- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Follow up to Merrick Charge Off question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Follow up to Merrick Charge Off question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

Yes, sir! It sure is. And I love it, too! Have always been techincal and "process driven". And I LOVE LOVE LOVE to get to the bottom of things (sometimes my line of questioning is 'off putting' to people....I tend to ask the same question three or four ways, but if one listens, then one sees that the questions are ever so slightly different).

Thank you for all of your help up to this point. Much appreciated.

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

Just a follow up to this long long long post.

I did send the initial letter to Merrick on August 19th. I also sent an adendum on August 27th.

Nothing from them (Merrick) just yet, but they do have another week (roughly) before they have to respond to the first letter.

I will keep everyone informed as I have new information.

The goal here is to inform folks how this process plays out!

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

@HowDoesThisAllWork wrote:Just a follow up to this long long long post.

I did send the initial letter to Merrick on August 19th. I also sent an adendum on August 27th.

Nothing from them (Merrick) just yet, but they do have another week (roughly) before they have to respond to the first letter.

I will keep everyone informed as I have new information.

The goal here is to inform folks how this process plays out!

Eagerly awaiting an update on this one lol

merrick is doing the same to me after settlers for less (updating as a CO on EQ only) which is bringing my date since last "late payment" to 1 month old 😐

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

I suspect that they will reply to my first letter within the week?

As mentioned, I sent a second letter about one week after the first where I had "much more detail" included.

I look at my credit reports each week (mostly because of the "Date Updated" data from this CO) and can validate that Merrick has not updated this since August 19 (which is right when I sent in the two "dispute" letters to them directly).

