- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: January 2018 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

January 2018 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2018 Check-In Thread

A new year is often a time that people reflect on past events and is also a great time to renew something in your life. Maybe that renewal or renovation is on your financial body or physical, now is a great of time as any to shed those extra things holding you down from being the best you possible.

Most people sit down and write out New Year's resolutions. Credit wise, what would be on your list?

As a reminder, participation in these monthly checkins is optional but encouraged. The goal is to help keep you on track, so feel free to post your progress updates here. This is a no-judge zone; feel free to say what's keeping you up at night or give yourself a kudo for having it all together.

If you're a continuing myFICO fitness challenger: Did you hit any potholes or speedbumps? Achieve some milestones, either small or mighty? Change your goals or add new ones?

Let us know how you're doing! Now that 2017 is behind us, 2018 can be positive moving forward provided we make the good, hard decisions.

Remember now is the time to update your signatures!! https://goo.gl/7iIjO5

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

Checkin in. Hopefully solidly gardening for the next 6-9 months while I just pay down some stuff and work on some bad stuff. Nothing I have won't get fixed with time, so after working on my scores since March of 2017 I've made it this far.

Currently: EQ 620 TU 654 EX 627

in the garden since 6/16/2021

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

I had to convert to ch 7 at the end of this year due to home. I am now waiting on 341 and prayerfully discharge. This is a new year for responsibility and personal reflection. Bankruptcy is not the answer fellow ficoers but this is the only reasoning to file/convert. This house belonged to parents and is totally upside down. I will move on and look forward to better financing. It took me a long time to make this decision and I am still questioning the outcome of the house. I am definitely not sure on renting or owning. Hope everyone had a good new year`s eve and wishing everyone a wonderful year ahead.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

A quick check-in for January. The main goal this year is to secure a mortgage. If I can do that and still have some bit of savings left over by the EOY, I will be satisfied.

2018 starting Fico 8 scores:

EQ: 850

TU: 791

EX: 850

2018 starting Mortgage scores:

EQ: 817

TU: 783

EX: 811

2018 goals:

Get Fico 8 850 across the board

This essentially means increasing my TU score and maintaining my current EQ/EX scores.

myFico simulator indicates that TU should reach 841 by April. I think this is very likely since two late payments will fall off of my TU CR within that timeframe. Even if I reach 850 ATB, those scores won't hold after the mortgage closes and post to all the CBs, but I only need 850 ATB once within this year to meet this goal.

Save 5% down for mortgage

2% already saved.

Saving will go slowly in the beginning as there are several major family/friends events this year that will require significant spend but progress should quickly gain speed when those things are done.

Garden until June 2018

There is still a possibility a CC from last year may appear on CR in 2018. This will reset my garden clock, but no other new TL should appear.

My local CU still shows the CC in question as open and the new replacement CC hasn't posted. I'm hoping it will remain as such as long as I don't activate it.

Start Savings Garden - Emergency fund

Save atleast 3 months of expenses by EOY.

Anyone know what happened to the Savings Garden from last year? I would like to join it this year, but can't find anything on myFico.com. Oh well, I guess I don't need it to do what I need to do, but it would have been nice to communicate with others who had savings goals also.

I look forward to seeing everyone's progress through out the year! ![]()

Life happens...Adjust accordingly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

So, my scores have been taking a beating as the full impact of my November mini app spree is settling in. I'd been dropping a few points here and there but, all the new accounts have finally posted now. I've been trying to keep up AZEO but, once my 3 Amex accounts were added, so were the balances AND I made a bonehead purchase that put my NavCheck balance at over $5700. Maybe the puchase wasn't boneheaded but, purchasing it RIGHT before Navcheck reported was. I tried to save it and make payments to at least bring it down to 19% util but, too late. The balance is down but $5780 (of $15K) still reported. That coupled with the additional cards showing up with balances (each of which had required spend which I hit within 5 weeks) spelled an average total points drop of 20 across the board. *facepalm* I knew better but forgot to check my planner for the best date to make that purchase. Anyway, that was in 2017. I'm leaving that behind me and looking forward to an upward turn in 2018.

I've enlisted Alexa to help keep my financial calendar in front of me with reminders. I loaded reminders for all of my credit card due dates, reporting dates and CLI request dates for the months of January and February so far. I hoped to get a BT offer from NFCU to move my NavCheck but, even if they offered, I don't think the transfer can be a Navy balance. So, I'll move part of it if BCP gives me a CLI on the 8th and just pay the rest off. My goal for this month is to get back to AZEO and lock myself in the garden.

