- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Adding an installment loan -- the Share Secure...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adding an installment loan -- the Share Secure technique

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

j@Anonymous_miami wrote:Okay, that's a different story then. I would never guess that a person could have FICOs near 780 with such a short and thin credit profile.

Bottom line, though, as I said above, there's basically no difference between having a FICO of 740 and a FICO of 810 if the rest of one's application profile doesn't support an approval.

With such a thin profile, I'd probably try to get the secured cards unsecured and/or apply for another credit card or two before I opened this loan. Otherwise, your average age of accounts is going to take a hit without actually adding any new credit to your profile. (Are all of your cards 3 years old or is your oldest card 3 years old?)

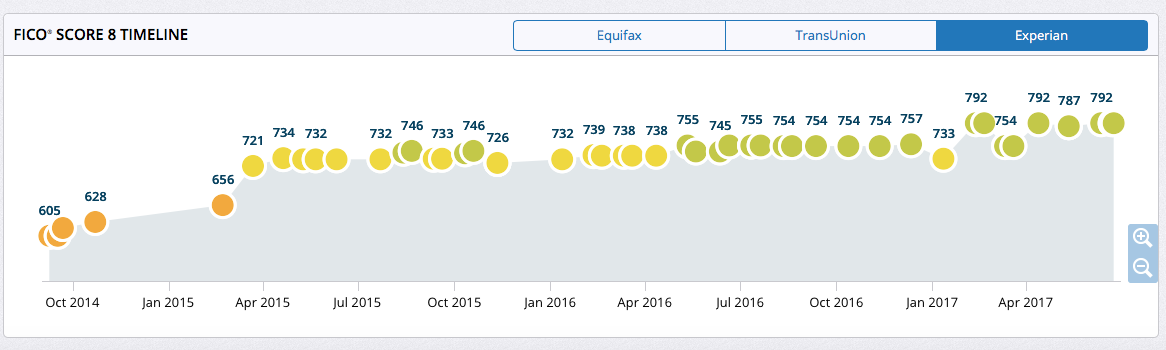

My FICO was 605 when i started this in 2014, I'd never had any credit of any sort before that but i had a bunch of medical collections that went onto my credit report the day i turned 18 from my childhood. My 2 oldest/secured cards with $500 limits are 3 years and 5 months old and 2 years 11 months old respectively.. My one single proper credit card, the Quicksilver with a $10,000 limit, is 2 years 2 months old.

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

That's really interesting. It sounds like you're in your early 20s. I can't recall ever seeing such high FICO scores with such a short, thin credit history.

I still think you'd be better off trying to unsecure the secure cards and/or obtain one or two more unsecured credit cards before opening this loan. Any extra FICO points you get aren't going to help you with an instant approval for a credit card, and if an underwriter looks at your report, having one more secured entry isn't going to help much. Adding this loan now would also needlessly reduce your average age of accounts by 25%.

In any event, I tried my best, but it's not looking good for getting my SSL opened by the end of business tomorrow, when Alliant would be due to next update the credit reporting agencies. Some other people here recently said they heard back from Alliant right after applying, but not me. Looks like my app is stuck in a queue somewhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

That's a shame, worth calling to see if someone can pull its status and expedite it maybe? I don't know just a thought.

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Have you checked for preapprovals at Amex, Chase, Citi, et al.? A lot of secured cards don't let people "graduate" to unsecured, but I've seen people with 4-figure income get the Amex Everyday or Blue Cash card, the Amex Delta card, the Chase Freedom card, Citi Simplicity, et al. (None of those cards have a minimum credit limit; others will have a $5,000 or even $10,000 minimum credit limit, so you might not want to go for those right away.) Capital One also has a page where you can check for preapprovals; maybe you could get a Venture One (no annual fee) to go with the QuickSilver?

