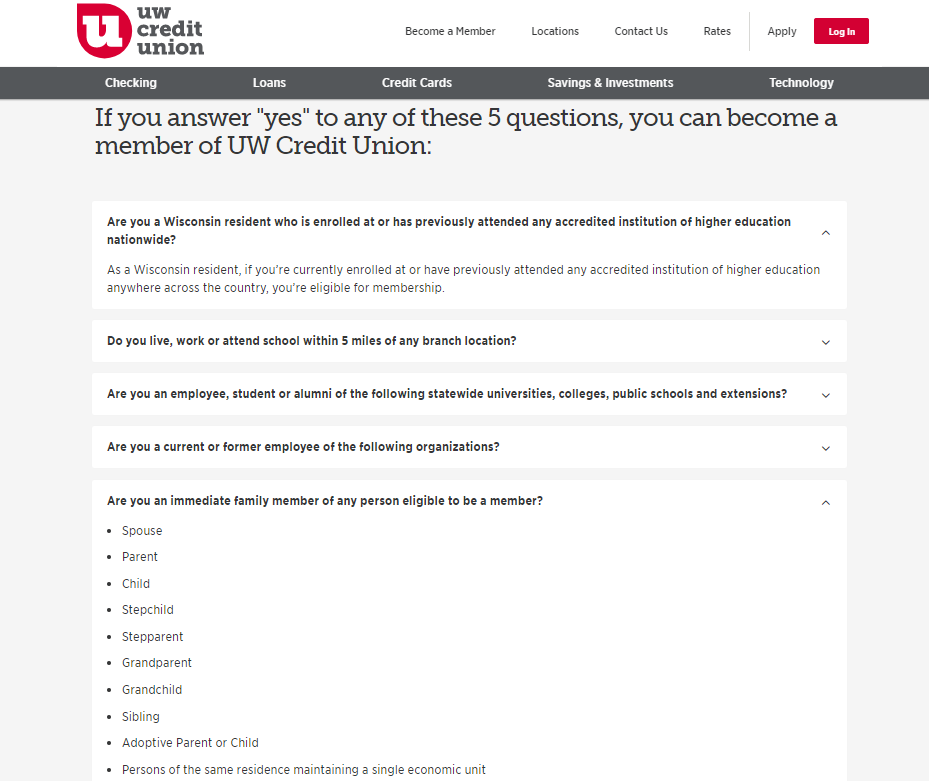

It says specifically on their eligibility page " As a Wisconsin resident, if you’re currently enrolled at or have previously attended any accredited institution of higher education anywhere across the country, you’re eligible for membership. " Well most of my sister's boyfriend's family in Wisconsin has attended college at one point in their life, which makes them eligible and thus makes my sister's boyfriend eligible, because immediately family members of those eligible are eligible to join.

https://www.uwcu.org/about-us/membership-eligibility/

Now it says below " Persons of the same residence maintaining a single economic unit " So since I live in the same house with my sister's boyfriend who is eligible, that makes me eligible as well.

On the application I just selected the " Immediate relative or household member of any eligible person " and the application was instantly approved, my accounts were funded and I got the online banking setup.

So are they actually going to "verify" my eligibility at all, or just take my word for it on the application? Is there a chance that they lock accounts until it gets verified or if they suspect something? (The fact I have a Minnesota address I think would pop out to them) What kind of documentation would I need to verify all of this anyway? Because they would not only need to verify not my eligibility, but my sister's boyfriend eligibility as well since I used the person living in the same household option, and also need to verify one of my sister's boyfriend's immediate family members living in Wisconsin.

I was expecting after I submitted the application it'd say they'd contact me to get more information from me. The fact everything was approved and ready to use kind of surprised me.

It is not my intention to fraudulently join or lie about my eligibility. I wouldn't of applied if I wasn't eligible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

If they approved you with out verifying eligibility, you are probably fine.

