- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- All Zero = 12 to 25 point decrease...AZEO = 12 - 2...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

All Zero = 12 to 25 point decrease...AZEO = 12 - 25 pt increase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All Zero = 12 to 25 point decrease...AZEO = 12 - 25 pt increase

UPDATE: THE POINTS ALL CAME BACK WHEN I WENT TO AZEO (see below for the update)

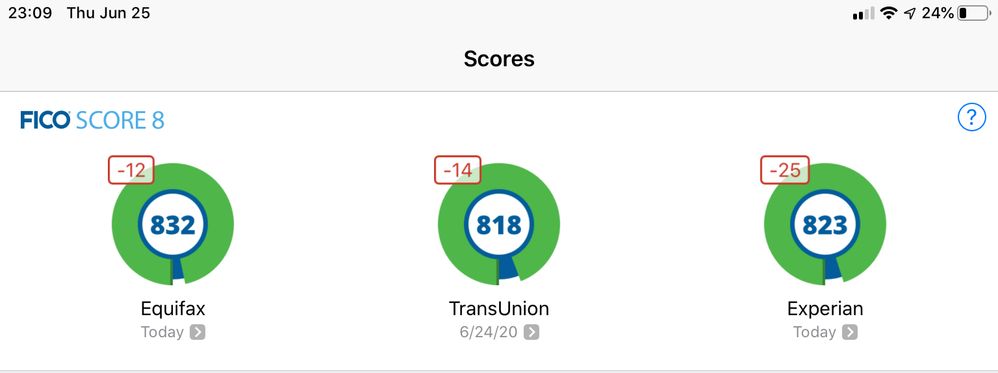

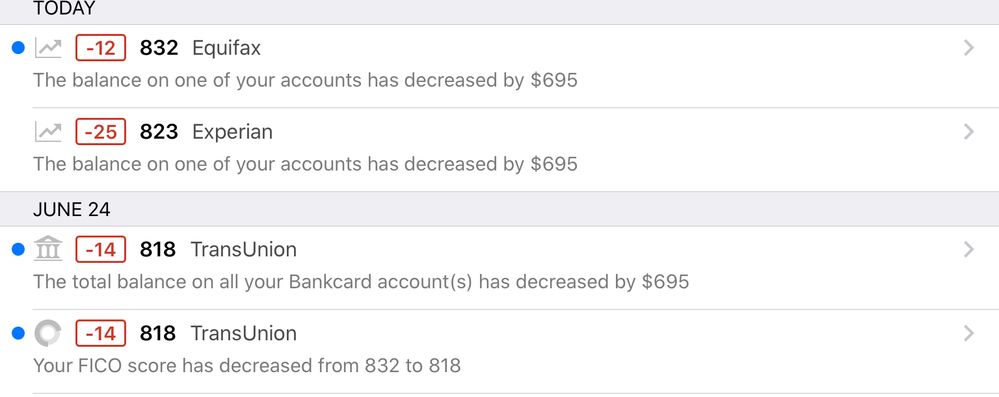

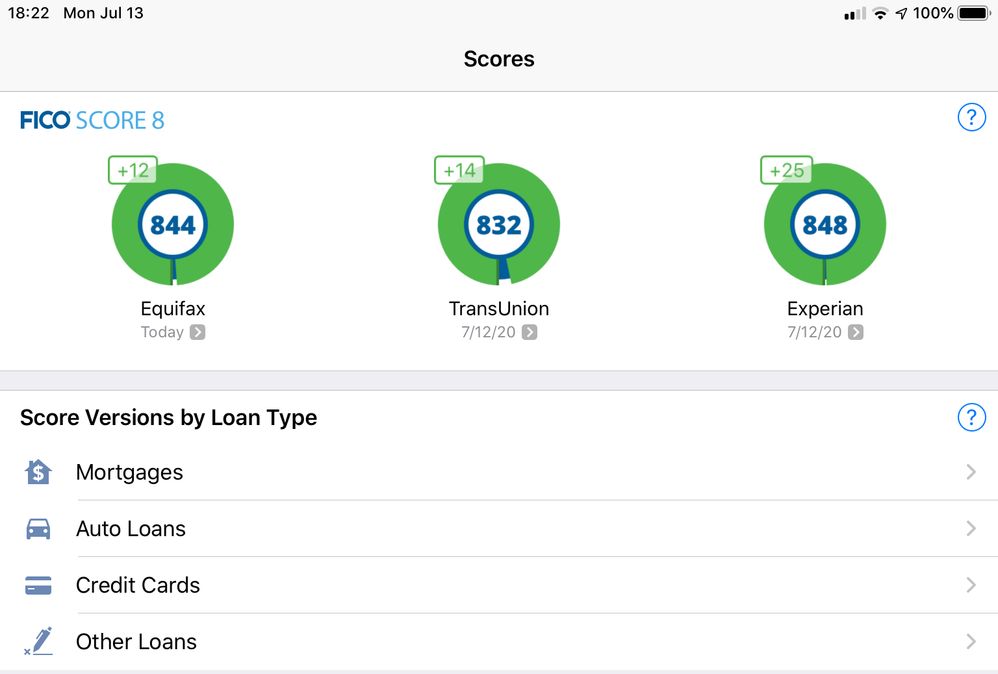

I don't watch AZEO too closely, but going to All Zero resulted in a 12 to 25 point drop with Experian dropping from 848 to 823. This was fun. I'll report back when I'm no longer All Zero...

