- myFICO® Forums

- Types of Credit

- Student Loans

- Re: Mohela

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mohela

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mohela

Good morning,

I have 6 90 day lates reported on my credit reports from 12/18(1 payment but for 6 accounts). I have a couple of questions, how much is this affecting my score?

Also, I had all 6 accounts place in forbearance which postponed the payments that were deliquent.

Per section 623(a)(2) of the FRCA they are obligated to provide updated information even it was accurate at one point.

Does anyone have advise on how to get the lates removed from my credit report. I have tried working with Mohela directly and they state it was accurate when it was reported so they cant cange.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

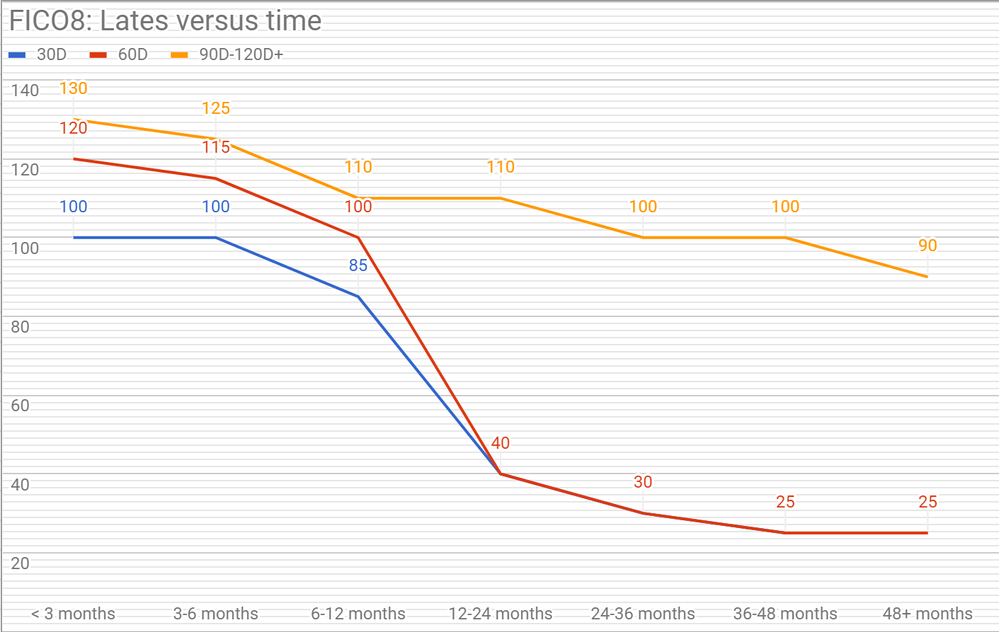

90d Derogatories are a major ding on your credit report. They not only hurt the score, but they will for the entire 7 years they're present (30s and 60s lose their major sting after about 2 years). There's a chart somewhere in this forum I'll have to see if I can find that shows the hurt (created by another forum user from data gathered).

Are you saying you had a forebearance in place before the lates or after?

When was your last payment and when did you request a forebearance?

Retroactive forebearance happens, but is very difficult to prove or get changed on the accounts, so I want to make sure we are understanding you correctly.

"Per section 623(a)(2) of the FRCA they are obligated to provide updated information even it was accurate at one point."

They are also required to report accurate information per the HEA. The HEA puts additional provisions on the reporting of federal student loans, particularly negative information, and particularly those that are not yet paid in full.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

Here's the graph - please note that it's crowdsourced data from some time ago, so not necessarily perfect, but you get the idea. This is just for FICO8 and assumes no other derogatories.

graph:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

The forebeance was granted in Jan 2019 1 month after the reported lates. The forebearce was retroactive to bring my account current. Is there anything I can do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

My letter shows

forbearance is approved for periods with a begin date of 9/14/2018

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

Thanks for clarifying!

My understanding is that technically, what a retroactive forebearance does is update the payment due to 0 so that you're no longer behind on the amount due. It doesn't remove the late, nor does it require the servicer to update the payment history (because your payment was late at the time it was reported). The HEA dictates that the late stay (it overrides the FCRA).

Honestly, your best bet is a goodwill letter/campaign with Mohela. If you dispute it with the CRAs they'll just ask Mohela, which will inform them that the late it accurate and it will stay. The change has to come from the servicer itself. I've heard mixed results on people who have gotten lates removed after getting a retroactive forebearance (though no info on those with Mohela - however, Mohela IS one of the few servicers that seems to grant goodwill deletions, though).

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

Thanks, my thought was that the letter specifically states the payments are "postponed" which, in my opinion, makes the no longer late as the due date changed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

Just an update, I reached out to my states attorney general a few weeks back, I finally heard from them today and they sent a letter to Mohela on my behalf.

Does anyone know if creditors typically abide by a letter from the Attorney General.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mohela

Creditors will follow the law (in this case the FCRA & HEA). Mohela is usually more forgiving (granting GW requests), so I think it's a better chance (than say Navient) that they will remove the lates if that's what your AG requested.