- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: 2 car loans. Paid one off. 7 point decrease. W...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2 car loans. Paid one off. 7 point decrease. Wth?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 car loans. Paid one off. 7 point decrease. Wth?

I understand the logic behind having an open installment loan, and the <9% rule for increase while having a paid off loan will net you a penalty. What i do not understand is how I just had a point decrease from paying off one of two loans. Data Points:

2 installment (car) loans - each almost exactly the same amount - 20k ish

5 revolvers in the form of credit cards. AZEO util around 30%

I paid off one loan, are figured i just decreased my debt by 20k, so i was expecting a small bump but instead was rewarded with a decrease.

feels bad ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

The remaining loan util % is all by itself now. And the 30% CC util can go below 28% and that will help also. Below 6% even better.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

@rosco75 wrote:I understand the logic behind having an open installment loan, and the <9% rule for increase while having a paid off loan will net you a penalty. What i do not understand is how I just had a point decrease from paying off one of two loans. Data Points:

2 installment (car) loans - each almost exactly the same amount - 20k ish

5 revolvers in the form of credit cards. AZEO util around 30%

I paid off one loan, are figured i just decreased my debt by 20k, so i was expecting a small bump but instead was rewarded with a decrease.

feels bad

Need to know the original loan amounts on both loans, the balance on the paid off loan just before you paid it off, and the balance on the remaining loan.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

@FireMedic1 wrote:The remaining loan util % is all by itself now. And the 30% CC util can go below 28% and that will help also. Below 6% even better.

Installment loan util was always there though. Since there were two, wouldnt it be better by itself? Im not sure I understand your meaning. Forgive me if I need it barney style, I am just a Marine afterall ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

@SouthJamaica wrote:

@rosco75 wrote:I understand the logic behind having an open installment loan, and the <9% rule for increase while having a paid off loan will net you a penalty. What i do not understand is how I just had a point decrease from paying off one of two loans. Data Points:

2 installment (car) loans - each almost exactly the same amount - 20k ish

5 revolvers in the form of credit cards. AZEO util around 30%

I paid off one loan, are figured i just decreased my debt by 20k, so i was expecting a small bump but instead was rewarded with a decrease.

feels bad

Need to know the original loan amounts on both loans, the balance on the paid off loan just before you paid it off, and the balance on the remaining loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

@rosco75 wrote:

@SouthJamaica wrote:

@rosco75 wrote:I understand the logic behind having an open installment loan, and the <9% rule for increase while having a paid off loan will net you a penalty. What i do not understand is how I just had a point decrease from paying off one of two loans. Data Points:

2 installment (car) loans - each almost exactly the same amount - 20k ish

5 revolvers in the form of credit cards. AZEO util around 30%

I paid off one loan, are figured i just decreased my debt by 20k, so i was expecting a small bump but instead was rewarded with a decrease.

feels bad

Need to know the original loan amounts on both loans, the balance on the paid off loan just before you paid it off, and the balance on the remaining loan.

Car#1 Age 8 monthsOriginal Loan Amount$21,594Remaining Balance$19,865Car#2 Age 1yr 4 monthsRemaining Balance$18,278Original Loan Amount$22,458I paid off Car#2 decreasing my debt by $18,278. Since the account is still reporting, just paid, the age would not affect it?

Thanks. Well I can't see any reason why paying off #2 would have caused a score decrease. Your installment utilization did not change much. Your number of accounts with balance decreased by one. I'm guessing it was something unrelated.

Maybe going from a little less than 90% installment utilization (86.5%) to a little more than 90% installment utilization (92%) caused a score decrease? I guess it's possible, but I doubt it.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

@SouthJamaica wrote:

@rosco75 wrote:

@SouthJamaica wrote:

@rosco75 wrote:I understand the logic behind having an open installment loan, and the <9% rule for increase while having a paid off loan will net you a penalty. What i do not understand is how I just had a point decrease from paying off one of two loans. Data Points:

2 installment (car) loans - each almost exactly the same amount - 20k ish

5 revolvers in the form of credit cards. AZEO util around 30%

I paid off one loan, are figured i just decreased my debt by 20k, so i was expecting a small bump but instead was rewarded with a decrease.

feels bad

Need to know the original loan amounts on both loans, the balance on the paid off loan just before you paid it off, and the balance on the remaining loan.

Car#1 Age 8 monthsOriginal Loan Amount$21,594Remaining Balance$19,865Car#2 Age 1yr 4 monthsRemaining Balance$18,278Original Loan Amount$22,458I paid off Car#2 decreasing my debt by $18,278. Since the account is still reporting, just paid, the age would not affect it?Thanks. Well I can't see any reason why paying off #2 would have caused a score decrease. Your installment utilization did not change much. Your number of accounts with balance decreased by one. I'm guessing it was something unrelated.

Maybe going from a little less than 90% installment utilization (86.5%) to a little more than 90% installment utilization (92%) caused a score decrease? I guess it's possible, but I doubt it.

isn't 89% one of the smaller installment loan thresholds for small point boosts? This would account for it if they went back above 89%.

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

Not sure that the drop specifically relates to the loan payoff. Your balance to loan ratio is looked at in aggregate for active loans. In your case not much change. BTW - analysis from a few years back suggests a minor score change B/L threshold somewhere in the 65% to 70% range.

