- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: AZEO For The First and Probably Only Time

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AZEO For The First and Probably Only Time

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZEO For The First and Probably Only Time

I've read on these Forums many times about the credit boost and the rush from reaching the Nirvana of AZEO. Though I almost always pay off my CC each month I felt my ever reaching that benchmark would never happen. Between different closing periods and re-accruing charges, I was never really close, until TODAY. Equifax has reported just one balance. The score jump was only 1 point though, but I did reach it. The other CRA reported me with two balances. The second was Citi which hasn't updated in over a month and is long paid in full. My utilization is well under 1%. My oldest CC is over 20 years, and my AAOA is just over three years. Total CL is over $170K. EQ CS is now 811.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

@Anonymous wrote:The score jump was only 1 point though, but I did reach it.

I think it's a common misconception that AZEO verses (say) AZE2 raises scores. Many times it doesn't move them even a single FICO point. All AZEO does is ensure that your FICO scores are maximized across all models, but they could very well be maximized already without being at AZEO if you're at AZE2, AZE3 etc. depending on the individual profile.

AZEO is simply an implemented best practice when an application is upcoming, as one knows that they are maximizing their score. In a nutshell it doesn't always help, but it can't hurt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

Thank you for clearing that up. Now I know it doesn't matter if I ever reach that point again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

It's definitely a good thing to know on your own profile just for the future. For me, I see no difference at all across all 3 bureau scores when moving from AZEO to AZE2. When I move to AZE3 I see a tiny penalty on EQ (but not TU/EX) and when I move to AZE4 I see a tiny penalty on EQ/TU (but not EX).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

@Anonymous wrote:It's definitely a good thing to know on your own profile just for the future. For me, I see no difference at all across all 3 bureau scores when moving from AZEO to AZE2. When I move to AZE3 I see a tiny penalty on EQ (but not TU/EX) and when I move to AZE4 I see a tiny penalty on EQ/TU (but not EX).

The first time I managed to not-AZEO (AZE2), I saw a 2point loss on EX that I could point to, and I didn't see much other movement on the other two (I have a lot going on, so it's rare for me to have anything isolated at the moment). I was panicking since I thought AZEO was the only way to go, and now I just make sure my utilization stays where it belongs and don't stress the rest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

I have been posting about this for well over a year now, based on my year long utilization test, my point gains going from all cards reporting naturally (8/8 during the test period) to AZEO on FICO8 was EX 0, TU 3 and EQ 3-5 (not 100% sure about TU and EQ because I no longer have my CCT archives), aggregate UTI always under 9% and individual UTI always under 29% during the entire test, scores are all in 830s now with all 6/6 cards naturally reporting and set on autopay.

IMO, AZEO is a wast of time and only useful during a mortgage process, my mortgage scores are about 30-40 points lower FICO8/9 with negative reason code "too many accounts with balance", which is not present under FICO8/9. I didn't pay much attention to mortgage scores during the utilization test but I suspect AZEO would probably give my mortgage scores a healthier bump.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

That's probably true. If your mortgage scores are 30-40 points off of your 8's when you're at all accounts with balances, I'd imagine that they would be much closer to your 8's if you went the AZEO route.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

@Anonymous, the scores used for mortages seem to be impacted more than FICO 8 for almost everything. Inquiries hurt more, young account age stats are penalized more, and you're hit harder for utilization and balances.

The exception is loans. FICO 8 wants to see an open loan account. Two of the three mortgage scores don't seem to care if you have any loan at all.

We had a recent thread where a bunch of us compared all 28 of our FICO scores. It was pretty common for "mortgage" scores to hover 30 points or so below FICO 8s. A 60-point difference isn't unheard of on Equifax.

I'm an exception to all this. My "mortgage" scores run neck and neck with my FICO 8s. Of the six scores, my highest is my Experian "mortgage" score, and my lowest is my Experian FICO 8. My guess is that my utilization, AoYA, AAoA, and AoOA are all sufficient to please the older models. But the big thing would be that the older models aren't penalizing me (much) for the fact that there are no loans on my reports at all.

If you're only monitoring FICO 8, I'd figure on a 30-point difference as a "default" amount. For those in a position where they're still "growing" their scores, I'd suggest testing one's AZEO score periodically (once a year maybe) until one's AZEO FICO 8 is in the 800 range.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO For The First and Probably Only Time

Lack of any revolving accounts hurt Fico 8 scores more than Fico 04 and Fico 98 scores. Those with "loan only" profiles experienced the pain when Fico 8 scores 1st started reporting.

In reality neither the Fico 98 nor the Fico 04 models care much about having an open installment loan on file. However, the older models do want to see a closed loan if there are no open loans - to satisfy the mix component.

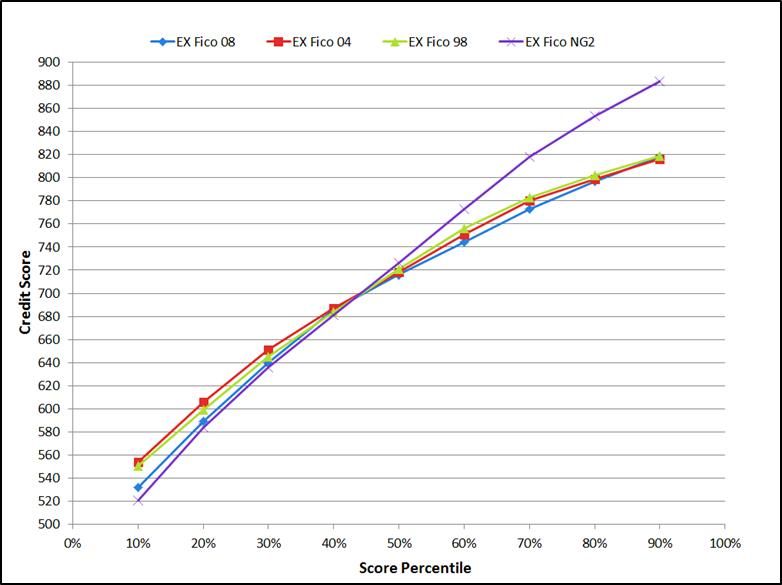

According to published data on over 50 million profiles all the Classic Fico models (9, 8, 04 and 98) score very close to one another in aggregate in the 30 percentile to 90 percentile range. So, the factor weightings must balance out with some being more influential on older models and others on newer models.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950