- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Best Buy closed in 2013 but is reporting late ever...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best Buy closed in 2013 but is reporting late every month.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best Buy closed in 2013 but is reporting late every month.

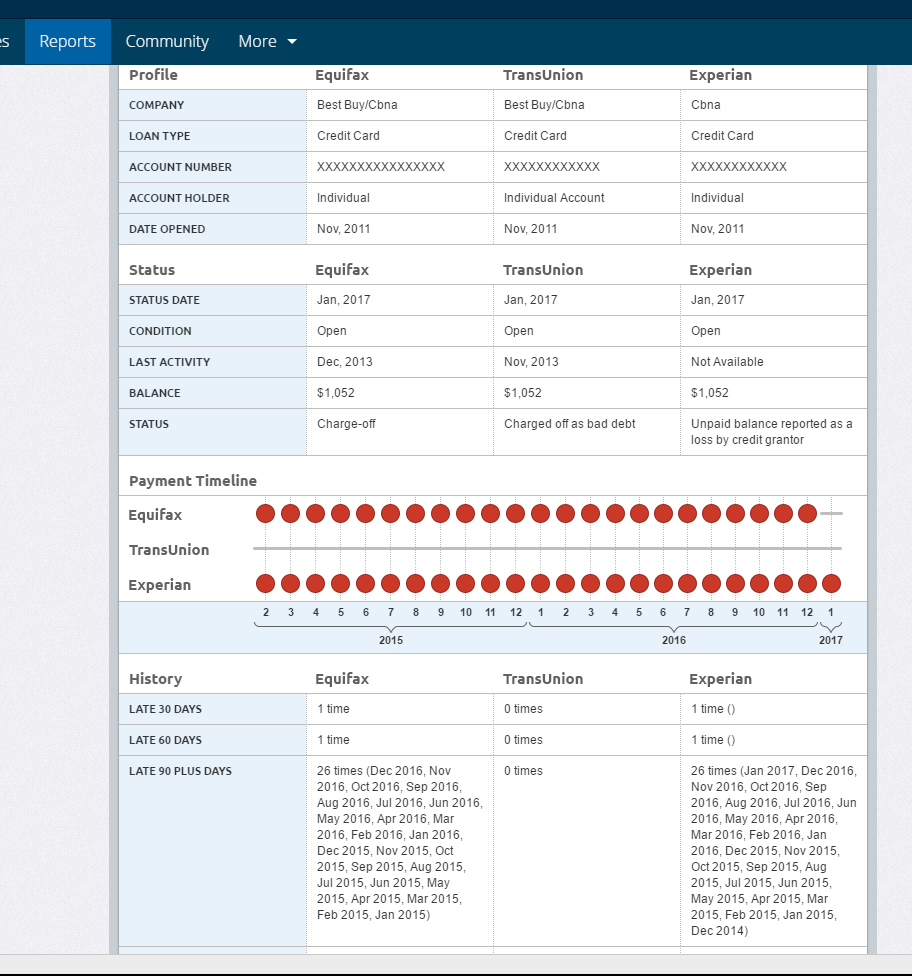

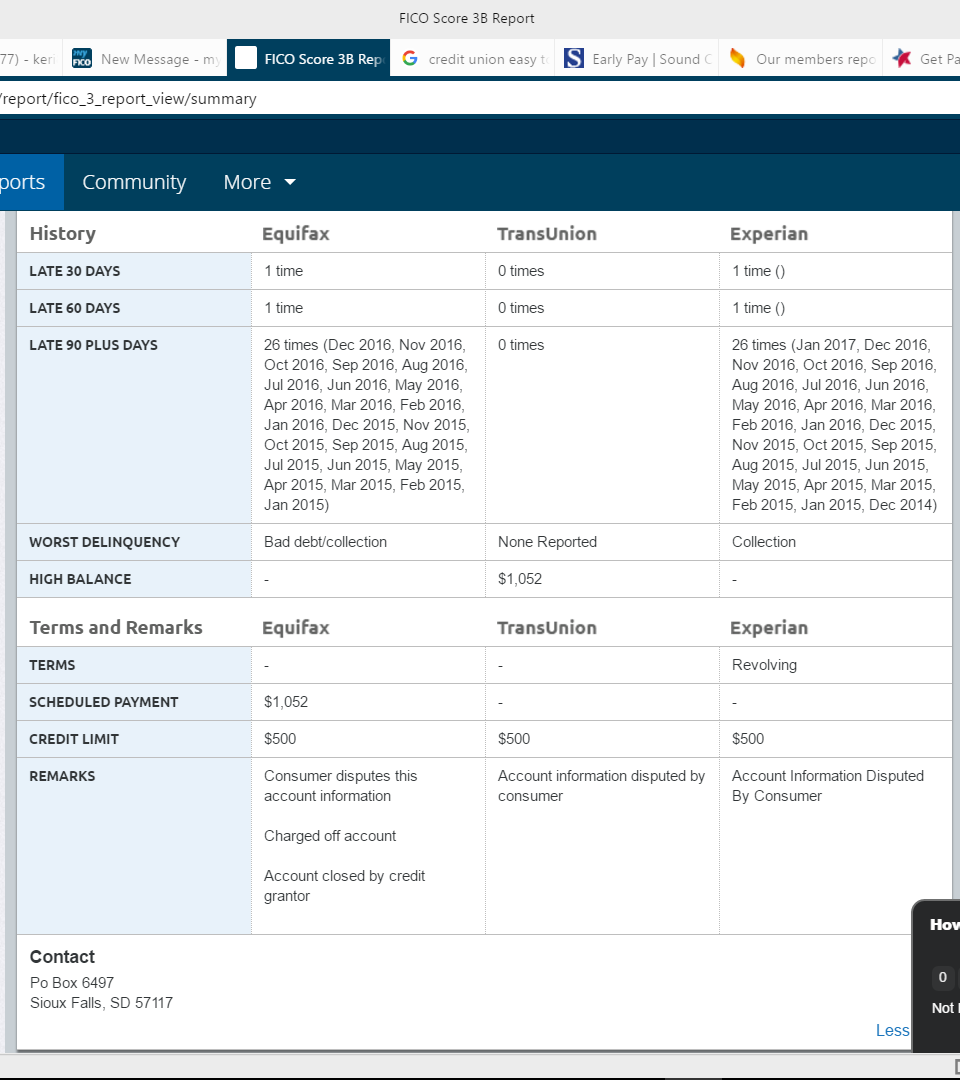

I need to know if it is affecting my credit score. It shows the account is open and also charged off but each month they report I am 90 days late. I also did dispute but nothing changed. I attached screenshots of the account to get some thoughts. I'm not sure how to get it fixed or if it is dropping my scores. Thanks for your help.

Current 9/28/16 Experian 659 Equifax 646Transunion 633

Starting over...06/13/2015

Experian 537 Equifax 544 TransUnion 525

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

Closing a revolving account ends the ability of the consumer to continue to increase the delinquent debt.

It does not end the fact that the account is delinquent, or prevent the reporting of continued or incresed level of delinquency.

A charge-off is an accounting measure that moves the delinquent debt from inclusion in the creditor's receivable asset column over to the bad debt/liability column.

That then reduces the stated net assets of the creditor, and thus is intended to more accurately reflect their "real" assets.

It similarly does not end the fact that the debt continues to be delinquent, and if it remains unpaid, continues to be reported as its current status.

You have a delinquent debt that is increasing in its length of delinquency with each reported update.

It appears to be corrrect reporting.

Additionally, it is common for a creditor to either assign a bad debt for collection assistance after a charge-off, or sell the delinquent debt.

Thus, if the debt remains unpaid, additional of a collection is possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

OP I noticed that the open date, the date the collector opened the collection account, is November 2011. The open date is younger than the DOFD. That means the account's 7-year clock is about to run-out. I suggest you pinpoint the DOFD on this account. This account could be on it's last leg.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

@rmduhon wrote:

I'm not seeing anything that might be construed as a DoFD. And it appears to me that this is Best Buy reporting it, not a CA. In that case the open date would be the date the account was opened, not the date a CA acquired it.

