- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- .75% utilization increase --> 7 point dip

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

.75% utilization increase --> 7 point dip

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@Thomas_Thumb wrote:The OP reported having a card at 46% utilization that was still at 46% when one of his other cards went from 1% to 18%. General belief is that Fico looks at the highest utilization % for scoring of individual cards. That remained constant at 46% before/after the score drop.

Exactly, that account remained constant.

(That's why I posted this, because it was one of those rare and precious moments when only 1 thing changed ![]() )

)

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

The CRA's keep at least two databases, and probably 3 or more from my experience. The monitoring ones are secondary to the business ones, the data is probably replicated but Captool and I think a few other people over time have seen wonkiness with TU specifically where old data seems to come and go... wasn't aged out of all of their infrastructure correctly.

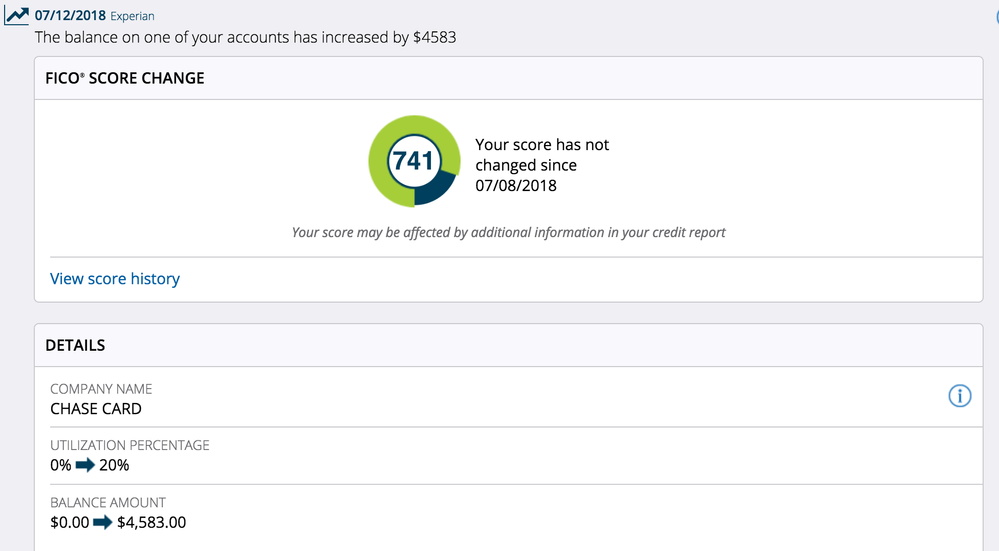

As for the dollar value, don't see why that wouldn't be the case potentially, Vantage I think got it absolutely right on that one. That said I'm not really sure where there's a line honestly, just speaking CC's I just got this one recently and absolutely flatlined score. 22K CL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

Good data point.

Is this a clean file datapoint? Utilization is not too impactful on dirty files.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@SouthJamaica wrote:

@Anonymous wrote:It would be interesting to hear what happens to your scores if you drop your overall utilization to < 0.1%. (I.e. 7.75% to 0.1%).

Thomas Thumb and I believe that it is possible that some FICO models may consider the raw dollar value of CC debt in addition to utilization. Your 0.7% increase involved an increase of 3k in debt, due to your huge total credit limit, and your current dollar value of CC debt is probably 30k. It would be interesting to see what happens when your total CC debt goes from > 30k to < $100.

You must have me confused with someone whose financial life is much more orderly and controllable than the one I have

Hi SouthJ! For a long time you were the poster boy for always paying all your cards to zero before the statement cut (except one). TT and I in contrast were more likely to say that it's ok for most people just to PIF after the statement, and not worry too much about being at zero. You never pushed your own approach on anyone, but as I understood it yours was to pay CC debt off pronto, even before it hit the statement.

It's everybody's right to change how he does things. So maybe now you are not only reporting huge balance but even carrying them with no easy way to pay them off. All kinds of reasons that could be the case. But if you are surprised that I might assume that you could pay to zero almost anytime you want, that's because historically that's been your modus operandi.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:It would be interesting to hear what happens to your scores if you drop your overall utilization to < 0.1%. (I.e. 7.75% to 0.1%).

Thomas Thumb and I believe that it is possible that some FICO models may consider the raw dollar value of CC debt in addition to utilization. Your 0.7% increase involved an increase of 3k in debt, due to your huge total credit limit, and your current dollar value of CC debt is probably 30k. It would be interesting to see what happens when your total CC debt goes from > 30k to < $100.

You must have me confused with someone whose financial life is much more orderly and controllable than the one I have

Hi SouthJ! For a long time you were the poster boy for always paying all your cards to zero before the statement cut (except one). TT and I in contrast were more likely to say that it's ok for most people just to PIF after the statement, and not worry too much about being at zero. You never pushed your own approach on anyone, but as I understood it yours was to pay CC debt off pronto, even before it hit the statement.

It's everybody's right to change how he does things. So maybe now you are not only reporting huge balance but even carrying them with no easy way to pay them off. All kinds of reasons that could be the case. But if you are surprised that I might assume that you could pay to zero almost anytime you want, that's because historically that's been your modus operandi.

Yeah, that's definitely my preference ![]() Better yet would be not needing credit at all

Better yet would be not needing credit at all ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: .75% utilization increase --> 7 point dip

@Thomas_Thumb wrote:Good data point.

Is this a clean file datapoint? Utilization is not too impactful on dirty files.

30D late on there so in the top 8 scorecards at least.

I don't know on that bit, agreed the point swings are smaller for dirty files (higher scores magnify everything apparently good or bad) and I routinely dropped points for going over 10% aggregate (or 9.01 rounded or whatever it is).

EQ was also flat.

TU dropped 1 point (with a 60D late, which appears to be bottom 4 on FICO 8), that could've been something else, will have to see when I zero it.