- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: PRO TIP for Navy Federal Credit Union Members

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PRO TIP for Navy Federal Credit Union Members

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PRO TIP for Navy Federal Credit Union Members

I've just gotten off of the phone with a very nice CSR. She kindly explained if I wanted to diversify my credit portfolio, I should look into their Certificate Pledged Loans. Basically, the min. down payment is $250 - but the payment is immediately made back to you.

You essentially pay ~$42/mo. for a positive report to the credit bureaus. But that $42 is immediately made back available to you. It shows as positive payment history. For those of you, like me, still building credit with a VERY thin file (I'm only 18) it helps show you don't only use credit cards.

Unless they're trying to sell me on something - which may be the case, it seems like a great deal for those of us with thin files...or maybe even those of us with derrogs on our reports.

Did I mention you get all of this without a hard pull?

Maybe I'm missing something...this seems too good to be true!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

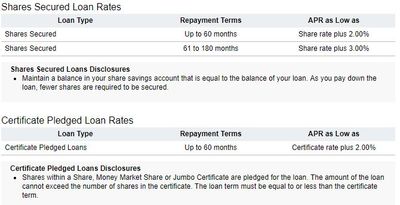

This is a variation on the Shares Secured Loan. The Alliant SSL technique was very popular around here until that credit union discontinued the product about a year ago. Navy Federal has the next best and, so far as I've heard, only alternative to employ the technique.

While the SSL uses money in your share account as security, this uses a CD. Looks like there is also the added caveat the loan cannot be for a longer term than the certificate.

For those that are eligible for NFCU membership and don't have any other installment loans it is indeed a nice boost to your credit.

P.S. For more information about SSL see these posts:

Adding-an-installment-loan-the-Share-Secure-technique

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

@Anonymous wrote:I've just gotten off of the phone with a very nice CSR. She kindly explained if I wanted to diversify my credit portfolio, I should look into their Certificate Pledged Loans. Basically, the min. down payment is $250 - but the payment is immediately made back to you.

You essentially pay ~$42/mo. for a positive report to the credit bureaus. But that $42 is immediately made back available to you. It shows as positive payment history. For those of you, like me, still building credit with a VERY thin file (I'm only 18) it helps show you don't only use credit cards.

Unless they're trying to sell me on something - which may be the case, it seems like a great deal for those of us with thin files...or maybe even those of us with derrogs on our reports.

Did I mention you get all of this without a hard pull?

Maybe I'm missing something...this seems too good to be true!

Yes it's a great way to improve your credit report, but my advice would be:

1. Do a share secured loan with NFCU instead. That way you will have the positive benefits of an installment loan for a much longer period. The one you're describing would be for a year only. You can do a share secured loan for $3010 over a 5-year span. The only difference is it's secured by your regular savings account rather than a certificate. Put $3020 in savings. Take out a $3010 60-month share secured loan. A day later transfer $2740 from the savings to the loan. Your loan balance will be around $270. Then pay very slowly for the next 59 months.

2. Bear in mind that although there's no hard pull, it does show up as a new account. But at your stage of the game, that's fine.

Total revolving limits 586020 (520820 reporting) FICO 8: EQ 694 TU 696 EX 683

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

@SouthJamaica wrote:

@Anonymous wrote:I've just gotten off of the phone with a very nice CSR. She kindly explained if I wanted to diversify my credit portfolio, I should look into their Certificate Pledged Loans. Basically, the min. down payment is $250 - but the payment is immediately made back to you.

You essentially pay ~$42/mo. for a positive report to the credit bureaus. But that $42 is immediately made back available to you. It shows as positive payment history. For those of you, like me, still building credit with a VERY thin file (I'm only 18) it helps show you don't only use credit cards.

Unless they're trying to sell me on something - which may be the case, it seems like a great deal for those of us with thin files...or maybe even those of us with derrogs on our reports.

Did I mention you get all of this without a hard pull?

Maybe I'm missing something...this seems too good to be true!

