- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: November 2021 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

November 2021 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

Update 2: Citi updated its reporting and reported a small balance (not yet reported $0), so I got the email from EX this morning: We have some good news, ByrdMan. You’ve reached your highest FICO® Score* since joining Experian. Now that’s something to celebrate! I opened the app to see the good news, expecting 5-7 points and saw an increase of 25 points. I was shocked as the simulator told me I could achieve this before 9 months.

I'm shocked that EX is so infactuated with me. I used to think that they loathed me. J/K ![]() I never expected this kind of love from EX. I'm now hopeful that once EQ catches up with the reporting that I could hit 800 with them this month.

I never expected this kind of love from EX. I'm now hopeful that once EQ catches up with the reporting that I could hit 800 with them this month.

Starting Score: 469

Starting Score: 469Current Score: 824

Goal Score: 850

Highest Scores: EQ 850 EX 849 TU 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

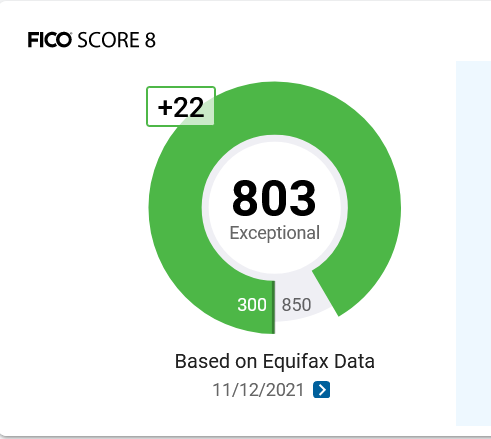

Update 3: Sorry about the constant updates. EQ finally caught up to the Citi reporting and my score went up 22 points to 803. New goal is 825.

Starting Score: 469

Starting Score: 469Current Score: 824

Goal Score: 850

Highest Scores: EQ 850 EX 849 TU 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

@Anonymous wrote:Just joined. I've never had a credit card before and have only ever had car loans as far as debt goes. My parents said that if I couldn't afford to pay cash then I didn't need whatever I was looking at so I never gave credit another thought. This year I decided I wanted to start looking into getting a garage (they usually come with a house attached so I guess I'll have to get the whole package) so I started my research. I quickly found out that I needed good credit and since I hadn't had a car loan in over a decade, I essentially had no credit. My FICO was 574 😱.

After reviewing ways to start building credit I decided that the Discover Secured card was the best trade-off for me. I gave them $500 and received my gray card about two weeks later. Since I'd read up on credit utilization I was petrified to ever have any balance at all so I paid everything the nanosecond it posted. I talked with Discover who reassured me that unless I ask them to, they won't report outside of the 11th of each month for me. Then I started using it in place of my PayPal debit card since they both give 1% cash back and the Discover card takes 24hrs to post my payments whereas the PayPal card takes five days to fund from the same bank account. After realizing that the Discover card could easily be a replacement for the PayPal card I called Discover and asked to max out the deposit and sent them another $1,500. I now use the heck out of it — making sure to have a zero or nearly zero balance by the 11th. My score has gone 574 > 611 > 635 > 639 in the three months since.

I don't know what a realistic 12 month goal is so I put 670 in the signature as that doesn't seem unattainable in that amount of time and would nudge me into "good" credit. My ultimate credit goal would be to hit the top category, so 800+? Some interim goals are:

- get to 670- get a Citi Double Cash Card

- get a Costco credit card

- get a house

Since I'm new to this game (and I really think that's an accurate discription), any constructive feedback/suggestions would be appreciated.

670 is indeed reasonable, but with your current score, you might want to think about a second card. Eventually, you will need three to play the AZEO game, and it gives you a thicker file. That will help you grow your score faster in the future. The drawback is you take some minor hits on AAoA and inquiries as you do so. If you're set on getting that Citibank card, I would open a checking account with Citibank(online if you aren't near a branch. If you can keep 1K plus, the odds are good you will be offered some entry-level Citicard once you hit their magic number(probably in the 670+ range), which will put you in a much better position to get the card you want in the future. Don't even THINK about applying for that Citicard until you get to at least 720(or get a pre-screened offer) Perhaps in six months after your second card, you might want to look at an Amex card. Amex will accept people over 670 for some of their basic cards, and they are very good with CLIs, which will enhance your credit score and let you play the AZEO scheme.

Basically this game involves a lot of tradeoffs. In order to get a better mortgage score, you need to demonstrate that you can use credit wisely. In order to get more credit, you have to apply for it, which will temporarily hurt your score. You may also want to consider opening an account at a local credit union, since they typically have the best mortgage rates and will help walk you through the process of a mortgage. Having a history with a good credit union is invaluable, and they might just have a credit card with rewards. Once you get in the 700 range, subscribe to MyFico or Credit.com to get all of your FICO scores. The biggest problem you will have is patience. The increases you have seen will slow, and it's hard to wait for time to run its course and move to the very good level(740) where you get far more flexibility and options.

