- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Synchrony Bank goodwill letter success (all la...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Synchrony Bank goodwill letter success (all lates removed)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Synchrony Bank goodwill letter success (all lates removed)

Persistance pays off, folks.

As of today, I received my hard-fought goodwill adjustment from Synchrony Banks.

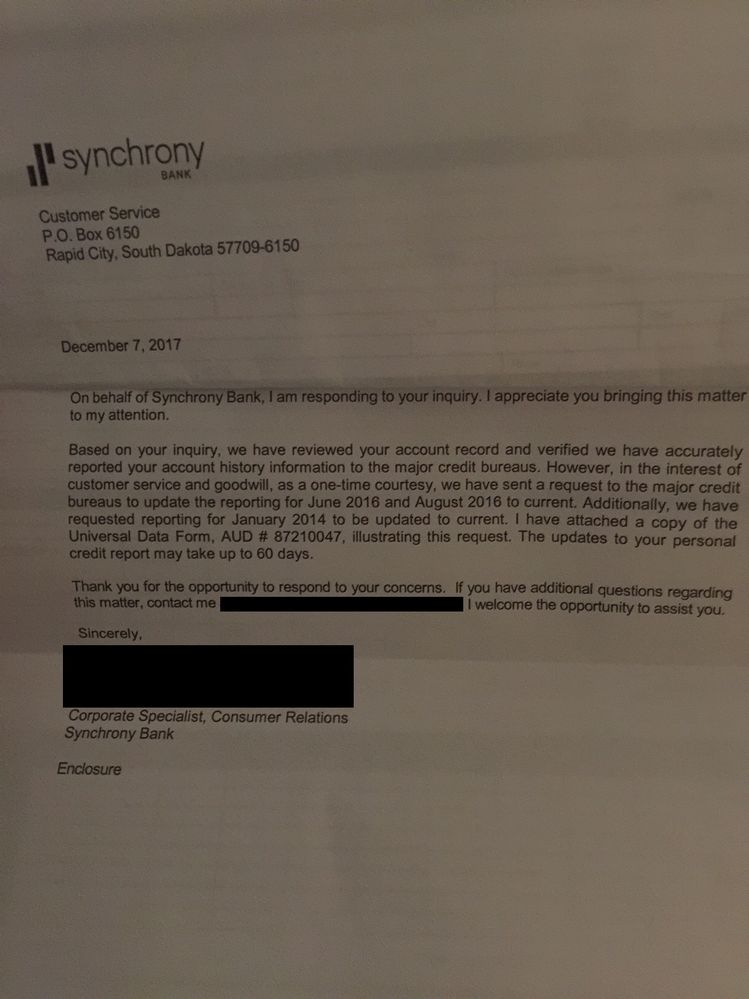

All delinquent late pays were removed after a couple months of sending emails to the corporate customer service personnel, and being patient. I'm attaching the letter I got from them.

Advice--don't attempt to get a goodwill adjustment at all if you haven't even paid off the account. Having some time between when you were late/delinquent and when you paid off the debt, I think, shows the lender gods that you're serious and just had a lapse (or two or three). I literally just sent emails with an attachment of my signed letter through the Synchrony site every other week, until, I'm sure, they got tired of me. I then sent a couple emails to the CEOs--and folks always called me back within a day or so from customer service. Fast forward a couple months later--here we are.

Those of you who have had goodwill adjustments, what kind of bump in scores did you get?

Happy Credit Rebuilding, folks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

Goodwill saturation: it works.

Those who quit after a few tries didn't try at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

OP, great job and congrats!

I had 2 dirty Synchrony accounts. One I was able to get a GW adjustment on pretty quick; it only took a few months and a couple of rounds of letters. The second took nearly a year to get a GW adjustment on... but, persistence paid off and it was cleaned up. The Saturation Technique is where it's at and I highly recommend it to anyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

Indeed~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

@Anonymous wrote:Persistance pays off, folks.

As of today, I received my hard-fought goodwill adjustment from Synchrony Banks.

All delinquent late pays were removed after a couple months of sending emails to the corporate customer service personnel, and being patient. I'm attaching the letter I got from them.

Advice--don't attempt to get a goodwill adjustment at all if you haven't even paid off the account. Having some time between when you were late/delinquent and when you paid off the debt, I think, shows the lender gods that you're serious and just had a lapse (or two or three). I literally just sent emails with an attachment of my signed letter through the Synchrony site every other week, until, I'm sure, they got tired of me. I then sent a couple emails to the CEOs--and folks always called me back within a day or so from customer service. Fast forward a couple months later--here we are.

Those of you who have had goodwill adjustments, what kind of bump in scores did you get?

Happy Credit Rebuilding, folks!success!

What I bolded is so true! Congratulations on your good will success!!

Last HP 08-07-2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

Would you mind sending me a PM of who your contact was at Synchrony Bank? I made two recent attemtps at Goodwill with them and was unsuccessful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

hello, is there some sort of genertic letter to use? i have been reading that having certain types of letters get you better results. im new to trying to get things removed by myself than paying someone else to do. i mean if we had the money to pay someone else to do this we wouldnt have been late on payments right? haha anyway i got divorced and just trying to repair my credit now. i want to purchase a new home next year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

@Anonymous wrote:Would you mind sending me a PM of who your contact was at Synchrony Bank? I made two recent attemtps at Goodwill with them and was unsuccessful.

I could very well take you far more than 2 attempts. It took me about 200 letters. If you use the Saturation Technique, this can be accomplished far quicker than if you're just mailing out a single letter here and there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

It was never an actual person to start. I sent my initial letters via the site. Go to "contact us", then select "send us a secure message". I got a response back within 48 hours.

After that I literally just kept sending letters every other week-- until I saw the past week that lates were removed from my account, and it was at that point I received a letter, signed, from customer service rep saying they were updating my report.

Also...if you have some kind of documentation that you can attach to the message via the secure message (i.e. financial records, job change, etc.), that will make your case further and increase your odds. I attached my literal job offer letter proving I was in flux financially and professionally (which impacted my timely payments). It was both the saturation of letters and the additional documentation that I think proved the difference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank goodwill letter success (all lates removed)

Ginger18--

No generics. Write your own letter concisely explaining your specific situation. Realize that you're essentially begging them for forgiveness, so you have write something that will appeal to their emotions and empathy.

Generally, though--

State the purpose for the letter

Acknowledge fault

Acknowledge that you realize lenders are required by law to report accurately

Describe briefly what causes your financial lapses

And you might finish talking about why you're a consumer with the lender and why you would like to remain so.

No set 'formula'--just realize they read hundreds of these all the time, so you'll need to make it stand out a bit--this is where your personal story/narrative becomes critical.