- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- How do y'all figure out how you're doing?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do y'all figure out how you're doing?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do y'all figure out how you're doing?

I never really tried this before, I've always been pretty good about about saving money (or at least not spending it) and I tried once to do a somewhat year over year look at my financial picture but didn't take it any further. Getting better about where my money is going too but never took a bigger picture look and think I was missing a pretty important scorecard on my financial life as a result.

The other day I simply went and dumped data for both debts and assets for what time periods I had (2016 is a little squirly and couldn't get a May date recreation as I lost access to the statements from the checking account which is kinda core to my financials whoopsie) for a year over year comparison... happier outlook in life realizing I'm doing just fine, which got me to thinking how do others do anything similar or hopefully better?

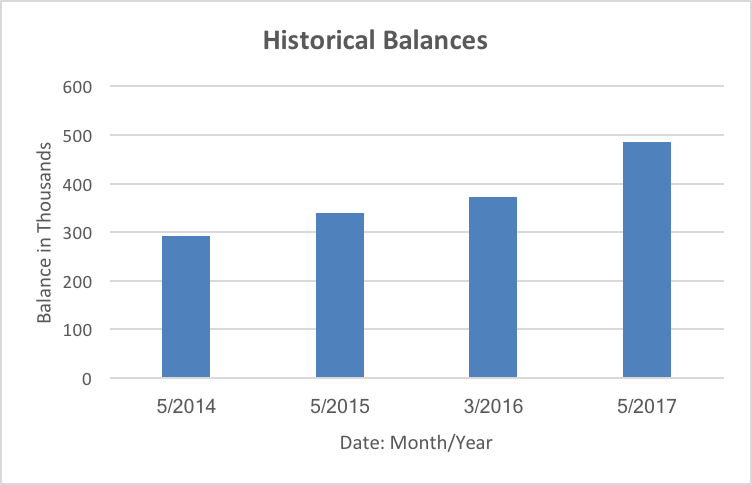

This was my stupid initial first-pass Excel graph, where the values are simply assets - debts vs. time. If I had access to my old checking account statements I'd probably try to get serious and do a month to month cash flow (or more accurately asset change) graph as it wouldn't take that long and would be interesting to me to see how various decisions affected my financial life, but c'est la vie... I may go bug Chase for them since they have to have them even if I lost access in their online interface after they closed it for a fraudulent check. Darn it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@Revelate...I assume this is in thousands...Would you care to share how your assets increased about 130k from 2016-2017? That is a huge increase compared to you previous years.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@sarge12 wrote:@Revelate...I assume this is in thousands...Would you care to share how your assets increased about 130k from 2016-2017? That is a huge increase compared to you previous years.

Yeah I updated the graph to put Axis titles on it, should've known better before. Hah, that was an error in the graph data actually, that's what I get for not using the base data values to simplify the graph. Updated picture again, still up 30.4% though in 14.7ish months between those two, it's been a fantastic year financially apparently.

Actually there's nothing personal identifying in this so just going to show the two datapoints, but the big things are my home value based on comparitive sales and this absurdly good market ride I've been on, Fidelity has me up 27.2% as of yesterday year over year of all things. I made a comment last year about being suboptimally over-invested in tech for 2016, but for 2017, haha, partying like it was 1999, literally. Some amount of cash savings even with the aborted school run in there too but without access to the old checking statements can't tease that out.

| Debt | 3/5/16 | 5/26/17 |

| Mortgage | 251000 | 234600 |

| HELOC | 0 | 0 |

| Auto | 0 | 0 |

| Installment | 300 | 22 |

| Credit Card | 0 | 0 |

| Sum Debts | 251300 | 234622 |

| Assets | 3/5/16 | 5/26/17 |

| Cash | 30000 | 3000 |

| Brokerage | 70100 | 168000 |

| WF Brokerage | 50600 | 0 |

| Rollover IRA | 53000 | 92150 |

| Trad IRA | 0 | 5500 |

| CC 401k | 13000 | 0 |

| PS 401k | 0 | 1500 |

| Roth IRA | 10600 | 25700 |

| Lending Club | 47000 | 40000 |

| Home Value | 350000 | 385000 |

| Sum Assets | 624300 | 720850 |

| Aggregate | $373,000.00 | $486,228.00 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

Well done, Revelate. You look like "the man with the plan."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@Anonymous wrote:Well done, Revelate. You look like "the man with the plan."

More like gotten lucky and now trying to make plans haha! Trying to do better.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@Revelate wrote:

@Anonymous wrote:Well done, Revelate. You look like "the man with the plan."

More like gotten lucky and now trying to make plans haha! Trying to do better.

Hey, I hear you. I have been pretty lucky, too. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

I log into Fidelity which provides me with nice summary reports individually and aggregated for my various retirement and after tax accounts.

Not doing nearly as well as you on investment returns (just over 12%).

Not looking at my house as an investment - overpaid dearly for a private, smallish, 1/4 acre lot on a hill that abuts a forever wild wetlands. Then spent too much on a custom build when building materials were peaking in 2005. Appraisal still $100k below cost. Oh well - it works for DW and me.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

My cash flow spreadsheet would give most people eye twitches because they're so complicated. A lot of sheet tabs connecting to data on other tabs.

Every recurring bill of any sort is forecast 36 months out and then I take 18 months of forecast bills, expenses, etc, and tie that to a number in my high interest savings. At any point in time I always have 18 months of Eff-You money where I can pick up and leave everything behind and survive for 18 months.

On top of that, my cash flow forecasts let me modify which card I run a balance on each month for reporting purposes but also help me maximize rewards and any float when there are large purchases. I basically know my income for 36 months from today because I am paid on long term contracts that can take up to 1000 days to reimburse me from work I performed today. My income never varies and my forecasts are +/- 1% even 3 years in advance.

I also have no loans or obligations, so that makes it a LOT easier but I am considering getting my first mortgage EVER this year to buy a 4-flat for investment reasons. Not sure if I want to mortgage it when I have the cash to buy but it might be fun to see what my accountant can do with it, if anything.

I also have a daily "don't spend more than" box which tells me exactly how much throwaround money I have today, based on forecasts. On top of that I have my "wish list" of items I want to buy but am waiting for a better deal to show up. I use websites like camelcamelcamel to track historic low prics and usually don't buy something until it hits that low number, even if it takes 12-18 months, lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

Amex Blue Business Plus

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

I would never manage my rentals any other way but spreadsheet. I keep track of odd data for every unit and every specific tenant: how often they call, complain, are late, etc. Over time I can look and see patterns pretty quickly and also know if it's time to jack rent up in order to find a better tenant (haven't had to do that in over 7 years, though). Also can tell if I'm having issues with one particular unit (fridge stopped working AGAIN???), and see seasonal issues -- such as one tenant of 6 years who is always 3 days late on rent in January. Nowadays with the Christmas card I just say "don't worry about rent until January 15th" and he pays around the 7th like clockwork.

All of the rental management apps (and accountants!) have missed out on key data that I can track myself for my own benefits. I also put in comp data on recent sales of identical or similar units and local rental data to give me ideas on when I should raise rent or not.