- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- January 2021 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

January 2021 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2021 Check-In Thread

@Anonymous curious. Do you mean soft inquiries as well? Have you frozen your credit files? Since I’m only interested in growing my current CL, I’m wondering if there anything extra I should be doing?

@Anonymous wrote:Welcome to the New Year 2021

In looking back at 2020, I stayed the course with no new credit products and no inquiries! Scores remained as shown in the signature.

1st Garden: Started January 2021

2nd Garden: Sept 2021 I’m returning to the garden - Doing a minimum of a year until 10/22 which will be 12 months post my newest 2 HPs

Scores as of 7.27.21

Experian: 760 Transunion: 732 Equifax: 741

Current Cards:

Macy’s Store: $15000 - CLI $100>$2K>$4K>$8>$13K w P.C. to Amex >$15k

Care Credit: $1800 (Sock drawer)

Discover It: $4500

Chase Freedom Unlimited: $1000 (sock drawer)

AMEX Cash Magnet: $3000

Chase Freedom Flex: $1000

Amex Blue Business Cash: $2000

FNBO Evergreen Rewards Signature Visa Card: $10,000

Amazon Prime Rewards Visa Signature Card: $9,000

Wishlist Cards:

AMEX Marriott Bonvoy Brilliant || AMEX Platinum || AMEX Blue Cash Preferred || Wells Fargo Propel American Express || U.S.Bank Altitude Go || Chase Sapphire Preferred || Citibank Double Cash

https://m.imgur.com/7eJQLoF?r

https://m.imgur.com/5QX7J6E?r

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2021 Check-In Thread

Hi all! I've been an off and on lurker on the forums for the past year. Not sure if I should post this here or in the kickoff post, so I may do both.

Brief summary: I started 2020 with a goal to get financially fit. I had been following the Dave Ramsey no credit plan previously in my life and was derailed by a divorce (five years ago) and then two years of partial employment why I cared for my mother and two ailing grandparents all on hospice around the same time.

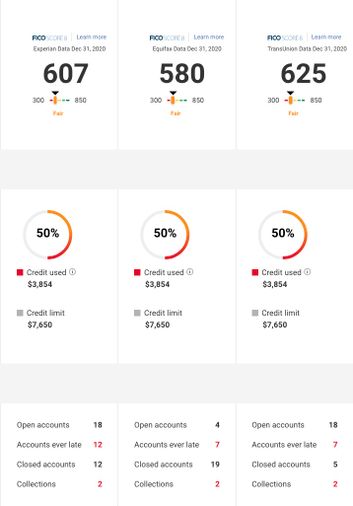

Needless to say, started with no score/thin profile. Pulled my reports and found $600 in derogs ($400 in cable equipment fees and $200 in misc. medical) all scheduled to fall off within the next year or so.

I originally applied for a Disco IT secured, but got caught in the "unable to verify taxes" issue, which confounded me. I ended up going on a spree for several new card, bringing my current limit to $2200 approximately.

Then covid hit our area pretty hard and I ended up using the cards to supplement loss of income. Though I'm carrying high balances, everything is current with no late/missed payments. I'm currently working on a plan to have these balances PIF within 60-90 days. From there I plan to work a 1-9% utilization plan with PIF every month.

My goal this year is to raise my scores and help my new wife win with her credit as well. I plan on adding her as an AU to my cards and working on her derogs (most of which are gone).

My personal goal is to raise my scores to at least 640 across the board and eventually finance a decent used car with a good rate since I'm still on the DR method of cheap cash cars.

Any advice or pointers to forum topics/posts are always appreciated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2021 Check-In Thread

@BrooklynDrip wrote:@Anonymouscurious. Do you mean soft inquiries as well? Have you frozen your credit files? Since I’m only interested in growing my current CL, I’m wondering if there anything extra I should be doing?

@Anonymous wrote:Welcome to the New Year 2021

In looking back at 2020, I stayed the course with no new credit products and no inquiries! Scores remained as shown in the signature.

Hard Inquirys

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2021 Check-In Thread

Thank you @GApeachy!!! I actually did use these forums to bring my score all the way up to the 700s many years ago... like around 2010 if I'm not mistaken!

When I signed up with myFICO in December, for some reason I selected the most basic plan - really need to upgrade - just Experian updating once a month on the 25th. WELL. My Capital One chargeoff settlement update posted (not even a PFD!!!!!!!) and I went from 583 to 638 in one month! My initial goal for this year was to get to 640 - now I think I'm going to aim for 660!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2021 Check-In Thread

@Anonymous wrote:Thank you @GApeachy!!! I actually did use these forums to bring my score all the way up to the 700s many years ago... like around 2010 if I'm not mistaken!

When I signed up with myFICO in December, for some reason I selected the most basic plan - really need to upgrade - just Experian updating once a month on the 25th. WELL. My Capital One chargeoff settlement update posted (not even a PFD!!!!!!!) and I went from 583 to 638 in one month! My initial goal for this year was to get to 640 - now I think I'm going to aim for 660!

Fantastic! Aim higher, and higher, and higher. You'll get there. Time is on your side.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2021 Check-In Thread

I'm late to the January Party, but better late than never! ![]()

I started off the new year with a new lease on life (literally and figuratively). Moved into a new luxury apartment after living room to room for almost 2 years. I plan to be here for 2 years tops while rebuilding my credit. I have a business as well, so I do have financial/credit goals on that end as well, but I know much of the success in that area depends on how healthy I can get my personal credit. So here are my main goals for 2021:

1) Reach 750 Fico8 scores by mid-year

2) Lease my first business vehicle, using PG (more than likely necessary after visiting 3 different dealerships during my research)

3) AMEX Gold/Platimum card

4) No negatives (Lates, CO or otherwise) anywhere on credit reports by year end

I will be checking in monthly (lurked for the past year in silence...LOL) and asking for tips regularly as I admire the progress many have made and will share and contribute where I can. I Love the accountability!

Everyone, be safe, well and keep crushing these goals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2021 Check-In Thread

I think after recovering from such a hell of a year that 2020 was, I've definitely made some big strides in making my way to the 700's club.

Paid off some COs, which made a tremondous impact on my scores. Now I have just one major baddie with PRA that I'm hoping to either settle for a huge discount or hope my disputes with them pull through and get dropped from my report!

Goals for Feb 2021:

- Write a few GW letters

- Bring utilization down to ~10%

- Begin gardening once AMEX sends me my Optima card already 🥺

Current Stats:

| 03/2021 | |||

FICO8 | |||

(01/2020) | |||

| INQ (24mo) | 8 | 7 | 5 |

| INQ (12mo) | 7 | 7 | 5 |

| AAoA | 4y 2mo | 4y 2mo | 4y 2mo |

| AoYA | 2 mo | 2 mo | 2 mo |

Personal Revolvers:

|  |  |  |  | |

| Credit Limit | $300 | $2000 | $1000 | $1000 | $1250 |

| Age | 4y 4mo | 2 mo | 1 mo | 1 mo | N/A |

| Utilization | 0% | 11% | N/A | N/A | N/A |