- myFICO® Forums

- This 'n' That

- SmorgasBoard

- Citibank AAdvantage Executive WEMC Unboxing

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citibank AAdvantage Executive WEMC Unboxing

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citibank AAdvantage Executive WEMC Unboxing

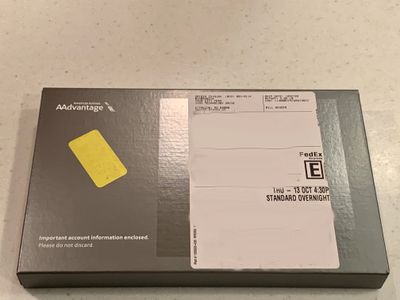

I'm a little belated posting my unboxing pictures from last month on my new Citibank AAdvantage Executive WEMC but I wanted to share these pictures. I was traveling out of town on a fall vacation when it arrived. As one of the higher AF cards, they put a little effort into the delivery and presentation. It was shipped via FEDEX in a sturdy box, with a presentation folder and with the card in a separate envelope. The unboxing reminded me of my AMEX Marriott Bonvoy Brilliant which at the time I received it also had a $450 AF.

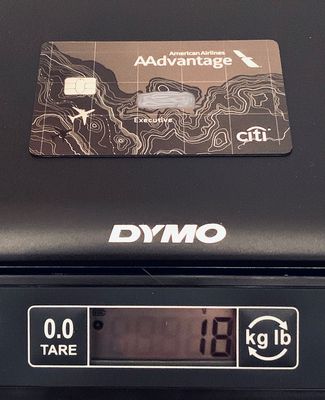

For metal card enthusiasts, the card weighs 18 grams which is the same as an AMEX Platinum. (DW had one briefly.) Those are both heavier than most other metal cards. Since Citi no longer issues the Prestige to new applicants, this is the highest AF and heaviest card available from Citibank right now to new applicants.

Enjoy! ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citibank AAdvantage Executive WEMC Unboxing

Glad to Citi has the right priorities. In an age where even teenagers are making secure payments via ubiquitous $1000 smartphones and watches, Citi knows that what really matters: that physical cards be heavier and louder!

As hard as it is to believe, just a few years ago Citi would waste money on things like three-hour trip delay protection. I mean, who on earth would ever have a use for something like that?

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citibank AAdvantage Executive WEMC Unboxing

@wasCB14 wrote:Glad to Citi has the right priorities. In an age where even teenagers are making secure payments via ubiquitous $1000 smartphones and watches, Citi knows that what really matters: that physical cards be heavier and louder!

As hard as it is to believe, just a few years ago Citi would waste money on things like three-hour trip delay protection. I mean, who on earth would ever have a use for something like that?

lol. or extended warranty protection!

Nonetheless, that IS a nice card and presentation.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citibank AAdvantage Executive WEMC Unboxing

Thanks @CYBERSAM and @OmarGB9.

Yes, I thought it was a nice card and presentation. ![]() While I realize that presentation, card weight, and other such asthetics are part of the overall card image and therefore a form of marketing, they are still nice attributes when coupled with a card that has overall value and benefits. Compared to some other cards that do these things without the overall value (such as things I've heard about Barclay Luxury Card or similar), there is a difference.

While I realize that presentation, card weight, and other such asthetics are part of the overall card image and therefore a form of marketing, they are still nice attributes when coupled with a card that has overall value and benefits. Compared to some other cards that do these things without the overall value (such as things I've heard about Barclay Luxury Card or similar), there is a difference.

Still, I see @wasCB14's point about Citi's priorities being askew when they nerf valuable card benefits but keep the premium card fluff. It's a move towards cards like Luxury Card. However, I see a huge difference when the AAdvantage Executive offers good value with Admiral's Club acess, 2x earning on AA points, first checked bags free for cardholder and up to (8) companions, the convenience of priority boarding, TSA Global Entry credit, and the enhanced airport check-in. It also offers an opportunity to earn 10K loyalty points for spending $40K on the card annually. While I may not take advantage myself of all of these things, there is a lot of real value to be gained.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citibank AAdvantage Executive WEMC Unboxing

@Aim_High wrote:Thanks @CYBERSAM and @OmarGB9.

Yes, I thought it was a nice card and presentation.

While I realize that presentation, card weight, and other such asthetics are part of the overall card image and therefore a form of marketing, they are still nice attributes when coupled with a card that has overall value and benefits. Compared to some other cards that do these things without the overall value (such as things I've heard about Barclay Luxury Card or similar), there is a difference.

Still, I see @wasCB14's point about Citi's priorities being askew when they nerf valuable card benefits but keep the premium card fluff. It's a move towards cards like Luxury Card. However, I see a huge difference when the AAdvantage Executive offers good value with Admiral's Club acess, 2x earning on AA points, first checked bags free for cardholder and up to (8) companions, the convenience of priority boarding, TSA Global Entry credit, and the enhanced airport check-in. It also offers an opportunity to earn 10K loyalty points for spending $40K on the card annually. While I may not take advantage myself of all of these things, there is a lot of real value to be gained.

The AA relationship definitely keeps it above the Luxury Card. Though without it, I do wonder what the Citi lineup might look like.

I'm not sure if you have to use an eligible Citi AA MC to buy the tickets to get the free checked bag. You used to not need to but I've not had a Citi AA card for a while (and only got the Barclays Aviator card a few years ago for the SUB).

You'd have to be redeeming pretty well for the $40k/10k bonus to make sense over AOD's 3%.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select