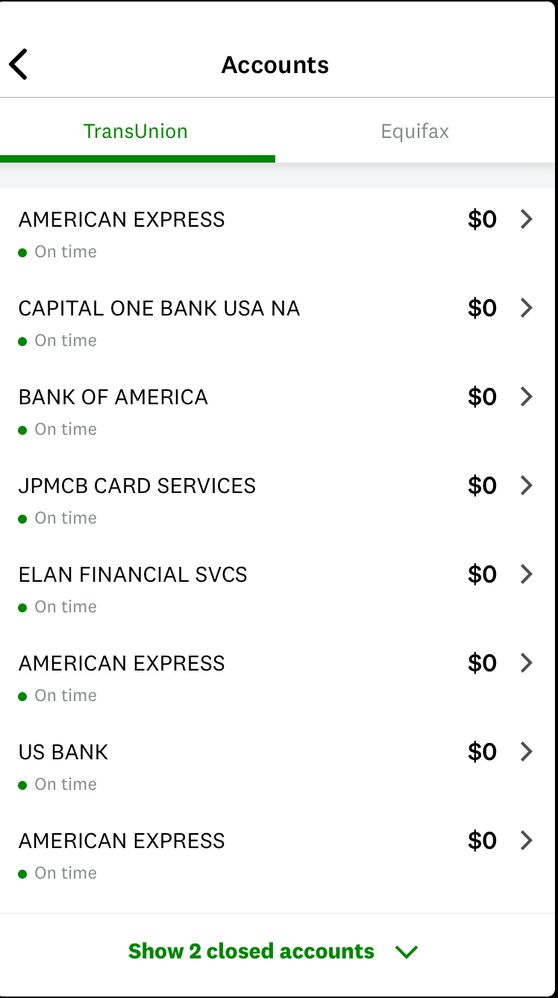

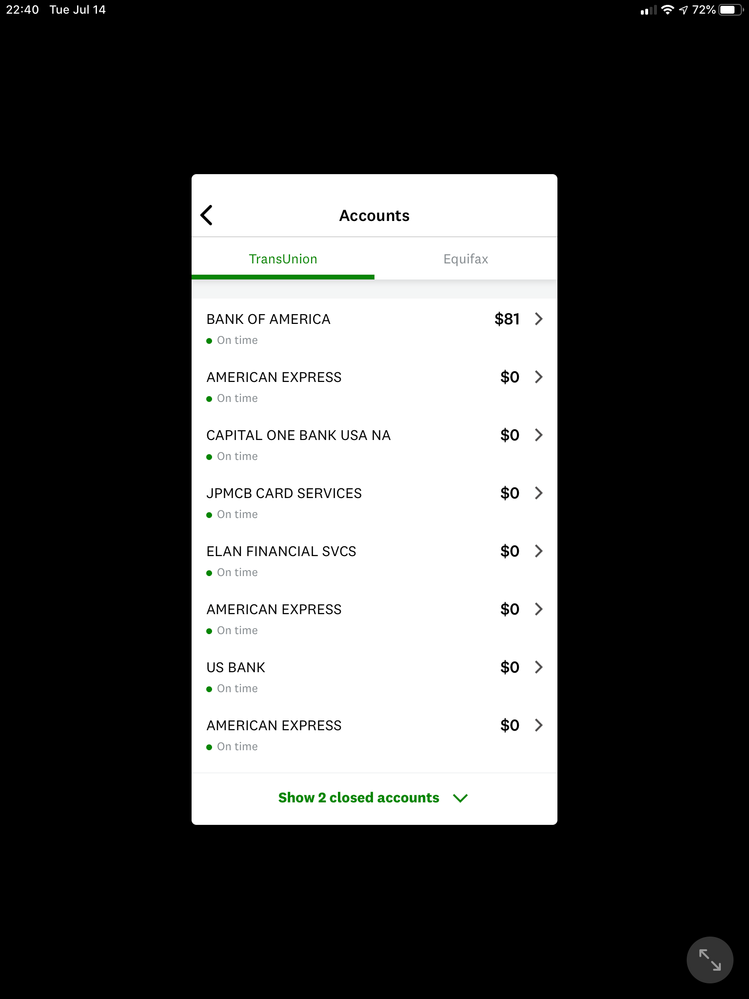

Util on the CC that was paid off for $695 was 3.3% at $695 (CL of $20,500). Total UTIL was $695 of $177,700. I don't know of any other changes that could have caused this drop other than paying my only CC with a balance from $695 to $0.

