- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Aging out of late payments

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Aging out of late payments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Aging out of late payments

I have an old mortage account which was paid in full on 08/2015. I had 2 30 day late payments on this account, one in 10/2013, and another in 12/2013. My understanding is that generally these negative items should fall off my report after 7 years. My question is, how much of an impact are they having currently? Since they'll both be 7 years old in about a year from now, should I expct to see any significant improvment in my FICO score by this time next year, or will the improvement be minimal?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

Not enough information to say for sure.

Do you have any other negative information on your credit report outside of this account? If you have other negative items present (especially if they are more recent) you'd likely expect to see no score gain from a couple of 30D lates falling off.

If they are in fact your only negative items, you'd expect to see a score gain of around 35-45 points on average based on the data provided from other members that have experienced the same thing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

I've got a couple of other late payments around the same time, but my thought that the derogitories on the mortgate would be weighted higher than a credit card account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

@Anonymous wrote:Not enough information to say for sure.

Do you have any other negative information on your credit report outside of this account? If you have other negative items present (especially if they are more recent) you'd likely expect to see no score gain from a couple of 30D lates falling off.

If they are in fact your only negative items, you'd expect to see a score gain of around 35-45 points on average based on the data provided from other members that have experienced the same thing.

I have a data point I just got today that says even 30D lates indeed have a significant impact the full 7 years - if they are your only late. At the start of this year, I had two lates on my report - one that was a 90+ "major derog" due to age-out on or around 5/2019 and a 30D late that was due to age out around 10/2019. You've probably even heard me mention these before.

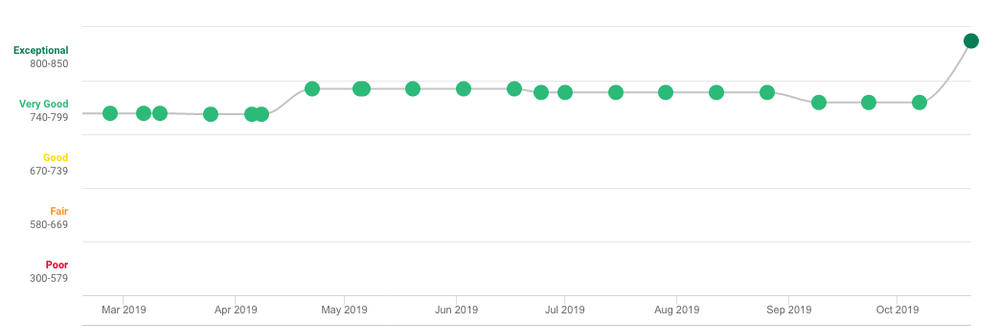

Anyway, here's my EX score path for the year:

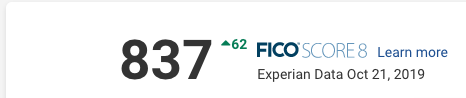

The 90D major basically capped me around 760 while it was on. When it disappeared, my score went up about 15 points to 775ish. But I was still struggling to break through much beyond that - my FICO9 got to about 830, but that last 70 points just wasn't happening. Then this morning, I get a EX alert that there was a change to my score and report. I logged in:

That's 62 points for a 30D late. My last late. The fluctuations in-between were my overall util bouncing from 1% to about 5%, plus my complete disregard for AZEO. On months when every card reported a balance, it went down 5-10, on months when only 1-2 reported a balance, it went up 5-10.

I would agree that if you have multiple 30s and one falls off, it doesn't mean much. If it's your only late though, it seems to have a rather significant impact.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

I have a data point I just got today that says even 30D lates indeed have a significant impact the full 7 years - if they are your only late. At the start of this year, I had two lates on my report - one that was a 90+ "major derog" due to age-out on or around 5/2019 and a 30D late that was due to age out around 10/2019. You've probably even heard me mention these before.

The 90D major basically capped me around 760 while it was on. When it disappeared, my score went up about 15 points to 775ish. But I was still struggling to break through much beyond that - my FICO9 got to about 830, but that last 70 points just wasn't happening. Then this morning, I get a EX alert that there was a change to my score and report. I logged in:

That's 62 points for a 30D late. My last late. The fluctuations in-between were my overall util bouncing from 1% to about 5%, plus my complete disregard for AZEO. On months when every card reported a balance, it went down 5-10, on months when only 1-2 reported a balance, it went up 5-10.

