- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- .75% utilization increase --> 7 point dip

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

.75% utilization increase --> 7 point dip

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.75% utilization increase --> 7 point dip

For those who doubt that small changes in overall utilization can lead to significant score changes in FICO 8, I just had a small isolated overnight change in overall revolving utilization, unaccompanied by any other significant change, which resulted in a 7 point dip in EX FICO 8.

Start: 8 out of 29 accounts reporting balances

1 account over 29%, at 46%

overall revolving utilization of 7.0%

Change: 1 of the 8 accounts reporting balances went from 1% to 18%

overall utilization went from 7.0% to 7.75%

no other changes

EX FICO 8 dropped 7 points.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

It would be interesting to hear what happens to your scores if you drop your overall utilization to < 0.1%. (I.e. 7.75% to 0.1%).

Thomas Thumb and I believe that it is possible that some FICO models may consider the raw dollar value of CC debt in addition to utilization. Your 0.7% increase involved an increase of 3k in debt, due to your huge total credit limit, and your current dollar value of CC debt is probably 30k. It would be interesting to see what happens when your total CC debt goes from > 30k to < $100.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

Interesting. Thanks for the info, SJ.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@Anonymous wrote:It would be interesting to hear what happens to your scores if you drop your overall utilization to < 0.1%. (I.e. 7.75% to 0.1%).

Thomas Thumb and I believe that it is possible that some FICO models may consider the raw dollar value of CC debt in addition to utilization. Your 0.7% increase involved an increase of 3k in debt, due to your huge total credit limit, and your current dollar value of CC debt is probably 30k. It would be interesting to see what happens when your total CC debt goes from > 30k to < $100.

Fico models are pretty clear that $$$ debt is a factor as well as utilization. I even recall SJ speculated about a potential dollar threshold of ($3000?). As with utilization, there might be multiple $S thresholds or QTY of cards exceeding a single tier $$ threshold. Interestingly, the 18% UT on the card does put its balance over $3000 by my calculation.

If SJ's score drop is related to the increase in spend, the most likely cause is an increase in QTY of cards above some dollar threshold - IMO. Of course, it is always possible that account summary data is not a point in time match with data pulled for scoring.

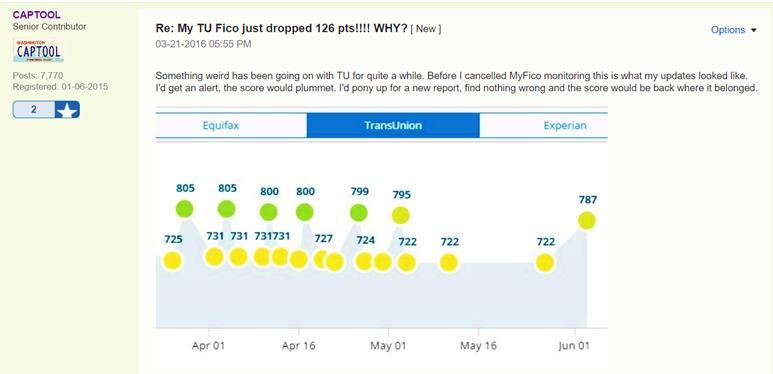

Sometimes I wonder if CRAs might maintain two databases. Some may recall the ping pong scoring CAPTOOL experienced only on TU which was determined to be a collection or tax lien counting/not counting toggle. However, looking at the report summaries both low and high scores showed the same information.

Individual CRA data can be a bit suspect. It is best to have before/after data from all three CRAs.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

Interesting discussion regarding raw dollar values possibly being a consideration in scoring.

I suppose the best (cleanest) way to test this would be someone that's got a bunch of CCs, at least several with very high credit limits. The non-high limit cards would all have to stay the same with respect to reported balances; Ideally having them all at $0 would be best so that their balances don't change for the experiment. Then on the high limit cards, the person could start with a small balance on each, then raise the [reported] balances steadily to look for data points with respect to dollars. What I think would be important here is of course keeping aggregate utilization in an ideal spot the entire time, but also keeping the individual utilization on each high limit card in an ideal spot as well... say, under 8.9% just to be certain that any threshold-crossing percentage wise isn't crossed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

One of your cards went above the 8.9% threshold ; I would imagine that might have contributed somewhat to the drop. I wonder what would happen if you backed that 18% util card down below 8.9% - obviously your overall util would drop as well from 7.75%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

The OP reported having a card at 46% utilization that was still at 46% when one of his other cards went from 1% to 18%. General belief is that Fico looks at the highest utilization % for scoring of individual cards. That remained constant at 46% before/after the score drop.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@Anonymous wrote:It would be interesting to hear what happens to your scores if you drop your overall utilization to < 0.1%. (I.e. 7.75% to 0.1%).

Thomas Thumb and I believe that it is possible that some FICO models may consider the raw dollar value of CC debt in addition to utilization. Your 0.7% increase involved an increase of 3k in debt, due to your huge total credit limit, and your current dollar value of CC debt is probably 30k. It would be interesting to see what happens when your total CC debt goes from > 30k to < $100.

![]() You must have me confused with someone whose financial life is much more orderly and controllable than the one I have

You must have me confused with someone whose financial life is much more orderly and controllable than the one I have ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@Thomas_Thumb wrote:

@Anonymous wrote:It would be interesting to hear what happens to your scores if you drop your overall utilization to < 0.1%. (I.e. 7.75% to 0.1%).

Thomas Thumb and I believe that it is possible that some FICO models may consider the raw dollar value of CC debt in addition to utilization. Your 0.7% increase involved an increase of 3k in debt, due to your huge total credit limit, and your current dollar value of CC debt is probably 30k. It would be interesting to see what happens when your total CC debt goes from > 30k to < $100.

Fico models are pretty clear that $$$ debt is a factor as well as utilization. I even recall SJ speculated about a potential dollar threshold of ($3000?). As with utilization, there might be multiple $S thresholds or QTY of cards exceeding a single tier $$ threshold. Interestingly, the 18% UT on the card does put its balance over $3000 by my calculation.

If SJ's score drop is related to the increase in spend, the most likely cause is an increase in QTY of cards above some dollar threshold - IMO. Of course, it is always possible that account summary data is not a point in time match with data pulled for scoring.

Sometimes I wonder if CRAs might maintain two databases. Some may recall the ping pong scoring CAPTOOL experienced only on TU which was determined to be a collection or tax lien counting/not counting toggle. However, looking at the report summaries both low and high scores showed the same information.

Individual CRA data can be a bit suspect. It is best to have before/after data from all three CRAs.

No that wasn't me. I have never seen any evidence of the dollar amount being significant. All my evidence has been that the percentages are significant, without reference to the dollar totals.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@BIGSTARXXX1 wrote:One of your cards went above the 8.9% threshold ; I would imagine that might have contributed somewhat to the drop. I wonder what would happen if you backed that 18% util card down below 8.9% - obviously your overall util would drop as well from 7.75%.

I personally have never seen evidence of an 8.9% threshold in individual card utilization. This month I have multiple accounts which are > 8.9% but < 28.9%

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682