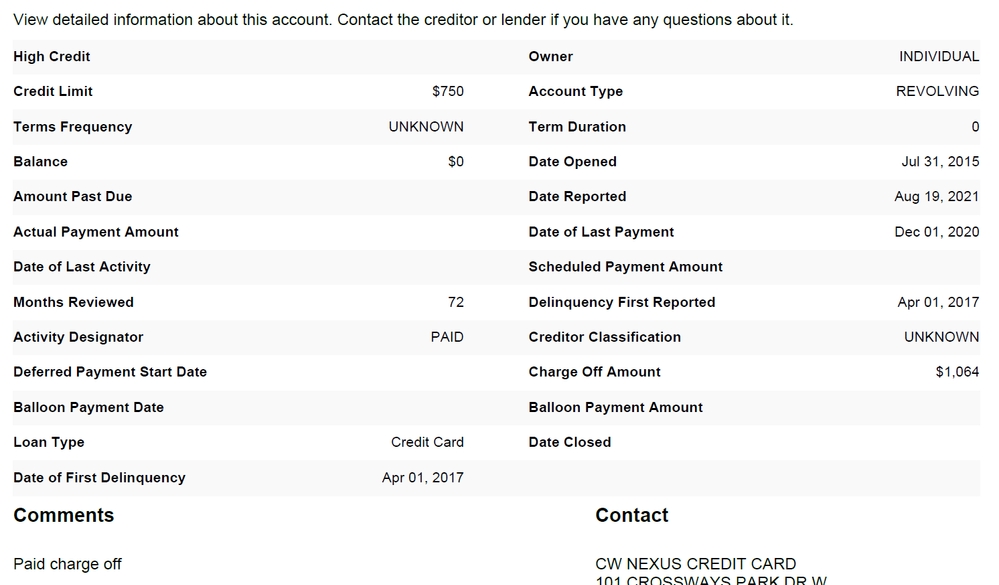

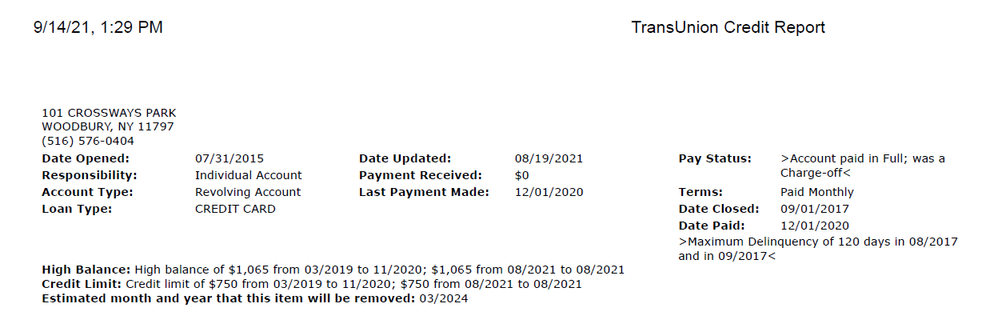

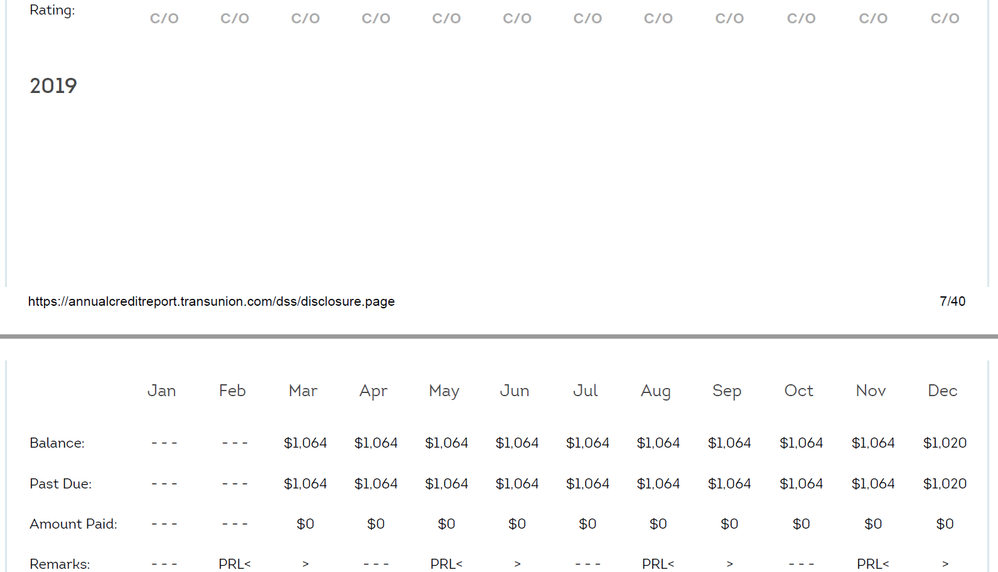

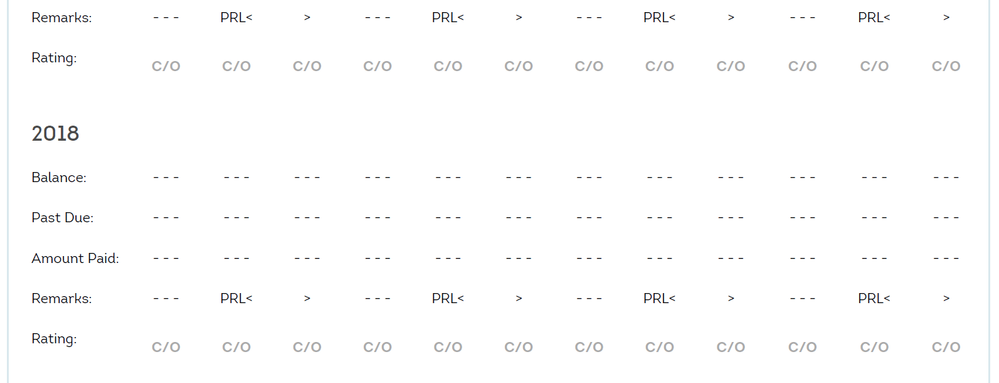

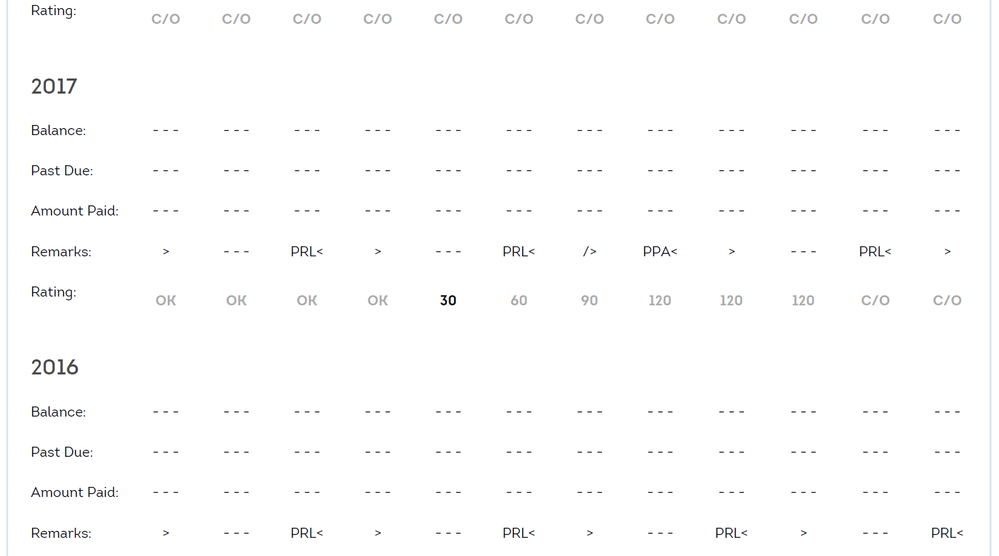

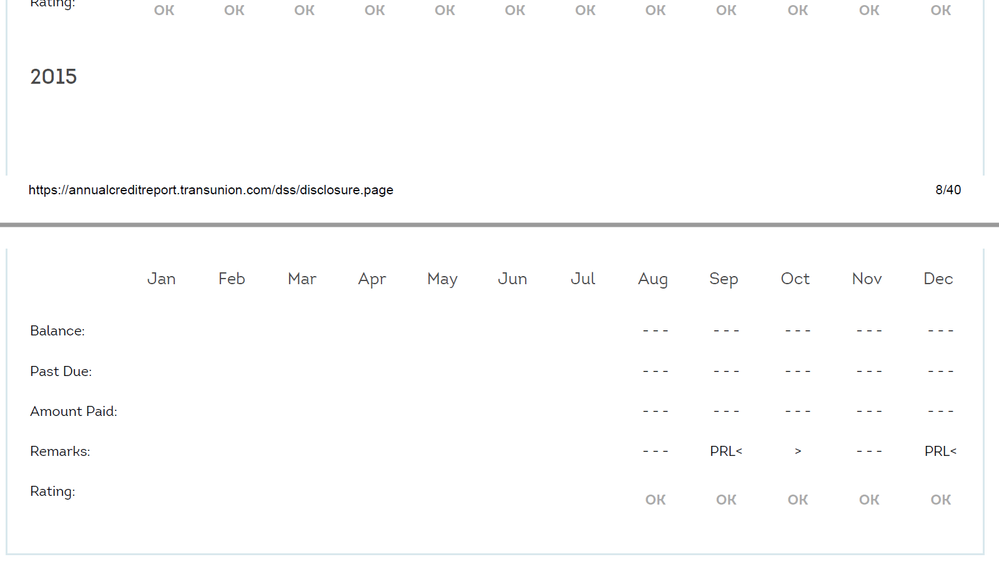

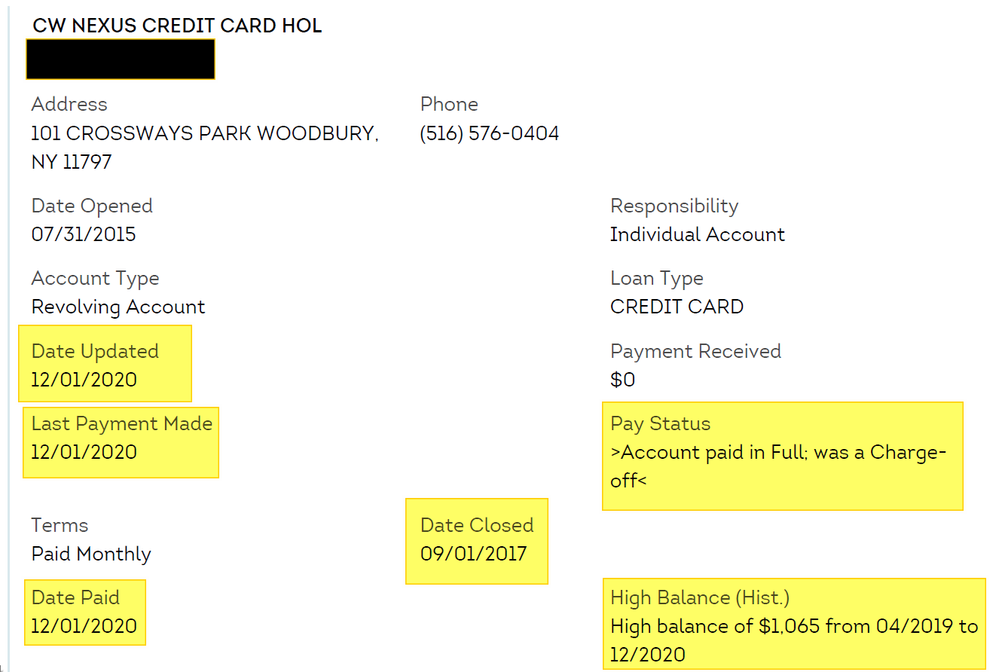