Today, my scores are sitting at EQ 725, TU 736, EX 718. I remember drooling for those numbers but, when you were visually in the green and trying so hard to rescue one last score from the yellow and now you're yellow across the board, that feels like punishment. Ah, but I expected a spanking and being sent to the garden so, there I am. And still, EX hates me. At least leave me above 720 across the board. Ah well. I guess I can't expect to get to choose sentencing. BUT JANUARY!!! I'm going to do better and am not even going to peek around looking for a 0% BT card, as planned. I'm going to serve my time and take my medicine and make it all better.

In 2018,

- I'm working to get into the 800 club across the board.

- I plan to build my business credit.

- Do some points-purchased traveling

- And, focus on acquiring income-producing assets.

I'm VERY optimistic, looking forward to 2018 and wish us all skyrocketing success!!

Current Scores: 752 TU, 717 EQ, 750 EX

Goal Score: 820+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

I want to keep it simple this year. ![]()

Goals:

1a). Continue saving 12% of income, and look to increase that if I'm able to lower my tax withholding.

1b). Look at depositing part of what I've already saved into a higher yield CD, maybe NFCU's Special 15-month at 2.25%

2a). Continue paying that extra $100 per month on my highest student loan balance

2b). Pay off my lowest student loan balance, which is less than $350 now. It's just annoying seeing it there, lol!

3). No credit apps. Looking to get a ruby spade in December 2018

4). Pay down utilization.

That's about it!

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

Welp. Following my November app spree I cringe when I get the MyFico score change notifications. I expected my scores to take a dive but, I did get a pretty nice haul out of the deal and should be satisfied. Today, I got a notification and responded with the familiar cringe. But this time was different. +1 TU! Hey! It's not a big deal at all but could signal the beginning of a rebound. I'm optimistic although I probably shouldn't expect very much until my February payments post. But, we'll see. For now, I'll take that +1 happily. I gotta get back in the green and every green "+" helps. ![]()

Current Scores: 752 TU, 717 EQ, 750 EX

Goal Score: 820+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

It seems like every year I tell myself that I will get my financial situation in order, and every year I take two steps forward before massively going backwards. I have decided that this year will be different, because I now have some personal and professional goals that I would like to attain. I have also been put into a situation where I will need to start looking for a new place to live at some point this year, and having good credit obviously makes things easier.

For 2018, my financial goals are to be responsible and stop the cycle of living paycheck to paycheck. I have set some challenges for myself this year including not incurring any overdraft fees or late payment fees. I never realized just how much these fees add up over time, and how that money could be better spent elsewhere. I also want to keep my utilization to 15% or lower this year. At one point, as recently as a few weeks ago, I was at over 200% utilization on my cards. I maintained that utilization for months, until I finally decided that I needed to become serious about my financial future and started working towards getting that number down. At the end of next month, my utilization will hopefully be at below 10%.

I am looking forward to reading everyones stories through their journey this year, and wish everyone the best of luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

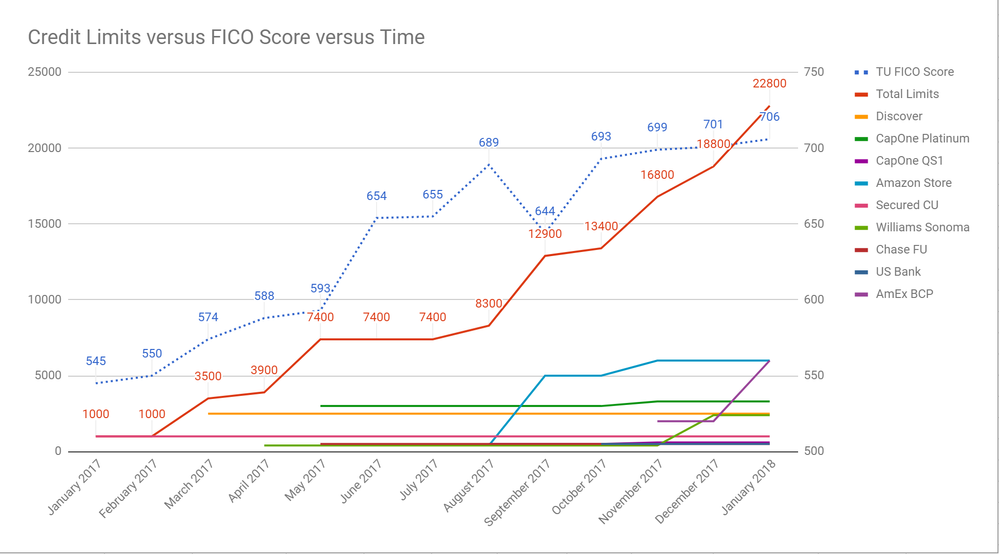

Happy to update my progress chart based on a few CLIs received since I posted December's chart.