If you're able to add a couple new credit cards, you could go ahead and close the secured cards. They'll stay on your credit reports for 10 years, so you won't really lose anything by closing them. (Or, assuming you're not paying big fees, you could withdraw them down to $50, so you don't have a lot of money tied up, and keep them open.)

I actually did call Alliant because I wanted to make sure they received my loan application, but they had long hold times and I hung up. Not sure if they're having a busy day, computer problems, etc. I don't want to be too pushy, but I was really hoping to get it done by tomorrow. This being summer, I wouldn't be surprised if some staffers are on vacation right now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@FiveOhFour wrote:j@Anonymous_miami wrote:Okay, that's a different story then. I would never guess that a person could have FICOs near 780 with such a short and thin credit profile.

Bottom line, though, as I said above, there's basically no difference between having a FICO of 740 and a FICO of 810 if the rest of one's application profile doesn't support an approval.

With such a thin profile, I'd probably try to get the secured cards unsecured and/or apply for another credit card or two before I opened this loan. Otherwise, your average age of accounts is going to take a hit without actually adding any new credit to your profile. (Are all of your cards 3 years old or is your oldest card 3 years old?)

My FICO was 605 when i started this in 2014, I'd never had any credit of any sort before that but i had a bunch of medical collections that went onto my credit report the day i turned 18 from my childhood. My 2 oldest/secured cards with $500 limits are 3 years and 5 months old and 2 years 11 months old respectively.. My one single proper credit card, the Quicksilver with a $10,000 limit, is 2 years 2 months old.

Go for the SSL, it will strengthen your profile. I had my now 20 yr old step daughter do the same last summer. I first added her to three of my cards. Waitied six months and then had her apply for three of her own cards. Approved instantly on all three. Then we moved to the SSL last summer. Two months ago she applied for her own car loan through Navy Federal. With a student income of $8000 a year, Navy approved her instantly for an auto loan with the best rate they offer. The SSL does help and her credit history is less than yours. I haven't looked at her scores recently. I assume they are all in the upper 700s at the present time. All should be in the neighborhood of yours. Her profile is just thicker.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique - NFCU

My NFCU loan is reporting already. My EX score went down 7 points as predicted by the score simulator. I hope it will go back up at the end of the month when I make a payment. My first payment is not due until AUgust but I will go ahead and pay most of it before it reports again.

10/15 ~ EQ: 406; TU: 520

10/18 ~ EX: 666; TU: 646; EQ: 652

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique - NFCU

@stinastina wrote:My NFCU loan is reporting already. My EX score went down 7 points as predicted by the score simulator. I hope it will go back up at the end of the month when I make a payment. My first payment is not due until AUgust but I will go ahead and pay most of it before it reports again.

Hello! Thanks for giving this mini-community an update. If you would, could you remind us of several things?

What tools are you using to pull your reports? And have you seen the account on the actual report yet? (That's different from inferring that it may be on the report based on getting an alert.)

If you have seen the reports, what is the Date Reported listed on the NFCU loan? And on which reports do you see this? (EX, EQ, TU)

What is the current balance as listed on the report? What was the original amount of the loan?

What plans do you have for making payments on that loan? What do you anticipate the next reported balance will be? (You mention a desire to make most of your next scheduled payment soon. The scheduled payment will be a small amount. Does that mean you will still owe most of the balance on the loan?)

You mention changes to your EX "score." What tools are you using to pull your scores? (myFICO, Credit Karma, your credit cards, etc.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique - NFCU - Navy Federal Credit Union

@Glen_M wrote:

@Glen_M wrote:

@Glen_M wrote:There aren't a lot of Navy Federal Credit Union examples for shares secured loans, despite the popularity of NFCU in general, so I thought I'd put mine up.

...

Scores before (April FICO8s via myFICO):

- TU - 657

- EX - 665

- EQ - 638

...

...

Experian was the first to report something, on the last day of the month after setting the account up:

- From 665 to 683 (18pt)

TransUnion was a few days later (4th):

- From 657 to 667 (10pt)

...