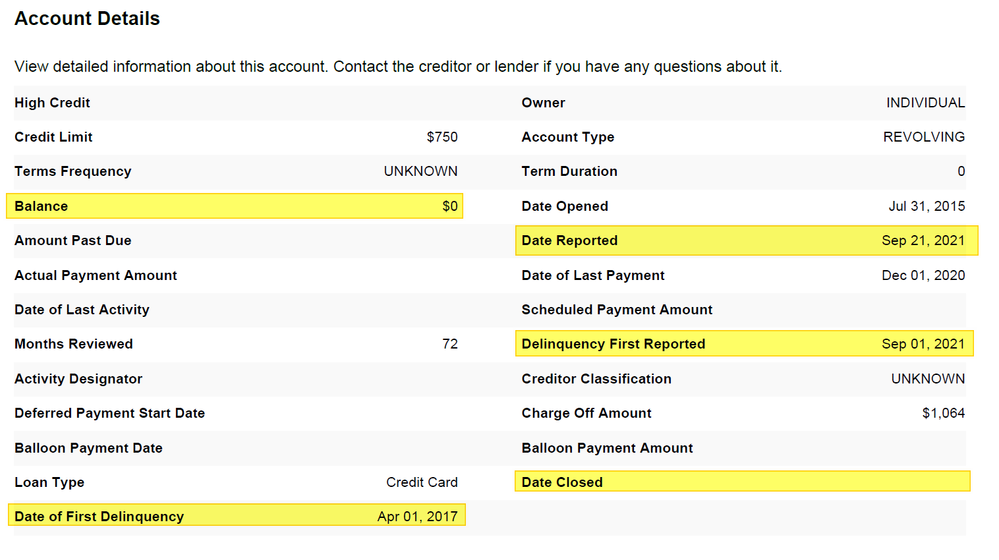

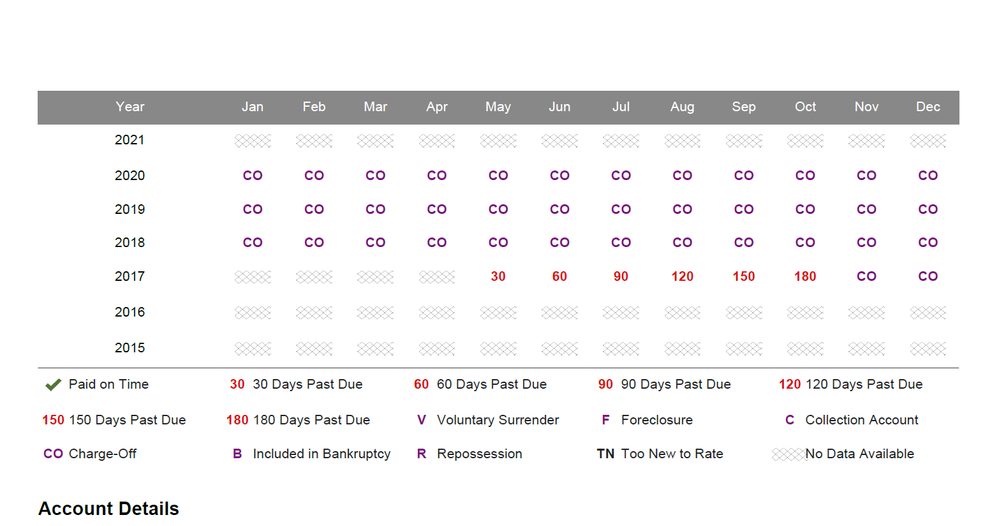

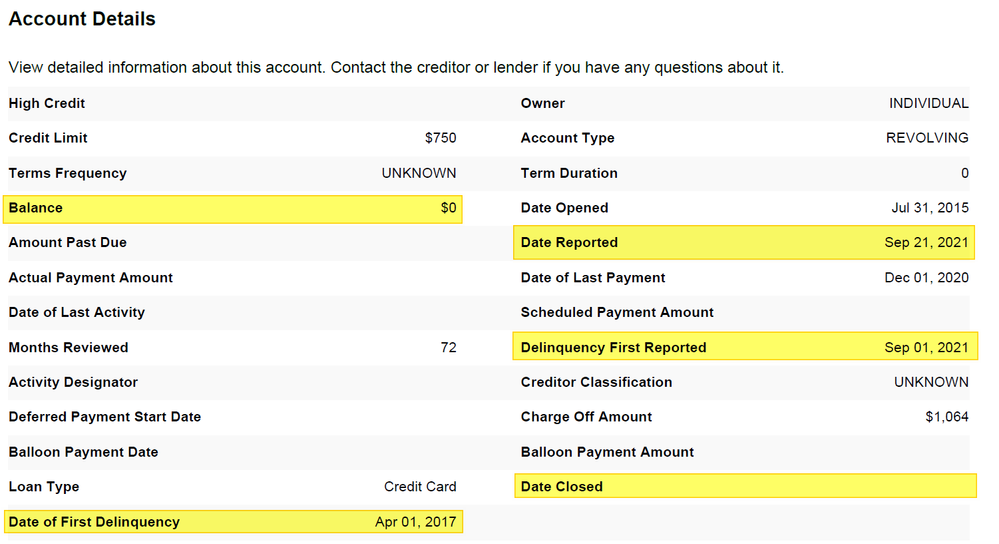

Below is a snip of the latest Equifax and Transunion Credit Reports:

Hoping that something positive changes soon.

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

In my case, Merrick doesn't update to my TU report at all - but they hit my EQ constantly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

@Coco_The_Awesome wrote:In my case, Merrick doesn't update to my TU report at all - but they hit my EQ constantly.

@Coco_The_Awesome Wierd! They hit EquiFax and Transunion every week for me....but have never hit Experian. Maybe different people within Merrick doing this and we all have our preferences? LOL Now, watch that silly idea be *EXACTLY* what is going on here!

