- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: What happens to 7year lates on closed accounts

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What happens to 7year lates on closed accounts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What happens to 7year lates on closed accounts

Hi,

I've been obsessing for quite a while about my student loan lates.

Im getting conflicting information from various sources. Please experts chime in and once and for all describe what happens.

I have 8 accounts. They are negative, closed -due to refinancing- each with 90 day lates one from 12/2013 and the other from 9/2014. Im approaching the 7 years since delinquency and am trying to understand what will happen. Will 1) the ENTIRE ACCOUNTS (the good payment history included) be deleted OR 2) ONLY LATE PAYMENTS deleted with the rest of my account remaining?

I apologize in advance as I've asked similar questions before but, I swear, i keep getting conflicting information. If anyone can cite a source for the answer please share do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

From what I’ve read, once the exclusion date is reached, the negative portions go away per the regulations that govern credit reporting. Once that's happened, you're left with a clean, positive tradeline that will report for up to ten years from the closure date. The entire tradeline will not vanish with the lates - only derogatory info falls off at seven years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

The credit report exclusion requirment under the FCRA is set forth in section 605(a).

Subsections 605(a)(1)-(4) detail specifi types of adverse information, such as BK, judgments, tax liens, collections, and charge-offs, and their exclusion provisions. It then provides q "catch-all' subsection 605(a)(5) that applies to any other adverse item of information that is not specifically provided for in one of subsections (a)(1) - (a)(4).

Monthly delinquencies dont have their own specific subsection, and thus are broadly covered under the catch-all provisions of subsection 605(a)(5). That subsection, being broadly applicable to any other adverse item of reported information, is not explicit as to when the period begins. It only sets a 7 year period from some unspecified date defining the adverse item of information to be excluded.

Each CRA has developed and uses its own interpretation of subsection 605(a)(5) when excluding reported monthly delinquencies.

Experian is the only CRA with clearly published policies on their exclusion of monthly delinquencies and their associated accounts, which can be found on their web page. The other two major CRAs have inconsistent exclusion policies that are unpublished, and are only known by consumer anecdotal posts.

Exp removes all monthly delinquencies in a common string once reaching 7 years from the date of first delinquency in that string, while the other two CRAs usually treat each reported level of delinquency as its own adverse item of information, and thus excludes each separately at their individual 7 year mark from reporting.

As for removal of entire accounts based on the 7 year provisions of subsection 605(a)(5), any account that remains delinquent (unpaid) when exclusion of monthly derogs occurs still has a current and reported delinquency status, which is also considered by EXP to be its own "adverse item of information," and thus also subject to the general exclusion provision of subsection 605(a)(5). They thus will exclude the entire account if it remains unpaid, but will only exclude the delinquencies if the current status is paid. See the EXP we page for discussion of that policy interpretation.

In summary, due to the lack of specificity in the statute, the CRAs have their own interpretations and policies regarding exclusion of monthly delinquencies and associated accounts.......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

Thanks @RobertEG and @Anonymous . Yes, I spoke with TU and was told the account is negative and they're going to delete once delinquencies are at the 7 year mark. They said if the account was still open then they wouldn't have to delete the whole account just the negative payments.

I dont know if I'm more sad than I am mad about this possibility....but it sucks. I consolidated based on recommendation from my Nelnet, it didn't help me at all. Basically, I consolidated and had newer accounts added (ding to my score) my loan capitalized (costing me more). The only differnce, is that I now have 2 accounts instead of eight. Absolutely no benefit since I just auto pay anyway. Nelnet kept pushing me to consolidate and mentioned it would be better. Shame on me for not being informed. So now the triple whammy, I may not ever get the benefit of the positive accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

I had my only neg account with 1 late fall off. It became a positive account with no lates showing. And will stay there for 10 yrs after the closing date. It was Santander auto. You'll want it to stay on your report after the neg is removed. Its in your favor then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

@FireMedic1 I hope to have a similar result.

@RobertEG I went to read the code section, in relevant portion. That section has a footnote citing Higher Ed Act. I'm having a hard time finding that. Apparently, there's some difference with regards to student loans. I'm still researching but will pivot to the cra guidance you mentioned earlier. I guess, at this point, it's just curiosity / and stress relief on my part.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

The question is:

Were these conolidated due to default or for another reason?

If they were consolidated due to default, they will fall off after 7 years from DoFD (the first late in the string of lates that lead to the default).

If it was for another reason, they should remain on your CRs for 10 years from the date they were closed/last updated, with each late dropping off at the 7 year mark (except EX, they drop entire strings of lates when the first late in a string hits 7 years old).

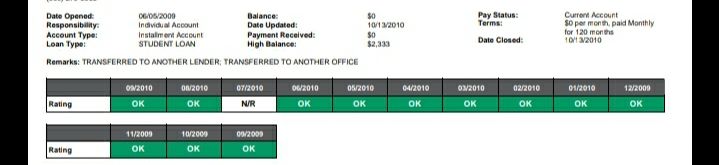

Example:

I would go to annual credit report and pull all 3 CRs for free (no scores, but free to do weekly through 4/2021). Only these reports have specific dates that will tell you for certain if they are derog TLs.

TU will have "estimated date of removal"

EX will have "on record until", but beware it already includes 2 months of EE baked into that date, so do not think the DoFD is wrong for any of the 3Bs.

EQ will have "date of first delinquency". Add 7 years to that date and that is when the TL will drop from your CR.

If they are in fact derog TLs (were defaulted), then it will help more to have them gone than the age of them could ever possibly help you.

This is just my experience from having dozens of SLs. Some were consolidated in good standing a decade ago and others that I have were defaulted. I have watched them on my CRs, and this is what happened. No other source to cite.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

@Anonymous Thanks! Will do...I consolidated on my own not due to default.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

@Anonymous wrote:@Anonymous Thanks! Will do...I consolidated on my own not due to default.

I would think then only the individual lates will drop at 7 years old while the entire TL will drop off at 10 years after it was closed.

I wonder, did you consolidate when the account was being reported late? Maybe that is why TU thinks it might drop the entire TL at 7 years? It shouldn't. I would definitely check those reports out to see how they have them listed. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens to 7year lates on closed accounts

Ok. I check annual credit report and there's no reference to a date of removal for any of these accounts. I appreciate everyone's input.