- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: I could use some help .....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I could use some help .....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I could use some help .....

Back in 2007 I had what I thought was good credit (700ish on all 3) with several open accounts. A seperation with my wife screwed everything up. I've finally got back to where all the negativity has been removed from my credit and I'm looking to rebuild.

I'm currently at 590 Transunion - 604 Eqifax - No Idea about Experian

I have open accounts with Fingerhut, Credit One, Farmers Furniture and Kays. All of which I was able to open within the last 3 months.

What else can I add that will help me build my credit ?

What else can I do to bring my score up ?

EQ - 604

TU - 590

EX - 601

Credit One / First Premier / Kay's / Farmers Furniture / Fingerhut

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

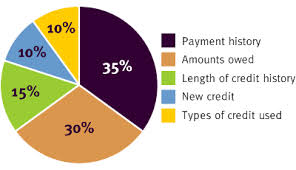

Welcome to MyFico. If you have not checked the rebuilding sub-section here, please do so as it has a wealth of info. Also, credit scores are calculated using this metrics..

What are the limits on your cards now?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

Thanks for the info ...

Kays - $500 - $200 balance

Fingerhut - $190 - $190 balance after a order today

Credit One - $300 - $120 balance

Farmers Furniture - $2800 (This is the only non-revolving)

Edit - Also have a car payment with an 18% interest, car belongs to my duaghter but is in my name. it'll be paid off within 14 months

EQ - 604

TU - 590

EX - 601

Credit One / First Premier / Kay's / Farmers Furniture / Fingerhut

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

@jvt_mercer wrote:Thanks for the info ...

Kays - $500 - $200 balance

Fingerhut - $190 - $190 balance after a order today

Credit One - $300 - $120 balance

Farmers Furniture - $2800 (This is the only non-revolving)

Edit - Also have a car payment with an 18% interest, car belongs to my duaghter but is in my name. it'll be paid off within 14 months

Apply for a Cap One Platinum card. If approved apply for the QS1 card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

@jvt_mercer wrote:Thanks for the info ...

Kays - $500 - $200 balance

Fingerhut - $190 - $190 balance after a order today

Credit One - $300 - $120 balance

Farmers Furniture - $2800 (This is the only non-revolving)

Edit - Also have a car payment with an 18% interest, car belongs to my duaghter but is in my name. it'll be paid off within 14 months

What is owed on your current credit cards are too high. For example, the $190 Fingerhut card is considered maxing it out. If it possible, use the cards and pay them off before the statement cuts and reports.

Also, get a secured card for 6 months to improve your scores and then go for an unsecured card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

Thanks for the advice. Just tried Cap 1 Plat and was declined. I'll go the secured route, any in specific ? I can do this with my bank, is that a better option ? How much should I do with a secured card ?

EQ - 604

TU - 590

EX - 601

Credit One / First Premier / Kay's / Farmers Furniture / Fingerhut

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

@jvt_mercer wrote:Thanks for the advice. Just tried Cap 1 Plat and was declined. I'll go the secured route, any in specific ? I can do this with my bank, is that a better option ? How much should I do with a secured card ?

Your local bank/CU is fine, limit is up to you its how you treat it that matters. 500-2000 is what I had on mine when I had secureds. We have a database of secured cards too here it is

http://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/Secured-Cards-Database/td-p/3846302

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

The State Department Federal CU is a good one. Check the 'who can join link' for info about alternate ways to qualify

You can make a share deposit and then apply for a secured visa, not sure if lower limit is 250 or 500.

You already have the installment loan covered or I would suggest making a deposit of 500, getting a secured loan for 500 for 36 months and repay it at 14 a month, then using the 500 from the loan to fund a secured cc of 500. Very nice trifecta, and I dont think you get a HP either. I just have a small share account, took me 15 minutes to sign up and I type slow. I am told I am an acquired taste, so giving them a chance to warm up to me before I app for an unsecured CC later.

Amount of secured CC is optional, objective is to show good use and build positive history. I have a secured CC with USAA at 250. Small amount is inconvenient but manageable, just cant make large purchases, and I pay it more than once a month if necessary.

HTH

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

ok ... after doing some more research Im stuck on going 1 of 2 options ... and I'd like to ask for advise on this ...

I have the ability to either open a new TL with $2000 secured and then using that $2000 to open a new secured CC

OR

just open a $2000 secured CC

My issue is this, based on the Credit Karma Score Simulator if I open the new TL and then new CC my score will barely increase, but if I just open a new CC with a $2000 CL my score jumps nearly 30 points with TU .... Should I go with the quick increase and establish from there or open 2 TL's and let it grow slowly ?

EQ - 604

TU - 590

EX - 601

Credit One / First Premier / Kay's / Farmers Furniture / Fingerhut

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I could use some help .....

@jvt_mercer wrote:ok ... after doing some more research Im stuck on going 1 of 2 options ... and I'd like to ask for advise on this ...

I have the ability to either open a new TL with $2000 secured and then using that $2000 to open a new secured CC

OR

just open a $2000 secured CC

My issue is this, based on the Credit Karma Score Simulator if I open the new TL and then new CC my score will barely increase, but if I just open a new CC with a $2000 CL my score jumps nearly 30 points with TU .... Should I go with the quick increase and establish from there or open 2 TL's and let it grow slowly ?

If you already have an installment loan, then another won't help, scorewise. Installment loan would be an auto loan, student loan, or personal loan. In general, two secured $500 revolving accounts will get you more mileage than one $2k account