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

***UPDATE*** ***UPDATE*** ***UPDATE***

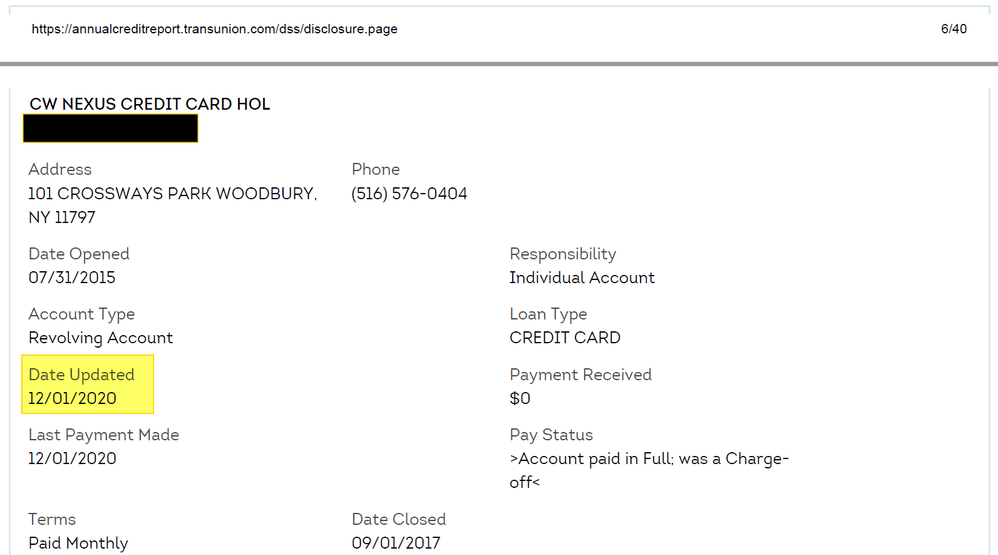

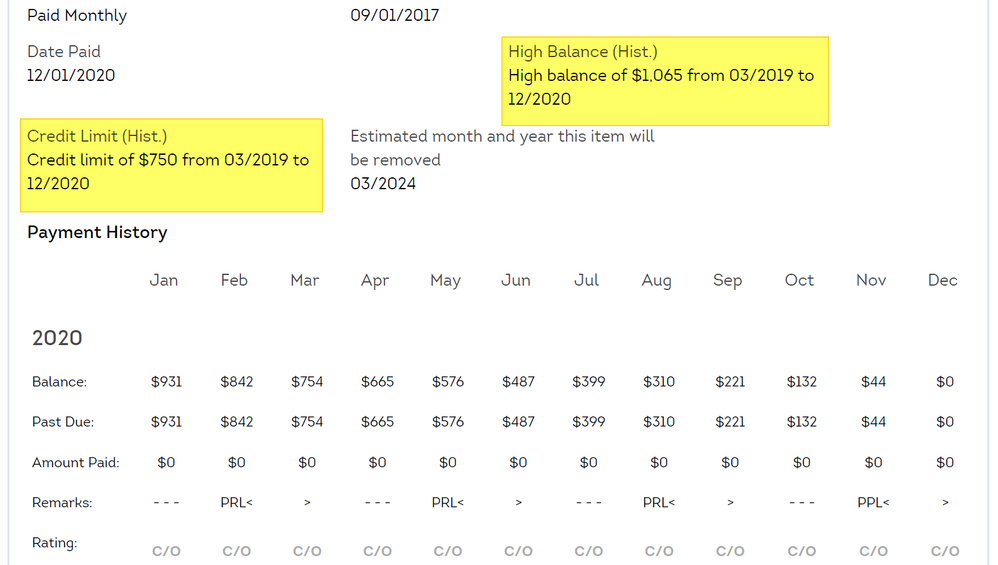

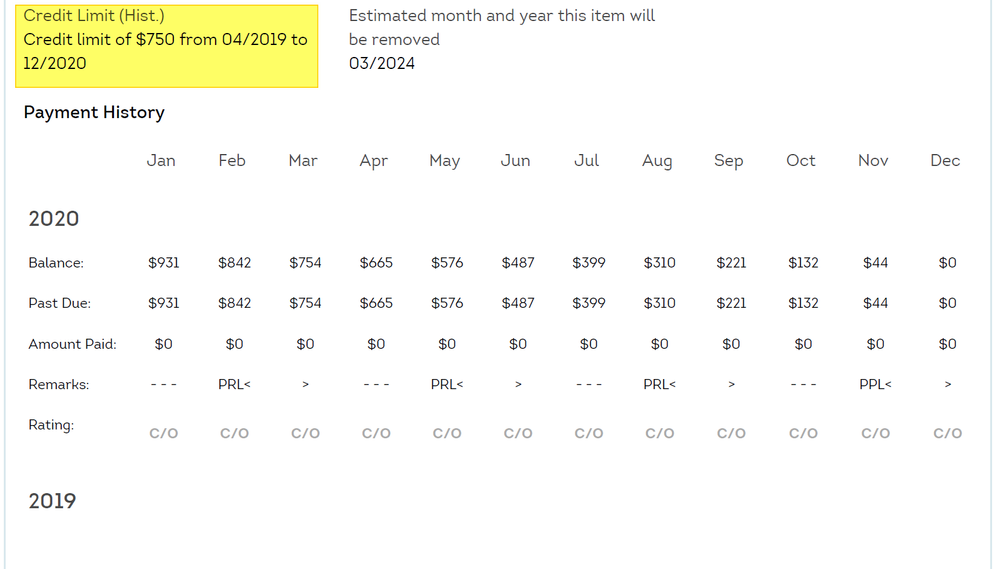

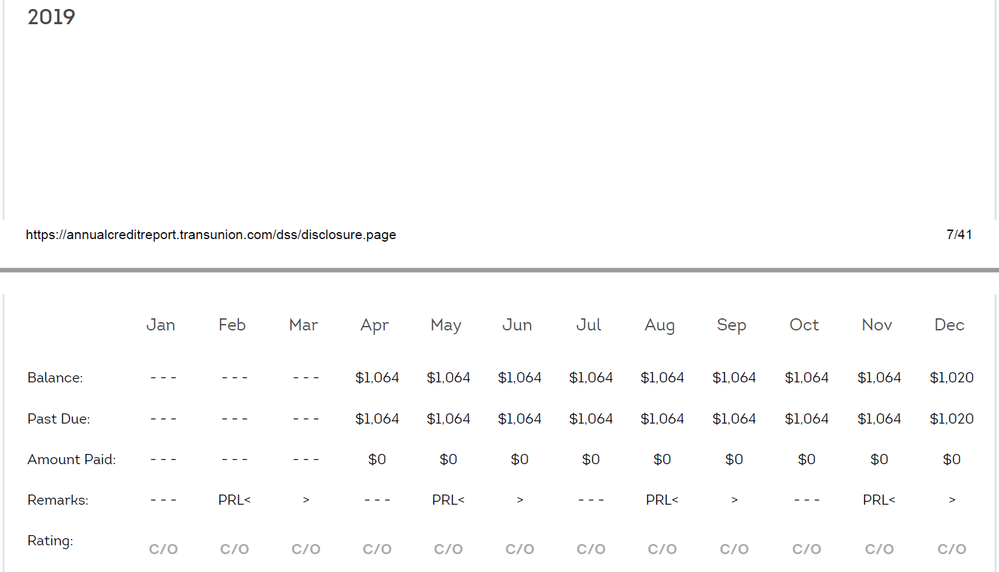

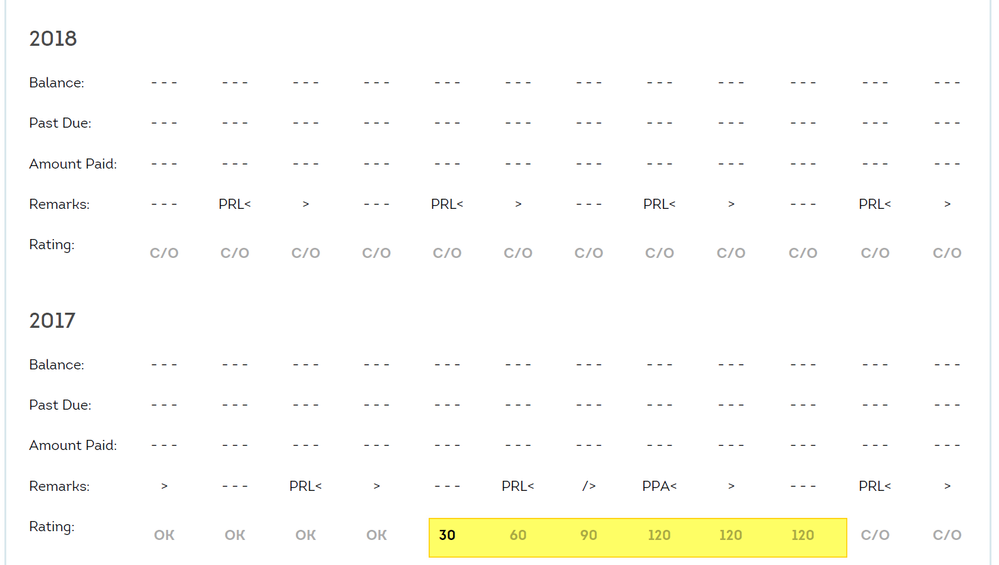

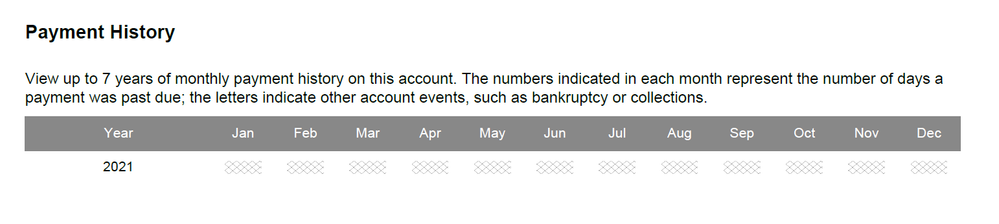

So, for those of you following this, I have an update. Short version: Transunion Credit Report is now correct - as to my satisfaction. Please find below the six screen shots (the first two have highlighted changes) while the EquiFax Credit Report still has issues. Could this be an issue with Equifax and not Merrick? Don't know. But will find out. I am more patient than most and have some time before this situation becomes a situation! HA! HA!

Here are the screen shots from the TransUnion Credit Report from 30 minutes ago:

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