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero = 12 to 25 point drop...from 848 to 823 on Experian...

@909 Thank you for the dp and look forward to your update! Beautiful scores with or without AZEO! 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero = 12 to 25 point drop...from 848 to 823 on Experian...

I see All Zero, but I don't see Except One. I thought that AZEO was you had to leave a small balance on one card reporting (PIF before due date), while all others Zero. Fico scoring penalizes you for just All Zeroes. AFAIK

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero = 12 to 25 point drop...from 848 to 823 on Experian...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero = 12 to 25 point drop...from 848 to 823 on Experian...

Back2Reality, correct, this shows how going FROM AZEO TO AZ results in up to a 25 point drop. I was surprised to see it drop that much.

I'll see if they all rebound when one of my cards reports a balance.

@Anonymous wrote:I see All Zero, but I don't see Except One. I thought that AZEO was you had to leave a small balance on one card reporting (PIF before due date), while all others Zero. Fico scoring penalizes you for just All Zeroes. AFAIK

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero = 12 to 25 point drop...from 848 to 823 on Experian...

@909 wrote:..... going to All Zero resulted in a 12 to 25 point drop with Experian dropping from 848 to 823. This was fun......

That's a bingo!

You win!

Still got the cushion!

Thanks for posting

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero = 12 to 25 point drop...from 848 to 823 on Experian...

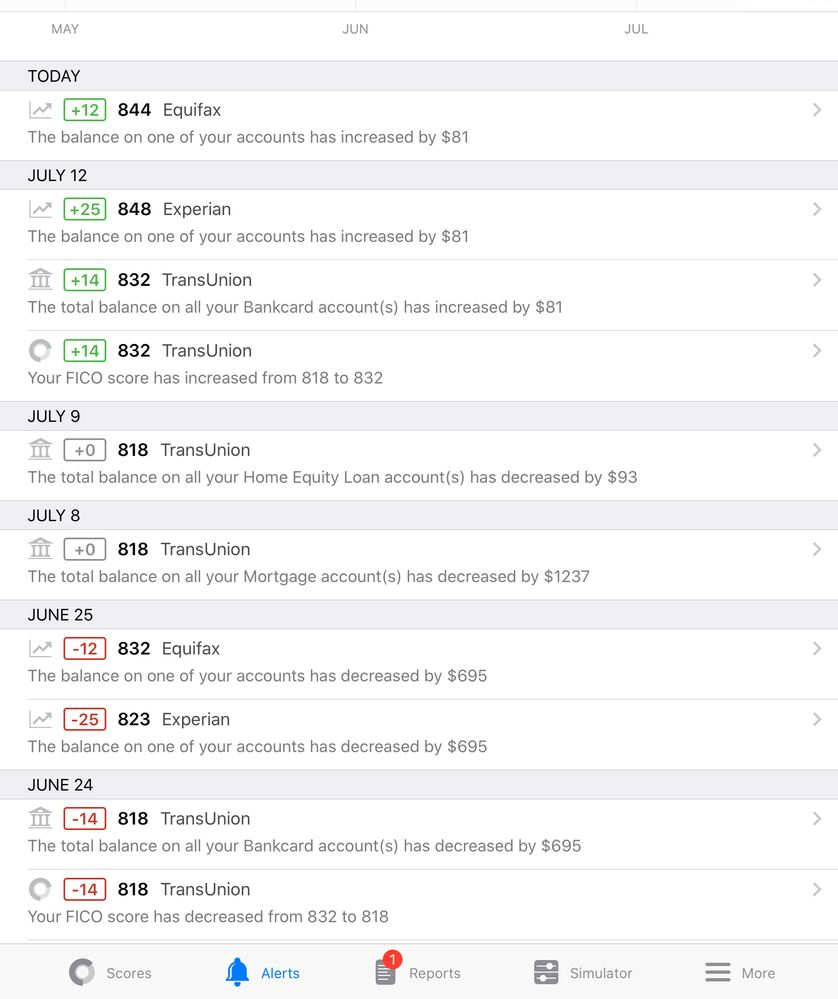

And they're back!

After losing one - two dozen points for going ALL ZERO, I got all the points back by allowing $81 dollars ($81 of $177,700 available credit and $29,700 available credit on this card) to report on one card taking me back to AZEO. This is why FICO scoring is a bit ridiculous and makes people angry or frustrated. Nothing I did over the last three weeks warranted a 25 point decrease and then increase in my credit score but the hyper-sensitive FICO model reacted as if it did. A change in score would be reasonable, but a 25 point swing for a minor change in credit activity demonstrates a failure in the process.

The algorithim is kinda dumb this way and it sucks for people in a place where capricious shifts like this matter.

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011