- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 1st FICO score above 800.Need help making sense of...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1st FICO score above 800.Need help making sense of it (UPDATED)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1st FICO score above 800.Need help making sense of it (UPDATED)

Hey! Myfico folks.

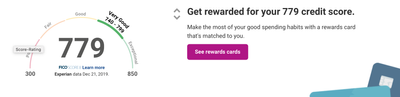

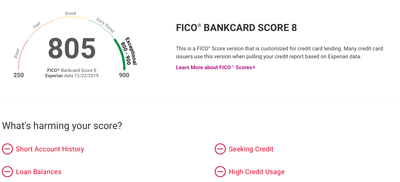

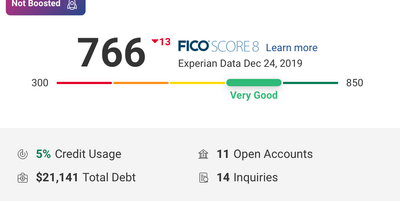

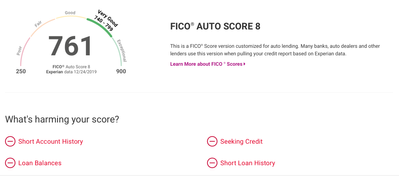

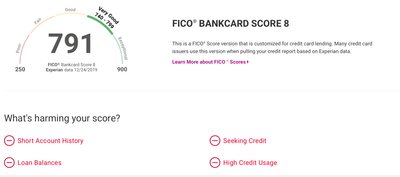

I checked my Experian Creditworks this morning and saw a score bump of +13 on Fico8 bringing me to 779; highest score ever. Proceeded to check the other scores; the 2 & 3 Fico flavours dropped between 5-10 points(mostly for another account reporting a balance) but the other Fico 8 scores they provide i.e. auto and bankcard also went up 14 points just like the regular 8. The creme was the bankcard score which is now a whopping 805. Not complaining but the trigger for this score change is a phenomenon(cause it has happened before) I still can't phantom.

Find screenshot below.

ONLY KNOWN CHANGE IN CREDIT FILE

I am an AU on DW's Chase freedom. It closed on the 19th with a balance of $764 which I paid off around 4 am on the 20th to prevent it from reporting to the CBs(i have done that several times and they just report the updated zero balance). Not this time. Chase decided to report the actual balance, which made me furious when I saw the update on DW's Experian account but low and beholds, when I checked mine, it led to a big increase(hers just stayed flat, though the 2&3 variants dropped as well).

Please note that I had been AZEO before this morning hence my insistence on not allowing the new balance report and I also have an open auto loan which is 19% paid off. UTI was 5% now 6%. 11 open accounts, 2 closed.

HISTORICAL OBSERVATION

From my experience, once the zero balance is reported by Chase which should be in a day or two, both the increases & decreases will be clawed back.

Question: How do you explain this fico8 behaviour? All takers are welcome. Thanks, for reading and chiming in.

Hey folks.

UPDATE:

Had to come to update this old thread as promised after some months of further testing and observation.

So here's what I can report:

1. After the Experian Fico8 scores(regular, auto and bankcard) gave back their gains due to paying down the AU account balance to zero, I went ahead and allowed an additional (non-AU) account to report a balance. Result: All FICO8 scores dropped at least 7 points, proving that I wasn't on any special path/basket as regards my own individual responsibility account.

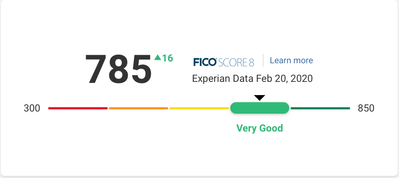

2. I then decided to allow the same AU account report a balance again to ascertain that it was the AU account specifically that triggers this substantial increase in FICO8 scores across the board. Yesterday the statement cut and this morning all FICO8 scores went up by 16points.

3. DW's Experian FICOs 2(mortgage) and 8-bankcard score took hits of 2 and 7points respectively but all the other scores remained the same.

4. I think with some level of certainty, I can now postulate that allowing 1 AU account report a balance, increases FICO 8 scores for the authorised user but it has the regular effect on the account owner that comes from an additional account reporting.

5. I will, therefore, recommend this as a worthwhile hack for those in need of short-term FICO8 boost for specific apps that pull the regular, auto or bankcard FICO8 scores. I do not know the impact it will have on the FICO9 variants.

Thank you for reading.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

You should have reason codes for the BC and AU scores, before and after snapshot is probably useful.

What revolver was your AZEO setup before? The semi-obvious guess would be DW's AU counts for you, and you came off all zeros. Guessing that's not what happened but generally an additional balance doesn't improve one's score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

Thanks for your response.

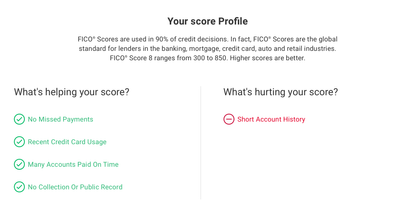

unfortunately, i cant post a screenshot of the "before' reason codes but the reason codes stayed same before and after the score change. Here's a snapshot of what it says;

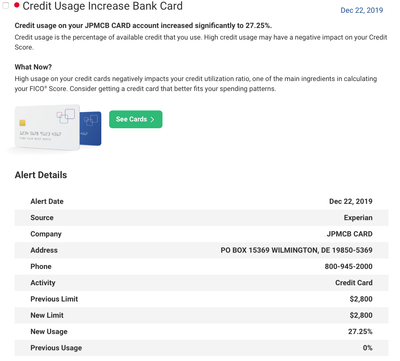

The shot at the bottom shows the codes for the regular Fico8 and it has pretty much stayed the same for months. The codes for the bankcard is same for all the other score variants. Just shows the negatives and nothing else changed. As a matter of fact, I got an alert from them saying that much;

Should the significant increase in usage, by itself, lead to a score increase? I have scrubbed through the accounts details; the age of individual accounts, AAoA, inquiries ageing off, new accounts becoming old etc. The next set of changes would occur on the 1st of January.