Yes it's a great way to improve your credit report, but my advice would be:

1. Do a share secured loan with NFCU instead. That way you will have the positive benefits of an installment loan for a much longer period. The one you're describing would be for a year only. You can do a share secured loan for $3010 over a 5-year span. The only difference is it's secured by your regular savings account rather than a certificate. Put $3020 in savings. Take out a $3010 60-month share secured loan. A day later transfer $2740 from the savings to the loan. Your loan balance will be around $270. Then pay very slowly for the next 59 months.

2. Bear in mind that although there's no hard pull, it does show up as a new account. But at your stage of the game, that's fine.

One could use a 5 year or longer term certificate to secure the loan. Otherwise I totally agree that the SSL is a better product. For the SSL once you pay off 91% of the balance that money is free to use again. Whereas if you go the certificate route its locked up until the CD matures.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

SelfLender essentially uses the Certificate loan but with a slight twist. Your payments go towards paying off the certificate. At the end of the 1 or 2 year term you can cash out your CD. The downside of SelfLender is that you can't prepay 91% of the loan and still keep the original term. I am thinking that also wouldn't be possible with Navy's certificate loan product. Their Secure Share Loan product is the better way to go for a longer term and prepayment option.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

I did the share secure loan through NFCU recently in order to build my history with them after I was denied a credit card. I also have a thin file with all of my accounts under a year old but no negatives on my report and an EQ score of 680. I did a $300 share secured loan and paid it off in the 6 months. Oddly enough, after the loan was paid off they still denied my credit card application due to thin file but they did approve a personal loan of $12K if I wanted to take it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

@SouthJamaica wrote:

@Anonymous wrote:I've just gotten off of the phone with a very nice CSR. She kindly explained if I wanted to diversify my credit portfolio, I should look into their Certificate Pledged Loans. Basically, the min. down payment is $250 - but the payment is immediately made back to you.

You essentially pay ~$42/mo. for a positive report to the credit bureaus. But that $42 is immediately made back available to you. It shows as positive payment history. For those of you, like me, still building credit with a VERY thin file (I'm only 18) it helps show you don't only use credit cards.

Unless they're trying to sell me on something - which may be the case, it seems like a great deal for those of us with thin files...or maybe even those of us with derrogs on our reports.

Did I mention you get all of this without a hard pull?

Maybe I'm missing something...this seems too good to be true!

Yes it's a great way to improve your credit report, but my advice would be:

1. Do a share secured loan with NFCU instead. That way you will have the positive benefits of an installment loan for a much longer period. The one you're describing would be for a year only. You can do a share secured loan for $3010 over a 5-year span. The only difference is it's secured by your regular savings account rather than a certificate. Put $3020 in savings. Take out a $3010 60-month share secured loan. A day later transfer $2740 from the savings to the loan. Your loan balance will be around $270. Then pay very slowly for the next 59 months.

2. Bear in mind that although there's no hard pull, it does show up as a new account. But at your stage of the game, that's fine.

Wait... I thought you couldn’t touch the money in the savings account until you paid down the SSL, I didn’t know you could transfer the money to it?

That would make it a lot more feasible if the money in the savings can be used to pay down the loan. I guess that’s the part I didn’t understand. I figured if you wanted a $3000 loan, you needed to have about $5700 to make it work.

I guess I will have to find out the different thresholds and look a bit more into this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:I've just gotten off of the phone with a very nice CSR. She kindly explained if I wanted to diversify my credit portfolio, I should look into their Certificate Pledged Loans. Basically, the min. down payment is $250 - but the payment is immediately made back to you.

You essentially pay ~$42/mo. for a positive report to the credit bureaus. But that $42 is immediately made back available to you. It shows as positive payment history. For those of you, like me, still building credit with a VERY thin file (I'm only 18) it helps show you don't only use credit cards.

Unless they're trying to sell me on something - which may be the case, it seems like a great deal for those of us with thin files...or maybe even those of us with derrogs on our reports.

