- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Adding an installment loan -- the Share Secure...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adding an installment loan -- the Share Secure technique

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:

Good job! That's quick! A word of caution though. Your auto-pay is probably still active. You should still attempt to delete it around Feb 27 or so. It's not the end of the world if a payment goes through on your original due date but it's something you definitely don't want to forget about. Otherwise, your 5 year loan will only last 5 months!

So, DMcG, I think you are right, and it still is going to pull the original Scheduled Transfer...it appeared, when I clicked "delete" on the scheduled transfer, it popped me to a confirmation screen which appeared that it would've let me complete the deletion of the payment. So I just went in and tried to actually delete it and I got the Red Error Pop Up...so I will go in after 3/1 and see if I can delete it after that...

I will keep an eye on it and report back on what the results are. I also have mint tracking the loan, so it shouldn't be hard to follow it...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:

@Anonymous wrote:Good job! That's quick! A word of caution though. Your auto-pay is probably still active. You should still attempt to delete it around Feb 27 or so. It's not the end of the world if a payment goes through on your original due date but it's something you definitely don't want to forget about. Otherwise, your 5 year loan will only last 5 months!

So, DMcG, I think you are right, and it still is going to pull the original Scheduled Transfer...it appeared, when I clicked "delete" on the scheduled transfer, it popped me to a confirmation screen which appeared that it would've let me complete the deletion of the payment. So I just went in and tried to actually delete it and I got the Red Error Pop Up...so I will go in after 3/1 and see if I can delete it after that...

I will keep an eye on it and report back on what the results are. I also have mint tracking the loan, so it shouldn't be hard to follow it...

You can login before 3/1 and try to delete it. Several of us were able to delete it 3 days before the original scheduled date.

You can wait after 3/1 too. At most it will pay it down to $34 or so, not a big deal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

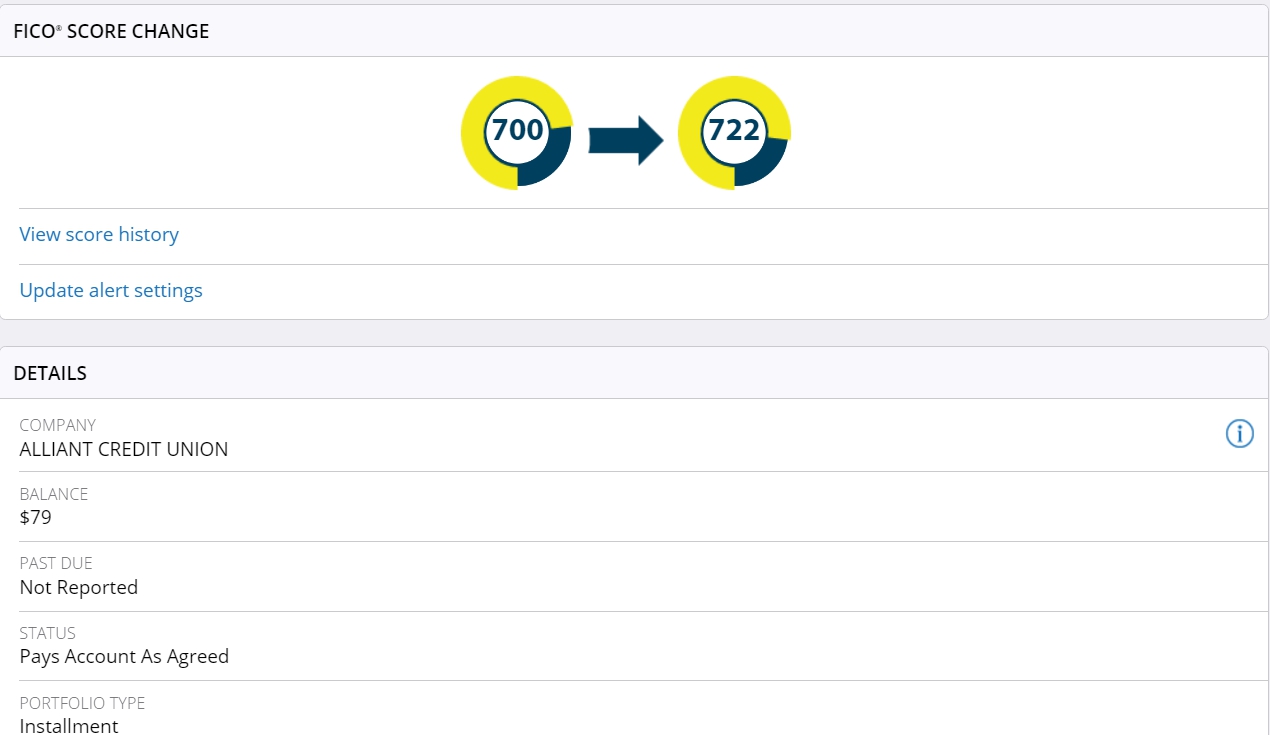

FICO 8 EQ score was reported today. Increase of 15 points! Only from optimizing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

I have a few balances that I paid off and haven't reported, but the alliant loan showed up on Equifax now and boosted the score by 22 points:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Hi Plwtred. Since your balance is $79 (on a $500 loan) you are at 15.9% installment util. You should pick up the rest of your points when it reports at $44.

I am curious... did you receive that alert today? If so, it means that the total number of days between Alliant reporting and you being notified was 11 days. Not surprising, but worth observing. I wonder how much of that was the extra time that the myFICO alert process took.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Plwtcred was the one who went in for $1k so he's optimized at 7.9% right now.

I'm finding that TU hits around the 8th, EQ hits around the 10th and EX hits around the 12th, give or take.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@newhis wrote:

You can login before 3/1 and try to delete it. Several of us were able to delete it 3 days before the original scheduled date.

You can wait after 3/1 too. At most it will pay it down to $34 or so, not a big deal.

Thanks! I set an alert for 2/26 - will update results...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

As I indicated in this thread, I took out a $1000 loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:As I indicated in this thread, I took out a $1000 loan.

Yup, you shore did. I forgot. I respond to so many people on a lot of threads, I often forget details that might have been told me if they are several days back. Thanks for you and Driver reminding me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Score Update: My loan hit Equifax. Score jumped 35 points from 724 to 759! Not on Transunion and Experian yet. Will update when available. Less than 2 weeks from approval to first score jump. Had to wait on Equifax to update through CCT but first saw on report from Credit Karma yesterday. Thanks CGID!

By the way just for data's sake, CK reported an 11 point drop for a new account.

12/15 - First Tradeline - 12/17 - 800 Credit Score - 3/18 - Homeowner