I agree. When my single late (30D) was removed in Jan, 11 months early from TU it netted 50 pts. EX was the last bureau holding on to that Dec-12 30D and woke up this morning and found it removed. YAY!!! Must be Experian's day of removal ![]()

But this netted only 24pts. My UTL is currently much higher than it was when TU removed that late early this year. I also have a new 1 month old acct.

Currently - (11% AGG, 1 revolver @ 40%, 2 less than 8% + MTG & car).

In January it was - (AGG 5%, no single card over 8%, 2 revolvers reporting + MTG & car).

This could be the reason for only 24 pts, but I'll take it. All bureaus clean now!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

iced, I tend to think your example is somewhat of an outlier. I think Trudy was the highest I've seen reported previously at ~50 points. In all examples I'm talking a single well-aged 30D late payment finally coming off. In just about every case I've read about, the score gain achieved was in the 30-45 point range. I think there was someone that reported as low as 28 and then Trudy with 50 as the two book-ends. Of course, there is more data out there and it's a small sample size of probably under a dozen people on the forum that have reported this (that I've read anyway). Your 62 is definitely the highest I've ever seen and a point of data that I'd suggest is that of an outlier. 62 is knocking on the door of the (say) 65-80 points gained on average seen from a lone well-aged major baddie such as a 90D going away.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

I have one 30 day late that is over 6 years old that only reports on EQ and EX, not on TU. I have no other derogs. My EX and EQ F8 scores are stuck in the mud around 779-783, they move very little up or down with changes in UTI, inquiries, new accounts, etc. My TU ranges between around 790 and 810 with those same changes.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

So if all other things are equal with your reports (which they may or may not be) it looks like that aged 30D is costing you possibly in the mid-upper 20's point wise. Definitely a little on the lower end, quite the opposite of what iced had going on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

@Anonymous wrote:So if all other things are equal with your reports (which they may or may not be) it looks like that aged 30D is costing you possibly in the mid-upper 20's point wise. Definitely a little on the lower end, quite the opposite of what iced had going on.

As far as I can tell, the only other difference between the reports is inquiries.

EQ has 6 (5 in the last year)

TU has 4 (3 in the last year)

EX has 1 (0 in the last year)

My EX score runs about 2-3 points higher than EQ so if they are in fact otherwise indentical the inquiries don't seem to be having a lot of effect.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging out of late payments

@Anonymous wrote:iced, I tend to think your example is somewhat of an outlier. I think Trudy was the highest I've seen reported previously at ~50 points. In all examples I'm talking a single well-aged 30D late payment finally coming off. In just about every case I've read about, the score gain achieved was in the 30-45 point range. I think there was someone that reported as low as 28 and then Trudy with 50 as the two book-ends. Of course, there is more data out there and it's a small sample size of probably under a dozen people on the forum that have reported this (that I've read anyway). Your 62 is definitely the highest I've ever seen and a point of data that I'd suggest is that of an outlier. 62 is knocking on the door of the (say) 65-80 points gained on average seen from a lone well-aged major baddie such as a 90D going away.

What I find odd about the 90D aging is that I was under the impression there was a glass ceiling at around 760 for majors, and that as long as one existed, you'd maybe hit 765 on a good month but usually around 760. I also thought that minors like a 30D were less impactful, especially one that's 6+ years old.

My score movement suggested something of the opposite of my expectations, though. I had expected to see the major boost earlier this year with the 90D and the last 30D adding maybe another 20.

I looked through my report again, and there's nothing I can find to explain the added points. Newest account is 1 year, 4 months, so I don't think there was some bump there. Number of inquiries didn't change. 4 of 5 cards are currently reporting a balance, so AZEO certainly didn't apply. AAoA is 8 years and change, so no anniversary there either. Util is always 1-5% and no single account gets near 9%.

I'll take it at any rate. Now I can go figure out how to get those other 13 points without having to play the AZEO game.