- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: IRS "Get My Payment" Portal is Live

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

IRS "Get My Payment" Portal is Live

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

@Anonymous wrote:So I'm not sure what's going to happen because in the FAQ, it does say if you receive a SSA-1099 and file taxes, you can use the portal, which means I might not get direct deposit since I filed my taxes when I didn't have to! 😡

You may have to wait a good while for a paper check in the mail.

I have helped 25+ people so far, about 15 have received DD.

Myself, I do not qualify for a wooden nickel![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

@M_Smart007 wrote:

@Anonymous wrote:So I'm not sure what's going to happen because in the FAQ, it does say if you receive a SSA-1099 and file taxes, you can use the portal, which means I might not get direct deposit since I filed my taxes when I didn't have to! 😡

You may have to wait a good while for a paper check in the mail.

I have helped 25+ people so far, about 15 have received DD.

Myself, I do not qualify for a wooden nickel

Yeah apparently if I end up being sent a check, it won't go out until 5/11. ![]()

Teach me to file taxes when I don't need to!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

I realized they are obviously overwhelmed and tried to knock these payments ASAP, but they really should have made sure the portal was up and running correctly. I have talked to so many people that get the message they can't determine if you qualify blah blah. My friends DD went to a bank account she doesn't even have🥺And anyone that used TT H&R etc and got money on a card well they are screwed too.

I know they wanted this money inpeople's hands quickly , but they really needed to get their ducks in a row which they failed miserably.

i even tried hubby's info same message 😡😡😡

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

No info available for me, filed last year not yet this year. My sis has a pending in her bank. With my luck i wont even get one![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

@Anonymous wrote:

@M_Smart007 wrote:

@Anonymous wrote:So I'm not sure what's going to happen because in the FAQ, it does say if you receive a SSA-1099 and file taxes, you can use the portal, which means I might not get direct deposit since I filed my taxes when I didn't have to! 😡

You may have to wait a good while for a paper check in the mail.

I have helped 25+ people so far, about 15 have received DD.

Myself, I do not qualify for a wooden nickel

Yeah apparently if I end up being sent a check, it won't go out until 5/11.

Teach me to file taxes when I don't need to!

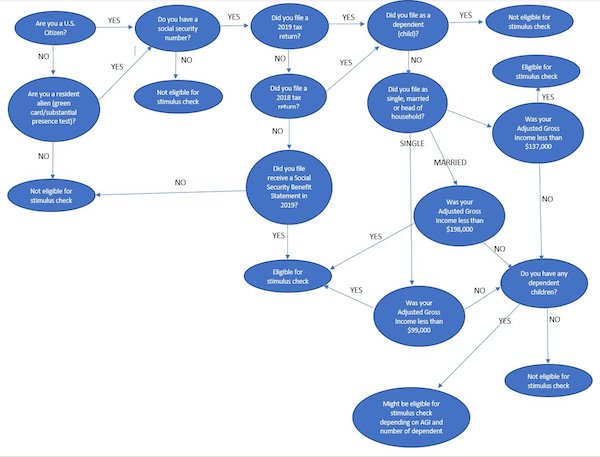

It is all very simple .. .NOT!

This might help?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

@AverageJoesCredit wrote:No info available for me, filed last year not yet this year. My sis has a pending in her bank. With my luck i wont even get one

I hear you @AverageJoesCredit I don't think we will get ours either

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

breaking this into a second post, just so it is not overlooked.

This might help?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

Thanks for the link . We have not filed our 2019 yet but they had claimed that did not matter , but now makes me wonder? But my son did file and got same generic answer which as the article states it is generic.

We owe again this year so I was excited about extension but that apparently might cost us 2400😡😡😡😡

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

Sorry Mom, thanks Smartie ![]() doesnt do much good as that article still cant help those receiving the message. Just have to wait and see i guess.

doesnt do much good as that article still cant help those receiving the message. Just have to wait and see i guess.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: IRS "Get My Payment" Portal is Live

@Jnbmom wrote:

Thanks for the link . We have not filed our 2019 yet but they had claimed that did not matter , but now makes me wonder? But my son did file and got same generic answer which as the article states it is generic.

We owe again this year so I was excited about extension but that apparently might cost us 2400😡😡😡😡

@Jnbmom ..If you did not file for 2019,

they will go off your 2018 tax form info. "If" (2018) had your bank account set up as DD, it will go there.

"if" they do not have your bank info, they will mail a check to the address on your 2018 tax return.

I would only file 2019 right away ..>> "IF" you made less than you did in 2018.

JMHO (Disclaimer: Not legal Tax advise)