Did I mention you get all of this without a hard pull?

Maybe I'm missing something...this seems too good to be true!

Yes it's a great way to improve your credit report, but my advice would be:

1. Do a share secured loan with NFCU instead. That way you will have the positive benefits of an installment loan for a much longer period. The one you're describing would be for a year only. You can do a share secured loan for $3010 over a 5-year span. The only difference is it's secured by your regular savings account rather than a certificate. Put $3020 in savings. Take out a $3010 60-month share secured loan. A day later transfer $2740 from the savings to the loan. Your loan balance will be around $270. Then pay very slowly for the next 59 months.

2. Bear in mind that although there's no hard pull, it does show up as a new account. But at your stage of the game, that's fine.

Wait... I thought you couldn’t touch the money in the savings account until you paid down the SSL, I didn’t know you could transfer the money to it?

That would make it a lot more feasible if the money in the savings can be used to pay down the loan. I guess that’s the part I didn’t understand. I figured if you wanted a $3000 loan, you needed to have about $5700 to make it work.

I guess I will have to find out the different thresholds and look a bit more into this.

You can do anything you want with the money so long as you leave in savings more than what's owed on the loan.

In my example you deposit 3020, then you take out a loan for 3010. When you do that, the loan proceeds go into savings and your savings balance becomes 6030.

Then you take 2740 and pay it towards the loan, at which point the loan is a mere 270 and you've got 3290 in savings to secure a 270 loan.

So you can take 3k out of savings and be on your way. Or leave it if you like ![]()

Total revolving limits 586020 (520820 reporting) FICO 8: EQ 694 TU 696 EX 683

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:I've just gotten off of the phone with a very nice CSR. She kindly explained if I wanted to diversify my credit portfolio, I should look into their Certificate Pledged Loans. Basically, the min. down payment is $250 - but the payment is immediately made back to you.

You essentially pay ~$42/mo. for a positive report to the credit bureaus. But that $42 is immediately made back available to you. It shows as positive payment history. For those of you, like me, still building credit with a VERY thin file (I'm only 18) it helps show you don't only use credit cards.

Unless they're trying to sell me on something - which may be the case, it seems like a great deal for those of us with thin files...or maybe even those of us with derrogs on our reports.

Did I mention you get all of this without a hard pull?

Maybe I'm missing something...this seems too good to be true!

Yes it's a great way to improve your credit report, but my advice would be:

1. Do a share secured loan with NFCU instead. That way you will have the positive benefits of an installment loan for a much longer period. The one you're describing would be for a year only. You can do a share secured loan for $3010 over a 5-year span. The only difference is it's secured by your regular savings account rather than a certificate. Put $3020 in savings. Take out a $3010 60-month share secured loan. A day later transfer $2740 from the savings to the loan. Your loan balance will be around $270. Then pay very slowly for the next 59 months.

2. Bear in mind that although there's no hard pull, it does show up as a new account. But at your stage of the game, that's fine.

Wait... I thought you couldn’t touch the money in the savings account until you paid down the SSL, I didn’t know you could transfer the money to it?

That would make it a lot more feasible if the money in the savings can be used to pay down the loan. I guess that’s the part I didn’t understand. I figured if you wanted a $3000 loan, you needed to have about $5700 to make it work.

I guess I will have to find out the different thresholds and look a bit more into this.

I believe $3001 is a threshold. My first attempt at the SSL they told me 36 months for $3000. The CSR told me $5k if I wanted 60 months. I believe that is wrong because there are multiple reports here of $3000+ getting the full term. So maybe $600+ per year you want the loan term to be.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PRO TIP for Navy Federal Credit Union Members

Thanks for the info about how this all works. Due to only being allowed $2000 in countable assets right now, I’ll have to be able to spend down the balance pretty quickly but once I pay off my balance on my platinum card, I may have to look into the SSL to get a lift when I go for goal cards when my BK falls next year.