- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

900 Club...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

Good info, thanks for the reply. Has anyone ever reported a 900 on EQ BCE8? I'm wondering what factor it could be holding you and Trudy from grabbing it. I would think it has to have something to do with revolvers... whether average age, oldest, youngest, [total] number of them, etc.

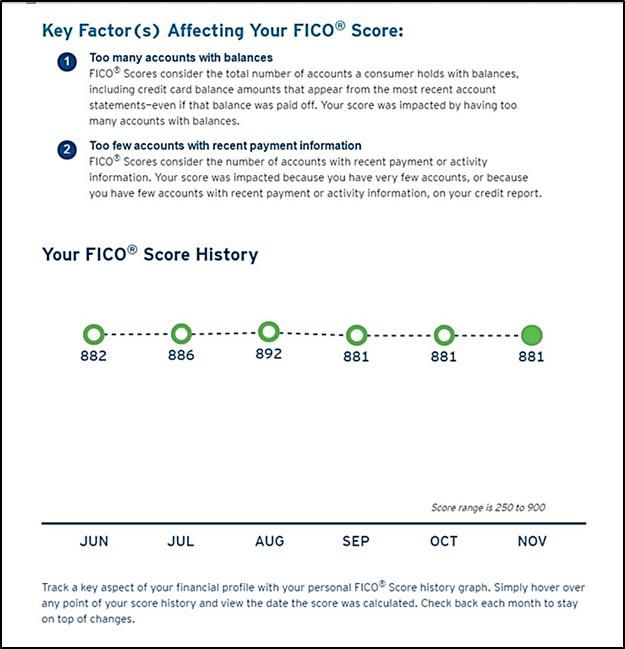

Here is an image from my Citi account of my 2 negative reason statements related to my EQ BCE8 score. These statements were generated when I was at I believe AZE3, but even when I go to AZEO they remain exactly the same. I have 1 open loan (mortgage) so by default I'm always going to have 2 accounts with a balance (1 loan, 1 revolver) when doing AZEO. I suppose that extra account with a balance (mortgage) hurts a bit, but I'd think eliminating it and having no open loan would hurt more. Who knows.

I do agree that BCE8 does seem a bit more sensitive to accounts with balances than Classic 8... not as sensitive as the mortgage scores, but somewhere between them and Classic 8. On Classic 8 (EQ) I see 11 points of movement in going from AZEO to all accounts with balances, where on BCE8 that number is easily twice that, probably close to 25 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

I added the below table to an earlier post which summarizes which Fico versions have a 900 score being reported by a poster. The most common ones are TU and EX BCE Fico 8. Relatively speaking, TU is a pushover ![]()

TU BCE 8 - 4 posters, EX BCE 8 - 3 posters, TU Auto 8 - 2 posters, TU Auto 9 - 1 poster, EQ Auto 9 - 1 poster

| Version | EQ | TU | EX |

| BCE 8 | No | Yes | Yes |

| BCE 9 | No | No | No |

| Auto 8 | No | Yes | No |

| Auto 9 | Yes | Yes | No |

My standard two EQ BCE Fico 8 reason statements are pasted below. The top statement remained the same for 5 years. The 2nd one was replaced with a recent inquiry statement when I took a HP for a CLI. The reason statement reverted back after the HP reached 12 months age.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

What exactly does that second reason statement you have pictured above point to? With the presence of the first (too many accounts with balances) it means you've got to have recent payment information on them... or you'd have late payments. That's a bit confusing to me. Even if it were based on a percentage and not knowing a ton about your profile I'd think that since a good chunk of your accounts have reported balances at any given time that you'd avoid that negative reason statement.

I'm not surprised by your top statement since I'm able to achieve it at AZEO. Have you ever gone to AZEO and checked to see if it remains, or if your 2 reason statements flip-flop?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

It means, IMO, that I am not showing activity on enough accounts independent of whether or not they are reporting a balance. My QTY of open accounts lacks critical mass. My file is not thin but, it is not thick either.

I only had 7 open accounts total, 6 now that the mortgage has closed (5 if AU card is excluded). Even when I used all my cards and let them report balances the 2nd statement showed up - until it was replaced by the INQ statement. I have not had a negative in 35 years so that's not in play.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

@Thomas_Thumb wrote:It means, IMO, that I am not showing activity on enough accounts independent of whether or not they are reporting a balance. My QTY of open accounts lacks critical mass. My file is not thin but, it is not thick either.

I only had 7 open accounts total, 6 now that the mortgage has closed (5 if AU card is excluded). Even when I used all my cards and let them report balances the 2nd statement showed up - until it was replaced by the INQ statement. I have not had a negative in 35 years so that's not in play.

Gotcha. So on your accounts you are showing usage (on all of them, perhaps?) but you're thinking that's simply not usage of enough accounts total. My file isn't far off from yours. I've got 7 revolvers and 1 loan, so 8 accounts, all of which are showing recent usage and I've never seen that reason statement. This could put the threshold point at (say) 7 total open accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

@Anonymous wrote:

@Thomas_Thumb wrote:It means, IMO, that I am not showing activity on enough accounts independent of whether or not they are reporting a balance. My QTY of open accounts lacks critical mass. My file is not thin but, it is not thick either.

I only had 7 open accounts total, 6 now that the mortgage has closed (5 if AU card is excluded). Even when I used all my cards and let them report balances the 2nd statement showed up - until it was replaced by the INQ statement. I have not had a negative in 35 years so that's not in play.

Gotcha. So on your accounts you are showing usage (on all of them, perhaps?) but you're thinking that's simply not usage of enough accounts total. My file isn't far off from yours. I've got 7 revolvers and 1 loan, so 8 accounts, all of which are showing recent usage and I've never seen that reason statement. This could put the threshold point at (say) 7 total open accounts?

I think we could be onto something here. @Thomas_Thumb was your authorized user account counting or discounted from versions 8 and 9? So 7 or 8 may be the sweet spot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

Even when I showed activity on all my accounts, I receive that reason statement ... except during the 12 months where I had a new inquiry (shown below). All I needed was one HP for "too many inquiries last 12 months" to take over the #2 spot.

In your case, I suspect "limited" average age of accounts is just more influential than # accounts. My AAoA is currently over 21 years and oldest over 36 years.

As mentioned in my "how low will my score go" thread, my total # of accounts has been dwindling with not all open accounts being considered. See below link. I know my AU card is not included. I wonder if BCE only considers official "bank" cards - which Fico lists as 3 for me.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 900 Club...

Do you have any idea what that inquiry was "worth" scoring wise on your file? I'm thinking due to buffer you may not have been able to quantify its impact. If you were able to quantify it to (say) 5 points, you'd then know that the account activity reason statement is impacting your EQ BCE8 no more than 4 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content