Finally, depending on where you spend your money, take a look at the BOA Customized Cash Rewards card versus the Citi Double Cash.. If you do a lot of online shopping, you can get 3% back on up to 2500 each qtr from your on-line shopping. I max that boy out every quarter, then use my Citibank or Amex Blue Biz card to get 2% on everything else. Many cards also offer bonuses at different times for various items.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

Thanks @Junejer. Leaving a little is easy enough. Yeah it looks like having between 1-9% is better than having zero. Thanks for the tip 💪

Looks like you went from 469 to 825. Wow. how long did that take?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

Wow that's a thorough reply @Phana24. Thanks! I'll def look into your suggestions. I see what you mean about the trade-offs. Ironically, IME most of life seems like a series of trade-offs.

I'm not set on the double cash card per se. It's just that aside from Costco, I don't do all of my shopping/spending in one place and the 2% cards seem like a good choice for someone in my situation. I'll look at the BOA card though as that seems like a good strategy.

As far as getting my next credit card, when score-wise and when time-wise is good to do that? What kinds of cards should I consider for that next "stepping stone" card? How do I make sure I don't get a hard pull only to be declined for it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

@Anonymous wrote:Thanks @Junejer. Leaving a little is easy enough. Yeah it looks like having between 1-9% is better than having zero. Thanks for the tip 💪

Looks like you went from 469 to 825. Wow. how long did that take?

@Anonymous, I went on a steady decline for about four years from 790s to 469 after the recession. Some of it is chronicled on these forums. I wasn't really concentrating on bringing my score up, so this has taken years. Once I started working on my credit (after most of the baddies were not having much effect anymore) it has been a rollercoaster ride. I would go from the 710s back to 670s, up to 700s back to 680s. It was maddening, but I was getting approved for a few cards (Chase Southwest, AmEx Everyday). It wasn't until this year that the rollercoaster ride stopped. My FICO for both EX and EQ have jumped about 100 points or more in the past four months.

Patience and playing the FICO game smart are the keys. Get enough cards (eventually) that you can manage and play the AZEO game. I'm looking for probably two or three more with nice CLs, so I can stay in the 1-9% range without jumping through hoops.

Good luck! I'm rooting for you.

Starting Score: 469

Starting Score: 469Current Score: 824

Goal Score: 850

Highest Scores: EQ 850 EX 849 TU 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

Wow @Junejer. Sounds like life threw you a few curve balls. Congrats for your perseverance! That must really feel great after what you've been through. Having never had a high credit score I can only imagine what having one only to see it topple must've felt like. That's inspiring.

Okay, I think I understand the AZEO: your fico is penalized for showing a balance on too many of your cards (even if the total utilization is below 9%), so unless you have a lot of cards, you'll have a better score by only having that 1-8% balance on one of them. I can do that (as you said, once I have more cards). I assume you can rotate which one has the balance for a particular month? I haven't seen that brought up, but I would assume it doesn't matter which one from month to month.

Thank you for the vote of confidence. It's cool how supportive people in these forums seem.

FYI, I know it's not fico (and not used for mortgages), but my TU VantageScore jumped 38pts to 732 this morning. Feels good.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

@Anonymous wrote:Wow @Junejer. Sounds like life threw you a few curve balls. Congrats for your perseverance! That must really feel great after what you've been through. Having never had a high credit score I can only imagine what having one only to see it topple must've felt like. That's inspiring.

Okay, I think I understand the AZEO: your fico is penalized for showing a balance on too many of your cards (even if the total utilization is below 9%), so unless you have a lot of cards, you'll have a better score by only having that 1-8% balance on one of them. I can do that (as you said, once I have more cards). I assume you can rotate which one has the balance for a particular month? I haven't seen that brought up, but I would assume it doesn't matter which one from month to month.

Thank you for the vote of confidence. It's cool how supportive people in these forums seem.

FYI, I know it's not fico (and not used for mortgages), but my TU VantageScore jumped 38pts to 732 this morning. Feels good.

@Anonymous, yes, life tends to do that. ![]() I'm better for it. I'm positioning my DW and I to be totally recession proof. Working hard to pay off mortgage and CC usage is totally within our control.

I'm better for it. I'm positioning my DW and I to be totally recession proof. Working hard to pay off mortgage and CC usage is totally within our control.

Yes, you can switch back and forth between which CC you allow to report a balance. FICO doesn't care or track that. It measures how many and how much. I don't look at it so much as a penalty to your FICO, but rather that it is not maximized. I find that I'm in a completely different state of mind using that mentality.