This puts me over $20,000 in total CLs whereas I started 2017 with $0 in usable credit limits. Current utilization is 9.1% aggregate (oops, bad math) but in 2-3 weeks it'll be $50 balance on one card and no higher than that in the future, ever. I accidentally calculated my "estimated" aggregate utilization based on my Amex 3X limit increase but of course that won't report until the next statement cut, derp.

Have a ton of inquiries fading out of score-territority between March and May. Will be down to 1-2 scorable inquiries on most bureaus then.

My goals for 2018 are really simple: gardening 365 days (until 6/1/19 actually), but hoping to get CLIs to get me from $20,000 in $50,000 in total limits. I know this is extremely unlikely but holding out for Amex 3X from $6000 to $18,000 if possible, and maybe getting the unicorn auto CLI on Chase FU, along with my other cards hopefully showing some luv. We'll see.

I just started my 60-month CD Ladder this week with my first roll-over into a 12-month, a 24-month, a 36-month, a 48-month and a 60-month set of CDs. This is exciting to me because if I face no emergencies and can "survive" cutting my expenses as much as I did, I'll actually be able to get a "paycheck" from myself to myself for 5 years. Not a great "paycheck" but more than I spend on essentials.

I think I will scratch 800 by the end of 2018 -- not at 800 FICO8s but in the 785-795 range on at least EX and EQ.

Only "goal" for this year other than gardening and expanding the CD Ladder is to get my unpaid tax lien nuked from TU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

@ohjoy wrote:So, my scores have been taking a beating as the full impact of my November mini app spree is settling in. I'd been dropping a few points here and there but, all the new accounts have finally posted now. I've been trying to keep up AZEO but, once my 3 Amex accounts were added, so were the balances AND I made a bonehead purchase that put my NavCheck balance at over $5700. Maybe the puchase wasn't boneheaded but, purchasing it RIGHT before Navcheck reported was. I tried to save it and make payments to at least bring it down to 19% util but, too late. The balance is down but $5780 (of $15K) still reported. That coupled with the additional cards showing up with balances (each of which had required spend which I hit within 5 weeks) spelled an average total points drop of 20 across the board. *facepalm* I knew better but forgot to check my planner for the best date to make that purchase. Anyway, that was in 2017. I'm leaving that behind me and looking forward to an upward turn in 2018.

I've enlisted Alexa to help keep my financial calendar in front of me with reminders. I loaded reminders for all of my credit card due dates, reporting dates and CLI request dates for the months of January and February so far. I hoped to get a BT offer from NFCU to move my NavCheck but, even if they offered, I don't think the transfer can be a Navy balance. So, I'll move part of it if BCP gives me a CLI on the 8th and just pay the rest off. My goal for this month is to get back to AZEO and lock myself in the garden.

Today, my scores are sitting at EQ 725, TU 736, EX 718. I remember drooling for those numbers but, when you were visually in the green and trying so hard to rescue one last score from the yellow and now you're yellow across the board, that feels like punishment. Ah, but I expected a spanking and being sent to the garden so, there I am. And still, EX hates me. At least leave me above 720 across the board. Ah well. I guess I can't expect to get to choose sentencing. BUT JANUARY!!! I'm going to do better and am not even going to peek around looking for a 0% BT card, as planned. I'm going to serve my time and take my medicine and make it all better.

In 2018,

- I'm working to get into the 800 club across the board.

- I plan to build my business credit.

- Do some points-purchased traveling

- And, focus on acquiring income-producing assets.

I'm VERY optimistic, looking forward to 2018 and wish us all skyrocketing success!!

Oh, I remember having those same woes. The good news is - all of it is fixable (if that's a word, lol). Last year, I knew I just had to hunker down, sit on my hands, and reap the benefit of TIME passing. I wish you all the best. Remember, just take it one fico day at a time. ![]()

Starting Score: 544

Starting Score: 544