- myFICO® Forums

- Types of Credit

- Student Loans

- How should I go about paying down/off multiple SL

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How should I go about paying down/off multiple SL

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I go about paying down/off multiple SL

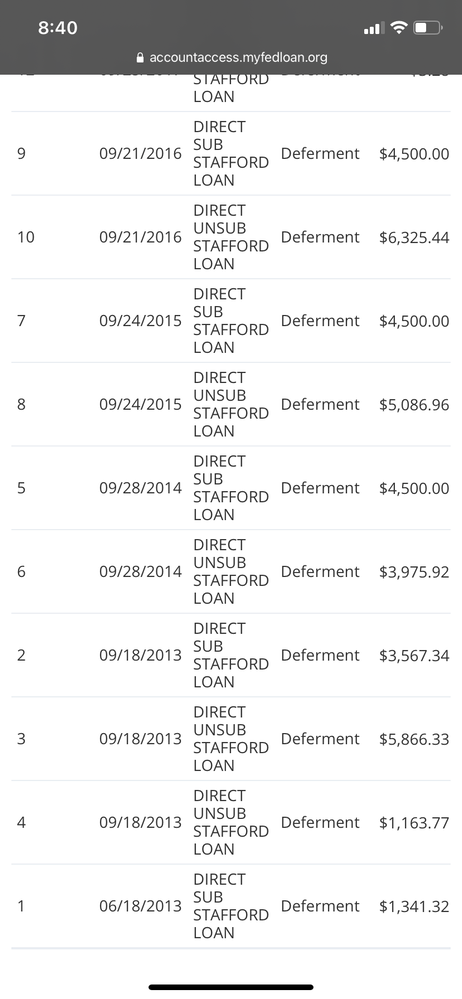

I have 11 student loans open. They range from $1160 to $6325. Mixed between sub and unsub. I have about $300-$500 a month I can put toward them. I had 12 loans but I paid the lowest one $240 off yesterday. I just don't know if I should tackle them as the lowest amount first or highest. Or look at it in a whole different way. I posted them below. They are all with the same servicer. Since they are not requiring me to make a payment until September I figured now would be the best time to get a head start on it. If it matters I want to get a construction loan to build a house in January.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I go about paying down/off multiple SL

If your goal is to get them paid off, I would go with the snowball method - starting with the smallest and working your way up.

If you think you can get them paid off before the 0% period ends, even better!

If they have different interest rates and you don't think you'll get them all paid off before the 0% ends - I would go from the highest interest loan first to the lower, to minimize potential interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I go about paying down/off multiple SL

Thanks for the reply. I pretty much figured that was the way to go. Can't get $46k paid off by September so I figure I will go with starting with the larger interest rate.

@calyx wrote:If your goal is to get them paid off, I would go with the snowball method - starting with the smallest and working your way up.

If you think you can get them paid off before the 0% period ends, even better!

If they have different interest rates and you don't think you'll get them all paid off before the 0% ends - I would go from the highest interest loan first to the lower, to minimize potential interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I go about paying down/off multiple SL

as of 1/1/23

as of 1/1/23Current Cards: