- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: A couple of DCU questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

A couple of DCU questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

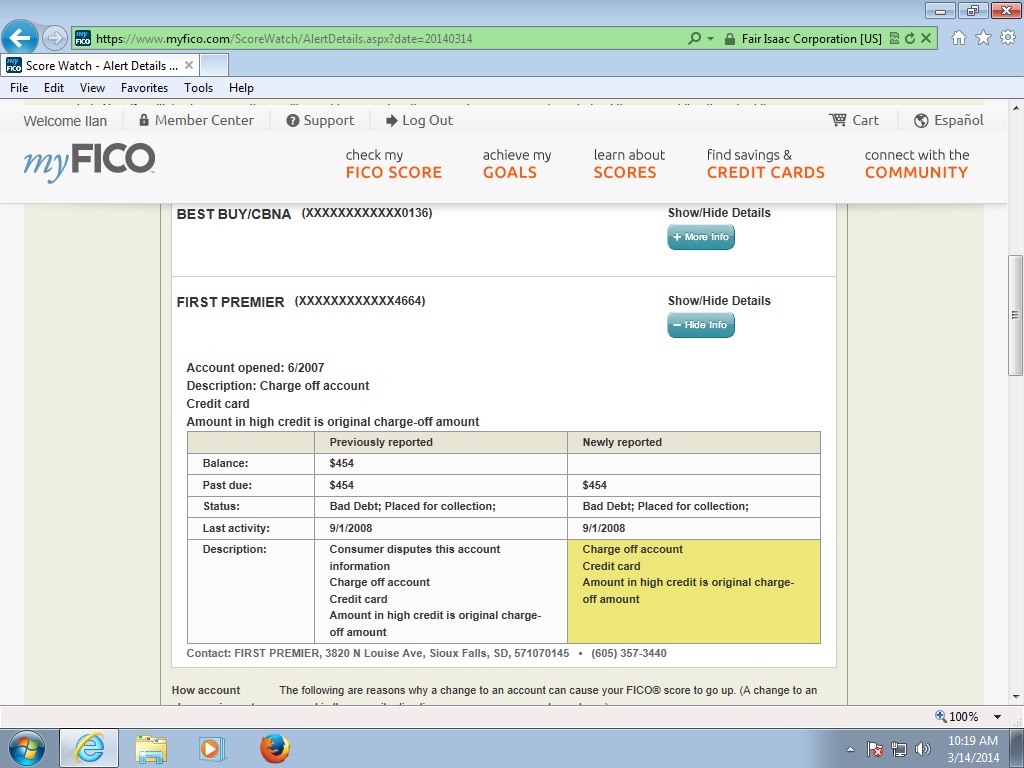

I got a score alert this morning that my EQ changed....went from 696 to 652. Only change was an update to my FP charge off, so I guess DCU is actually using the same score as here.

Doh....the update must have litteraly come maybe an hour before I happened to apply for the auto refi and cost me savings of a few grand. Damn FP....my scores were all about to go over 700 and nothing has changed except my util keeps going down and now Im back to the mid 600's all because they decided to let the CB's know again that I had a chargeoff 6 years ago and now its like I missed a payment yesterday, so frustarted with this set back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

This is whhat it shows for the change withteh FP charge off. I dont see any difference other than the balance is gone but still shows past due. Amazing how you can lose 44 points with no real material change, just an "update" to a charge off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

@oilcan12 wrote:As of a couple of weeks ago, my Equifax score from DCU and my Equifax score from MyFico were identical. If DCU has changed the version of FICO scoring that they are using, it must have been very recently.

If it did it was recently but it's possible I was confused by another poster who was quoting a FICO score from a loan application which absolutely may not be the same as the FICO score they provide monthly to checking account holders.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

See I got the reverse. My EQ on Fico was 701, but, DCU said 737. I didn't argue... Lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

My DCU scores are always the same as what I view here. Their site updates at the end of the month while scores here update as they happen. The person that I spoke with when I applied for my current auto loan a few months ago asked if I knew my score. I told her it was 699. She pulled it up and said "yup, it's 699". I think their lowest rates are available for scores of around 680 or higher (forget the exact #).

I would think they'd pull a score the day when a loan app is being processed. That would provide them with the most recent score.

Capital One Savor - $17000 / Capital One Venture - $13000 / Travel Advantage Visa - $13000 /Bread Rewards AMEX - $8450 / TD Cash Card - $7500 / Apple Card - $6500 / TD Double Up - $5500 / Mercury - $5000 / Ally Master Card - $4300 / DCU Visa - $3000 / Capital One QuickSilver - $600

$83,850

DCU Auto Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

@masscredit wrote:My DCU scores are always the same as what I view here. Their site updates at the end of the month while scores here update as they happen. The person that I spoke with when I applied for my current auto loan a few months ago asked if I knew my score. I told her it was 699. She pulled it up and said "yup, it's 699". I think their lowest rates are available for scores of around 680 or higher (forget the exact #).

I would think they'd pull a score the day when a loan app is being processed. That would provide them with the most recent score.

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/FICO-8-Announcement/td-p/2996572

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

@masscredit wrote:My DCU scores are always the same as what I view here. Their site updates at the end of the month while scores here update as they happen. The person that I spoke with when I applied for my current auto loan a few months ago asked if I knew my score. I told her it was 699. She pulled it up and said "yup, it's 699". I think their lowest rates are available for scores of around 680 or higher (forget the exact #).

I would think they'd pull a score the day when a loan app is being processed. That would provide them with the most recent score.

I am assuming DCU is Delta Credit Union. Sorry I am not very current with the acronyms used here. I use DCU for auto loans and everytime I used them the score they pulled was always exactly what was on myfico.

They use other systems for different products. I recently applied for a new mortgage loan with them and the scores they quoted were nothing like the scores I had at myfico.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

@oilcan12 wrote:

@masscredit wrote:My DCU scores are always the same as what I view here. Their site updates at the end of the month while scores here update as they happen. The person that I spoke with when I applied for my current auto loan a few months ago asked if I knew my score. I told her it was 699. She pulled it up and said "yup, it's 699". I think their lowest rates are available for scores of around 680 or higher (forget the exact #).

I would think they'd pull a score the day when a loan app is being processed. That would provide them with the most recent score.

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/FICO-8-Announcement/td-p/2996572

I was under the impression the myfico score product was at least in a ballpark. Myfico even says their score is within a certain amount of points. That has not been true. I've had a credit pull with a 32 point difference.

Case in point...I just applied for the discover. When they sent my package it showed my EQ fico score at 713....well you see what it is in my signature. The 670 was after the Discover inquiry. However, my Eq myfico has never gone over 683 which is probably what it was when they pulled it.

I dont understand the big fluctuation in my scores. It appears myfico scores are no where near my actual scores.

If they are migrating people and expect inaccuracies...they should refund customers if they already know the scores are bogus.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A couple of DCU questions

I wish there was just one scoring standard that all lenders and the 3 CRAs used. That would make life so much easier instead of all of the different versions that they use.

Capital One Savor - $17000 / Capital One Venture - $13000 / Travel Advantage Visa - $13000 /Bread Rewards AMEX - $8450 / TD Cash Card - $7500 / Apple Card - $6500 / TD Double Up - $5500 / Mercury - $5000 / Ally Master Card - $4300 / DCU Visa - $3000 / Capital One QuickSilver - $600

$83,850

DCU Auto Loan