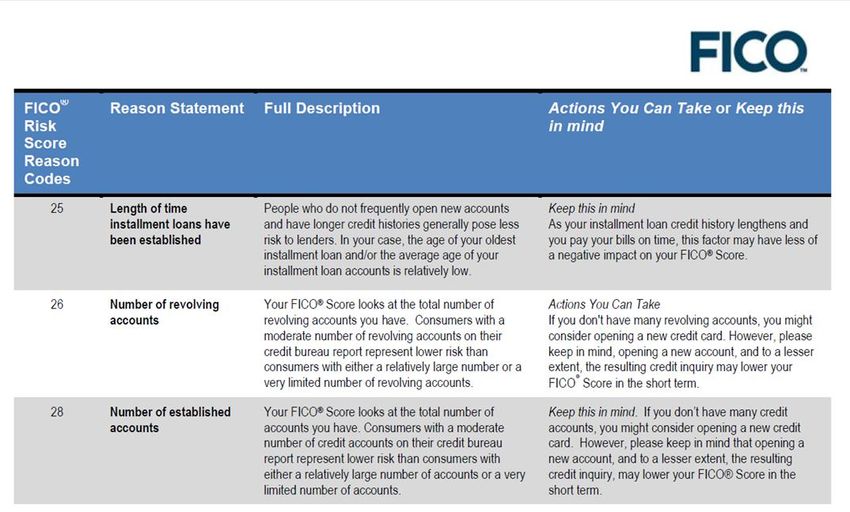

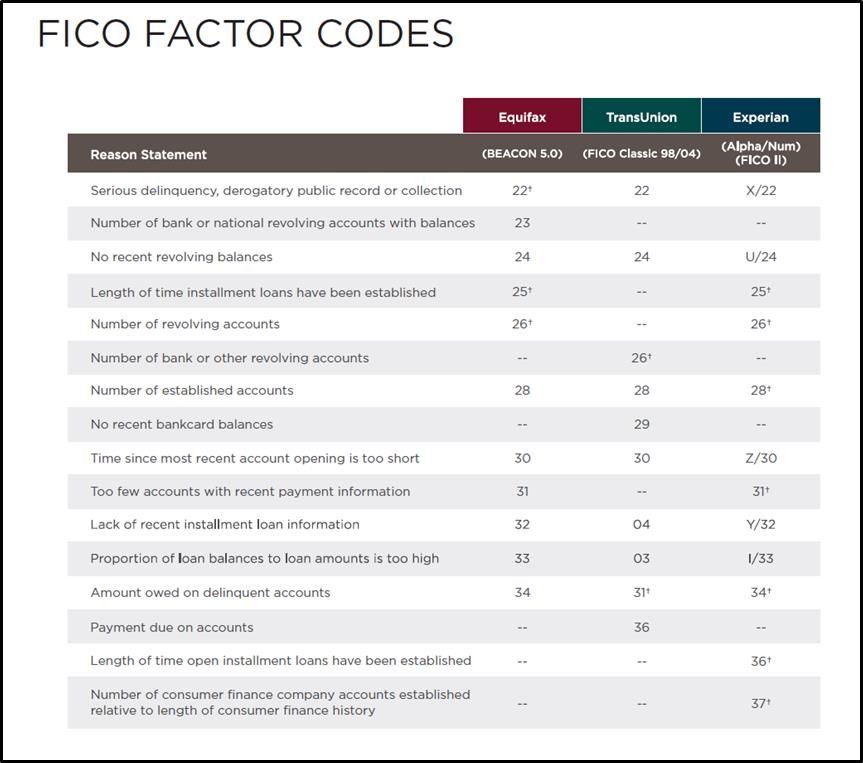

Nonetheless, there is one rather obscure scoring factor that one credit bureau uses as a minor component: Age of open installment loans. I believe the factor looks at age of oldest open loan moreso than average age of the loans. Code 25 encompasses all loans (open + closed) whereas code 36 in the lower table is for open loans only.

I have seen a variety of these lists and only Experian looks at age of open loans.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

@SouthJamaica wrote:

@rosco75 wrote:

@SouthJamaica wrote:

@rosco75 wrote:I understand the logic behind having an open installment loan, and the <9% rule for increase while having a paid off loan will net you a penalty. What i do not understand is how I just had a point decrease from paying off one of two loans. Data Points:

2 installment (car) loans - each almost exactly the same amount - 20k ish

5 revolvers in the form of credit cards. AZEO util around 30%

I paid off one loan, are figured i just decreased my debt by 20k, so i was expecting a small bump but instead was rewarded with a decrease.

feels bad

Need to know the original loan amounts on both loans, the balance on the paid off loan just before you paid it off, and the balance on the remaining loan.

Car#1 Age 8 monthsOriginal Loan Amount$21,594Remaining Balance$19,865Car#2 Age 1yr 4 monthsRemaining Balance$18,278Original Loan Amount$22,458I paid off Car#2 decreasing my debt by $18,278. Since the account is still reporting, just paid, the age would not affect it?Thanks. Well I can't see any reason why paying off #2 would have caused a score decrease. Your installment utilization did not change much. Your number of accounts with balance decreased by one. I'm guessing it was something unrelated.

Maybe going from a little less than 90% installment utilization (86.5%) to a little more than 90% installment utilization (92%) caused a score decrease? I guess it's possible, but I doubt it.

Pretty sure there is a scoring threshold somewhere in the high 80's I want to say 88%

I seem to recall a 7 point or so change on my report around that number on my report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 car loans. Paid one off. 7 point decrease. Wth?

@rosco75 wrote:I understand the logic behind having an open installment loan, and the <9% rule for increase while having a paid off loan will net you a penalty. What i do not understand is how I just had a point decrease from paying off one of two loans. Data Points:

2 installment (car) loans - each almost exactly the same amount - 20k ish

5 revolvers in the form of credit cards. AZEO util around 30%

I paid off one loan, are figured i just decreased my debt by 20k, so i was expecting a small bump but instead was rewarded with a decrease.

feels bad

There is no penalty on paying off a loan it is strictly loan balance utilization changes when going from a very high utilization like you had it is possible for your score to rise, your change resulted in a 7% or so utilization increase and that or an unrelated reason is why your score decreased