You can toy around with your util % to see if a particular % maximizes your score. There seem to be DPs where some report a better score with util % below 5%. I have never experienced that personally. For me, anywhere between 1%-9% have yielded roughly the same results. As always, YMMV.

Starting Score: 469

Starting Score: 469Current Score: 824

Goal Score: 850

Highest Scores: EQ 850 EX 849 TU 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

@Anonymous wrote:Wow that's a thorough reply @Phana24. Thanks! I'll def look into your suggestions. I see what you mean about the trade-offs. Ironically, IME most of life seems like a series of trade-offs.

I'm not set on the double cash card per se. It's just that aside from Costco, I don't do all of my shopping/spending in one place and the 2% cards seem like a good choice for someone in my situation. I'll look at the BOA card though as that seems like a good strategy.

As far as getting my next credit card, when score-wise and when time-wise is good to do that? What kinds of cards should I consider for that next "stepping stone" card? How do I make sure I don't get a hard pull only to be declined for it?

You want to wait until you're well above "good credit" which is generally considered 670, so 685 might be a target. Around that time, you might want to call Discover and see if you can get the unsecured card. Also, keep an eye out for an eventual offer for the Discover "It" card. That pays 5% back in varying categories every quarter with 1% on everything else, and they've been decent about CLIs. They also match your cashback for the first year, so the potential to save 10% on gas, groceries, etc, is kind of neat.

The more experienced people on the board might give better advice, but here's my take. Avoid at all costs anything with an annual fee, i.e. Premier, Merrick, etc. DO NOT EVEN THINK ABOUT CREDIT ONE!!!! They make Synchrony appear to be the Kyle Larson of credit card companies. Also, wait at LEAST three weeks after that score is dated before applying. When my EX CS went from 707 to 742 I immediately applied for a card, only to be rejected because my EX showed 707 to Amex. FWIW, you might want to think about the Sync 2% card. I know Sync is a pain in the ass, but their standards are lower, and as you gain history with them, they process payments faster, and they are very generous(IMHO) with CLIs. As your score improves, you should get an offer from Sync. If you want to stay with better quality cards, Citi, Chase, and Amex tend to lead the pack. I'm a little partial to Amex, since they've been good to me and most of their customer service is American. My hearing is pathetic, and if I'm talking to an Asian with a heavy accent(such as my wife when I met her), I have trouble. Citi is heavily promoting their "Custom Cash" card, and the Chase Freedom Flex is a neat card. Amex has been very generous with CLIs as well, both on my Blue Everyday(1%) and Blue Business(2%). BOA seems to be ramping up their game, so check out all their cards. Typically, at your level, you have to settle for a less than ideal card until you get into the 720+ region, which is when you start getting offers for good cards. Early in the game one of the reasons I got rejected my first tries was "lack of account with Citibank/BOA." Decide which card is your target and open a checking acct with them(I'm nowhere near a Citi branch, but threw 1100 in an on-line checking acct and used it periodically, always keeping a balance above 1K). Again, there's a tradeoff, the fewer the rewards the greater the probability of success/acceptance. Did I mention not to think about Credit One?

Timing is also a trade-off. The sooner you can get 3 cards, the sooner you get to play AZEO and your credit limit grows. The problem is that you take a hit for each inquiry and new account. IIWY, I'd take any offer that you get for a no-fee card from any of the companies I mentioned. If you don't get any offers, wait a few weeks after 685 and go with the best match you can find on EX or CK. Wait until your score recovers from that hit, and then go for another quality card. That gives you one more inquiry you can handle in the next year in the event you get a really good offer.

I've found the free EX credit monitoring to be fairly accurate in terms of their recommendations. https://www.experian.com/?intcmp=ecw-signin I've never been rejected when my credit match is 95% or higher. In addition, I've also had good luck with the Credit Karma recommendations. I was 3-for-3 when my chances were "outstanding" and 3-for-4 when my chances were "excellent." My less patient wife was 2-3 when CK rated her chances at "very good." Finally, good news with your Vantage score. In my experience, while these are not FICO scores, I have found all three CRA Vantage score changes to be highly and positively correlated with my FICO score changes. Most people find their Vantage score to be higher, although some get the opposite result. I find Vantage scores quite useful for trends, and I believe Sync uses the Vantage 4.0 for scoring. Again, I would classify myself as moderately useful, you should give more weight to those who've been here longer and know far more than I. Best of luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2021 Check-In Thread

Wow. Lots to think about. Thank you for such detailed info! Ironically I received a pre-approval for Credit One the day you replied.

My EQ vantage score went down 73 points today due to "remarks added to account." I assume this is due to a dispute I opened a few month ago with something Verizon added to my account claiming that I had an $88 charge-off a few years ago which isn't true. Lexington Law is handling it. Hopefully they'll be successful.