Ok I see your point. I didn't note that Best Buy is reporting. Then DOFD is probably a few months before November. That leaves about a year and a half. That's really not a long time if you are unable to pay it. Also, its impact might not be great.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

From what I'm seeing DOFD is late summer of 2014. 26 90+ plus the 30 and the 60 make 28 months.

Cap1 QS-$4,500 Chase Freedom Flex- $800 Chase Freedom Unlimited- $1,000 Victoria's Secret- $1,200 Citi DC- $800 Amazon Store Card- $3,500 AMEX Hilton Honors-$1,000 Discover It-$1,000 Wal-Mart MC $290 Chase Sapphire Preferred-$5,000 NFCU Flagship $13,800 AMEX BCE-$1,000 AMEX Gold-$5,000 AMEX Delta Blue $1,000 Lowe's $5,000 Navy Platinum $17,000 AMEX BBP $2,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

I haven't been able to find the DFOD so I am searching old records. I think without checking it was in 2013. If I settle with them, would that restart the 7 year clock?

Current 9/28/16 Experian 659 Equifax 646Transunion 633

Starting over...06/13/2015

Experian 537 Equifax 544 TransUnion 525

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

The DOFD cannot be inferred from the payment history reporting of monthly delinquencies.

Best guess is that the DOFD is likely sometime in 2014.

Regardless, the DOFD only relates to the exclusion of the reported charge-off.

Monthly delinquencies each have their own exclusion date of 7 years from their date of occurence.

Payment would end the reporting of monthly delinquencies.

It would also preclude the possible addition of a new collection being reported.

I would begin by attempting a pay for deletion offer, thus attempting to both discharge the debt and remove any and all reported derogs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Buy closed in 2013 but is reporting late every month.

@RobertEG wrote:The DOFD cannot be inferred from the payment history reporting of monthly delinquencies.

Best guess is that the DOFD is likely sometime in 2014.

Regardless, the DOFD only relates to the exclusion of the reported charge-off.

Monthly delinquencies each have their own exclusion date of 7 years from their date of occurence.

Payment would end the reporting of monthly delinquencies.

It would also preclude the possible addition of a new collection being reported.

I would begin by attempting a pay for deletion offer, thus attempting to both discharge the debt and remove any and all reported derogs.

RobertEG, if OP wasnt successful in a PFD, they would still be far better off seeing if they could work out some type of settlement for the debt so that it stops reporting, correct?

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!