Sometimes they check, sometimes they don't.

I would advise a low profile for a little while...use your accounts, but don't set off any red flags. ![]()

Fico 9: EX 812 04/15/25, EQ 804 04/08/25, TU 792 02/15/25.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

I am actually eligible according to their criteria hency why I decided to join, it's just if I have to "prove" it I wouldn't know how to do so really. I'd have to prove I live with my sister's boyfriend in the same household (easy enough) but then I would have to show them proof that one of my sister's boyfriend family members that currently lives in Wisconsin attended college somewhere at one point.

Because my sister's boyfriend is only eligible via through an immediate family member that (to quote their membership eligibility page) "As a Wisconsin resident, if you’re currently enrolled at or have previously attended any accredited institution of higher education anywhere across the country, you’re eligible for membership."

It got me thinking, do credit unions typically verify eligibility through some of the more difficult ways to join like roommates and relatives of those eligible, or do they even care? I know Navy Federal NFCU does (with them being for military people andf the like) and regularly does audits and locks accounts and potentially closes them if they find out that you're not eligible. But most credit unions aren't like NFCU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

Congrats on your approval!!! After reading the 5 approval questions, I don't think you will have any issues with your new membership. Now, if they need further information, they will contact you and go from there. If you live, work or attend school within 5 miles of a branch location, you are good also... ![]()

“Most people work just hard enough not to get fired and get paid just enough not to quit.”

“Most people work just hard enough not to get fired and get paid just enough not to quit.”Take the myFICO Fitness Challenge

Inquiries: Experian - 4 | Equifax - 3 | TransUnion - 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

Thanks! I live in Minnesota so the nearest branch is over 150 miles from me haha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

I think you are ok. As you said, your eligibility is through someone who is eligible to join (your sister's boyfriend) and by living in the same residence with him in a single economic unit.

According to the National Association of Federally-Insured Credit Unions, a single economic unit can include roommates who participate in the maintenance of the household as long as it's not in the context of a group home such as a fraternity/sorority house or nursing home.

Source: https://www.nafcu.org/compliance-blog/back-basics-are-all-members-created-equal

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

@Royalbacon wrote:<snip>

It is not my intention to fraudulently join or lie about my eligibility. I wouldn't of applied if I wasn't eligible.

How you reconcile the quoted statement with the credit union's qualification of "As a Wisconsin resident?" Is your sister's boyfriend a Wisconsin resident? Is his name on the lease of the house where you currently reside?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

He lives in the same house as I do in Minnesota. The fact I live outside of Wisconsin is irrelevant.

He has a sister and mom who live in Wisconsin that have attended an accredited college at one point in their life, thus making them eligible. Now the boyfriend is eligible because his sister and mom is eligible, and thus makes me eligible since I live in the same house as him, as it says "Persons of the same residence maintaining a single economic unit"

It gets a bit confusing because im eligible because I live with someone that is eligible because their family members are eligible. Thats why I was wondering if they ever conduct and audit and ask me to provide proof of eligibility, it's going to be a mess to do so. Thats what I was initially asking, if they ever want me to verify eligibility, how would I go about doing so?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

It sounds like you are going to have to lay low and let the account age for 6-12 months or more. Don't go applying for anything and just make deposits, no matter how small, to have positive activity. If you slipped through the cracks, then don't go poking the bear, just to be safe... ![]()

“Most people work just hard enough not to get fired and get paid just enough not to quit.”

“Most people work just hard enough not to get fired and get paid just enough not to quit.”Take the myFICO Fitness Challenge

Inquiries: Experian - 4 | Equifax - 3 | TransUnion - 3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do credit unions verify/prove your eligibility when you join via roommates?

Yeah probably the best idea. I didn't slip through the cracks as I am technically eligible, just in a way that is going to be a gigantic pain the butt to verify if they ever wanted to. Definitely will just lay low and not do anything out of the ordinary to cause a red flag or suspicion.