Equifax was in the middle with reporting response time (3rd):

- From 638 to 655 (17pt)

...

Well, another month passed and no change or additional bonus was observed. A bit dissapointed with the increases I saw, especially TU which had no other installment loan listed at all getting 10pt.

It still rounds things out, and I'll let it continue along with $10/month payments to fluff age of accounts in the long run. I'd still do it knowing the results. I got a couple new accounts, and the Penfed might not have happened without the boost:

NFCU is definitely doing some kind of partial reporting at the statement date, and a more meaningful (at least to the scoring) report at the end of the month. Neither statement date has resulted in much, but the end of the month has been far more rewarding.

This time around I saw some big jumps again, bringing my SSL results more in line with what others have seen. My new cards reported their existence, knocking me down a few points each as well, but the over-all change is still quite positive.

Experian reported quickly again, on the 2nd I got an alert for 20 more points (+38 combined):

- From 665 to 691 (+26 with other account influences)

TransUnion was faster this time, also on the 2nd for 18pt (+28 combined):

- From 657 to 678 (+21 with other account influences)

Equifax was islow again coming in on the 4th with 13pt (+30 combined)

- From 638 to 661 (+23 with other account influences)

@stinastina wrote:My NFCU loan is reporting already. My EX score went down 7 points as predicted by the score simulator. I hope it will go back up at the end of the month when I make a payment. My first payment is not due until AUgust but I will go ahead and pay most of it before it reports again.

Don't be surprised if it jumps at the end of the month. They seem to be reporting something important then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique - NFCU

@Anonymous wrote:

@stinastina wrote:My NFCU loan is reporting already. My EX score went down 7 points as predicted by the score simulator. I hope it will go back up at the end of the month when I make a payment. My first payment is not due until AUgust but I will go ahead and pay most of it before it reports again.

Hello! Thanks for giving this mini-community an update. If you would, could you remind us of several things?

What tools are you using to pull your reports? And have you seen the account on the actual report yet? (That's different from inferring that it may be on the report based on getting an alert.)

CCT

If you have seen the reports, what is the Date Reported listed on the NFCU loan? And on which reports do you see this? (EX, EQ, TU)

I only see EX and it syas date opened 6/1/2017 but I actually opened it around the 23rd.

What is the current balance as listed on the report? What was the original amount of the loan?

What plans do you have for making payments on that loan? What do you anticipate the next reported balance will be? (You mention a desire to make most of your next scheduled payment soon. The scheduled payment will be a small amount. Does that mean you will still owe most of the balance on the loan?)

I have not made apayment yet. My first payment is due 8/23 so I am considering paying most of the balance by 7/22.

You mention changes to your EX "score." What tools are you using to pull your scores? (myFICO, Credit Karma, your credit cards, etc.)

Answered above.

10/15 ~ EQ: 406; TU: 520

10/18 ~ EX: 666; TU: 646; EQ: 652

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique - NFCU

I just signed up for the Alliant Savings Secured Loan last month. Alliant claims they reported the account to all three credit bureaus on 07/01/2017, the first day of the month after I opened the account. It did not report to Equifax until 07/08/2017 (Alliant customer service saidf it could take up to two weeks to see it on your credit reports). It has not reported to the other two credit bureaus as of yet. I only saw a 2 point score boost in my Vantage 3.0 score on Equifax, however I had done some credit repair work prior to getting the loan. I removed all negative collection accounts that were paid off the report. Then I was added as an Authorized User on 3 family credit cards which boosted my score considerably. I have 0 credit cards in my name, 3 authorized user credit cards, and 1 savings secured loan. I have a feeling the score boost will be more significant when it has a few months of payment history. I opened the Savings Secured with $500, and paid $420 off immediately as mentioned in the guide and the first autopay is setup for 08/03/2017. The main point of this account is to change the credit mix and to have a solid and lengthy payment history, so I will focus on that long term goal.