Apart from the change detailed in this alert, everything about my individual accounts stayed the same. AooA, AAoA, age of individual accounts, payment history(never missed a payment), usage on my only other account with a balance is $3600 of $29600(BT offer). The next set of changes would occur on the 1st of January.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

As a follow-up, my report was updated this morning with the zero balance report from the Chase freedom AU account and as I expected based on precedence, the gains in the Fico8 scores; regular, auto and bankcard were clawed back and the deficits in the Fico2 & 3 variants were returned, point for point.

Here's the screengrab;

As additional info, I don't know if it's relevant but as shown above, I have 14 inquiries on this report, 3 of which are scorable with one expected to age off on the 31st of December. Also as I had said earlier, up-thread, everything just went back to the way they were before the $764 statement balance, and the changes were reversed.

I had really hoped someone could offer an explanation for this very scientific, consistent and predictable behaviour of the Fico scoring models as it could help a lot of people who would be experiencing the same outcomes without even observing it or knowing why and that could make all the difference in retaining healthy score increases.

Anyways, thanks so much for reading and a merry Christmas to everyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

Scientific.... that's a good one ![]()

Each of us here is doing reverse engineering with a limited data set. Some ( such as Revelate ) are better than others, but each file, such as yours, has unique aspects.

Do you have any lates ever in your credit file?

One speculation: if DW AU card has no balance, does that also mean, similar to an installment loan, the models would simply ignore it? If that account had perfect history, and OP's file had lates, perhaps bringing in the perfect file, when a balance reports on that, is the boost to OP's score?

In any event, at ~766 the OP file is not so bad.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

Your FICO 2 behavior sounds absolutely consistent. FICO 8 though... hrm.

I would try putting the balances on other cards and see if you can replicate it. There have been others with strange AU behavior reported in the past and it isn’t common but IIRC some people have seen better results with 2 balances even if we all deadpanned the result at the time as the result of some wonky tradeline.

Out of curiosity what are the age metrics on your file? I wouldn’t have expected to see that FICO 8 behavior as it doesn’t reconcile with literally any of my data from the past 5 years.

The other thing I would try is use a smaller revolving balance like $5, seeing high revolving usage, what is your aggregate CL? Something strange.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

@NRB525 wrote:Scientific.... that's a good one

Yes "scientific" cause i believe there are specific triggers: events, activities etc. that will lead to these outcome, everytime(If only we knew what that was). It has happened to me on five different occassions and the more i think about it the more paranoid it makes me feel. LOL!

Each of us here is doing reverse engineering with a limited data set. Some ( such as Revelate ) are better than others, but each file, such as yours, has unique aspects.

Do you have any lates ever in your credit file? No, i don't.

One speculation: if DW AU card has no balance, does that also mean, similar to an installment loan, the models would simply ignore it? If that account had perfect history, and OP's file had lates, perhaps bringing in the perfect file, when a balance reports on that, is the boost to OP's score?

In any event, at ~766 the OP file is not so bad. Yes, the 766 is very good but the 779 is "gooder". Lol!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

@Revelate wrote:

That is weird.

Your FICO 2 behavior sounds absolutely consistent. FICO 8 though... hrm.

I would try putting the balances on other cards and see if you can replicate it. There have been others with strange AU behavior reported in the past and it isn’t common but IIRC some people have seen better results with 2 balances even if we all deadpanned the result at the time as the result of some wonky tradeline.I would put this to the test by allowing a balance to report on a different card closing in the next few days and i'll report back on the outcome. If the change is replicated with this stimulus, i would then maintain that balance for a while to see if the change holds. I might be one of those profiles that's better off with ALL ZERO EXCEPT TWO(AZET). Thanks for this suggestion.

Out of curiosity what are the age metrics on your file? I wouldn’t have expected to see that FICO 8 behavior as it doesn’t reconcile with literally any of my data from the past 5 years. AooA is 2yrs 5months, AAoA is 1yr 2months, AoYA is 1month(2 new accounts were reported on all 3 CBs in the last month)

The other thing I would try is use a smaller revolving balance like $5, seeing high revolving usage, what is your aggregate CL? Something strange. Total CL reporting is $75k. I have an apple card that's not reporting yet with a $6.5k CL. Also have $17.6k left on my auto loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

I wonder if this is another FICO 8 new file idiosyncrasy (read as credit age <3 years). Will be interested to see your further test results!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st FICO score above 800.Need help making sense of it

@Revelate wrote:

We only semi-recently really found a lot of evidence for a new file scorecard and we have seen different behavior in it than for those of us with established files.

I wonder if this is another FICO 8 new file idiosyncrasy (read as credit age <3 years). Will be interested to see your further test results!

Hey there @Revelate

Please check out the update i added to this thread.

My results might be restricted to young files as you put it up here but with some degree of certainty(after 3 other people reported the same results) i can now say this is "scientific". Lol !!!

What are your thoughts?