- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Is Affirm considered Sub Prime?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is Affirm considered Sub Prime?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Affirm considered Sub Prime?

I see a fantastic way to finance a new computer on Amazon for a ridiculously low rate, but I am worried that Affirm would make my credit profile look bad. I have scores around 760 on all 3 major bureaus. I have 3 cards, Cap One Quicksilver $4800 (Rebuilder, started at $500), Navy Federal Cash Rewards $25,000, and Navy Federal More Rewards $25,000. I also have a new mortgage $144,000 from a few months ago plus $7900 in Student Loans. I just don't want to hurt my credit long term trying to get a great short term deal. Thank you for your insight!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

I think it reports as a consumer finance account. If so it would probably hurt your scores for many years. Not worth a huge amount of savings in my opinion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

@Toastmaster wrote:I see a fantastic way to finance a new computer on Amazon for a ridiculously low rate, but I am worried that Affirm would make my credit profile look bad. I have scores around 760 on all 3 major bureaus. I have 3 cards, Cap One Quicksilver $4800 (Rebuilder, started at $500), Navy Federal Cash Rewards $25,000, and Navy Federal More Rewards $25,000. I also have a new mortgage $144,000 from a few months ago plus $7900 in Student Loans. I just don't want to hurt my credit long term trying to get a great short term deal. Thank you for your insight!

If Affirm reports as a consumer finance account (CFA), stay far away. Another MyFICOer reported a gain of about 20 points on her FICO scores when the fully paid-on-time and closed account finally aged off of her CRs 10 years after closure.

Decades ago, I had a really tough time getting credit. It took me 13 years to get my first CC, despite applying every 6 months to a year, even for secured CCs, and having perfect payment histories for a 1-year Navy Fed personal loan, a 1-year auto loan, and a 2-year CFA (for a new computer, coincidentally). The CFA was probably on my CRs for 12 years, making me look like a bad credit risk.

Not worth it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

Your credit profile will definitely take a hit. I used affirm to pay over time for my annual ski pass and took a 19 pt hit.

Barclay(jetblue, arrival)

Bofa(US pride, premium, travel, cash, Suzy komen)

Citi(Premier, Double cash, Costco)

Fnbo(Mlife)

Amex(everyday, cash, Hilton)

Blockfi

Caesars rewards

Sofi

Gemini

Cap One Savor One

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

I suppose the exact point loss varies by profile, but yes, in a way, Affirm is viewed as "subprime" by the FICO algorithm since it is considered a "consumer finance account", which is bad.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

Thats interesting, my girlfriend actually financed something on affirm last year, did the 6 month plan. It never reported until after it was paid and closed, and it had zero impact on her score. She has a relatively thin file as well.

Edit: I have done it twice as well, never a HP and never reported until after it was paid. Posted as "installment account" and never impacted my score.

"When prosperity comes, do not use all of it"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

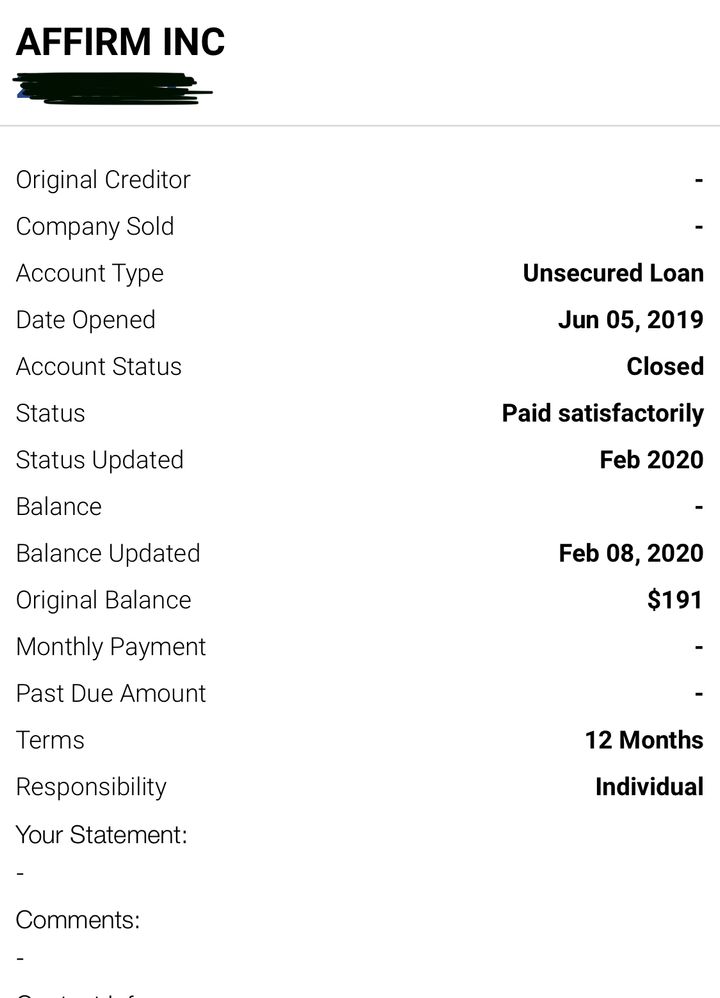

Just to add, I had used Affirm and it is only on my Experian report and under the same section as my student loans - Account Type: Installment Loans. When I open up the account, it says it is an unsecured loan. I am including a picture of what it looks like. How this is actually affecting, I am not sure. I did it to try since it was when it first became popular, not necessarily needing to go this route. When I first started with them, they did not report so it was not of a concern. Once they did, I stopped using them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

Looks like this is kind of an evolving thing with the BNPL companies and the credit bureaus:

https://www.cnbc.com/select/bnpl-loans-to-be-reported-on-credit-reports/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

Regardless of what it may or may not be considered as, since it seems to be quite subjective on a personal opinion and as noted by others can be drastically different based on your credit profile, history, etc. but why wouldn't you just use one of the cards you already have instead anyway? I don't think their rates are that great unless it's a first time purchase with them, then they may offer crazy low APR? I've used Affirm with no problem for the past 3 years and it only dinged me for an initial HP but bounced back not long after and ever since I've had an on-going revolving amount of credit to use with no noticable affect to my credit.

In the end, I just can't believe that having this type of account is going to seemignly wreck you for 10 or more years, let alone past 6 months. This is coming from someone who has used and continues to use Affirm for multiple little loans since it doesn't hit your utilization, I actually favor it. Currently I have a 12-month Apple loan out with Affirm and 2 other smaller loans with Affirm totalling under $2,000 with a score of 706. I've been utilizing my Discover card quite a bit and have 2 $200 medical baddies, otherwise I'm generally around 763 even with the multiple Affirm loans.

I am curious now though, to see what kind of affect it may or may not have on my credit after the loans are paid off in full and see just how much of a difference it might make. Think my last payment will be end of year and will know shortly after.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Affirm considered Sub Prime?

I know a lot of these companies are having deals to use them. So like you can get a 20% discount if used through them. This is if you can not find one elsewhere. Some do offer 0% APR if you qualify.