*****TRANSUNION UPDATE***** *****TRANSUNON UPDATE*****

So, as of one week later I got the three current credit reports (2021 OCT 05). There is - compared to last week - nothing changed on the Transunion Credit Report and this account. The Date Updated field still shows 12/01/2020 - so that is a win! And the High Balance History and Credit Limit History still show 04/2019 - 12/2020 - so a win there as well. Let's see what the next two weeks bring.

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

*****EQUIFAX UPDATE***** *****EQUIFAX UPDATE***** *****EQUIFAX UPDATE*****

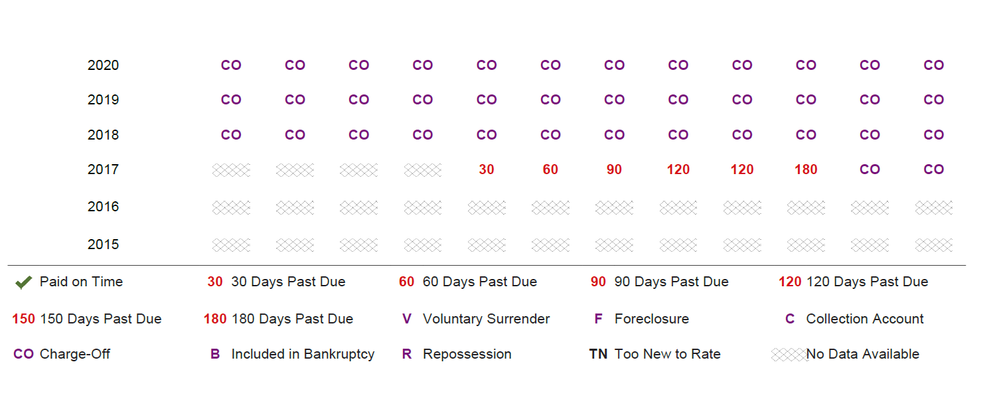

So, it looks like things with Equifax are indeed going in the wrong direction (well, spoken from the perspective of a newbie with all things credit). Here are two screen shots from the 2021 SEP 28 Equifax Credit Report:

The data for the field "Date Closed" is still missing. Apparently, this is very very important (Equifax still insists that this account is an open account...). And the two fields that I was hoping would be changed are not. And, to add insult to injury (often how we best learn our lessons, I fear) the field "Delinquency First Reported" has changed data (from April, 2017 to September, 2021). UGH!

So, I waited for a week. Just to see if anything might happen. Here are three screen shots from the 2021 OCT 05 Equifax Credit Report:

Experian and Transunion are now - as far as I am concerned - reporting correctly. Equifax is just not. Now, I am not pointing any fingers at anyone. I do not know the process for this sort of thing (speaking about how a Creditor interacts with a Credit Reporting Agency). So, I do not know if this issue is with Merrick, if this issue is with Equifax, or if this issue is a "combined effort"!

Anyone have any experience. Yes, I have heard a lot about "Let Equifax sleep....do not poke that bear. You will loooooooooooose!". Yet, I prod forward with this......

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Follow up to Merrick Charge Off question

Speak to a consumer protection attorney and sue Merrick for violation of the FCRA. They'll fix it quick.