- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: All Zero balance = 13 point score drop -- An e...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

All Zero balance = 13 point score drop -- An experiment report

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All Zero balance = 13 point score drop -- An experiment report

I have always wanted to figure out how an all-zero balance impacts a credit score; today I got the chance.

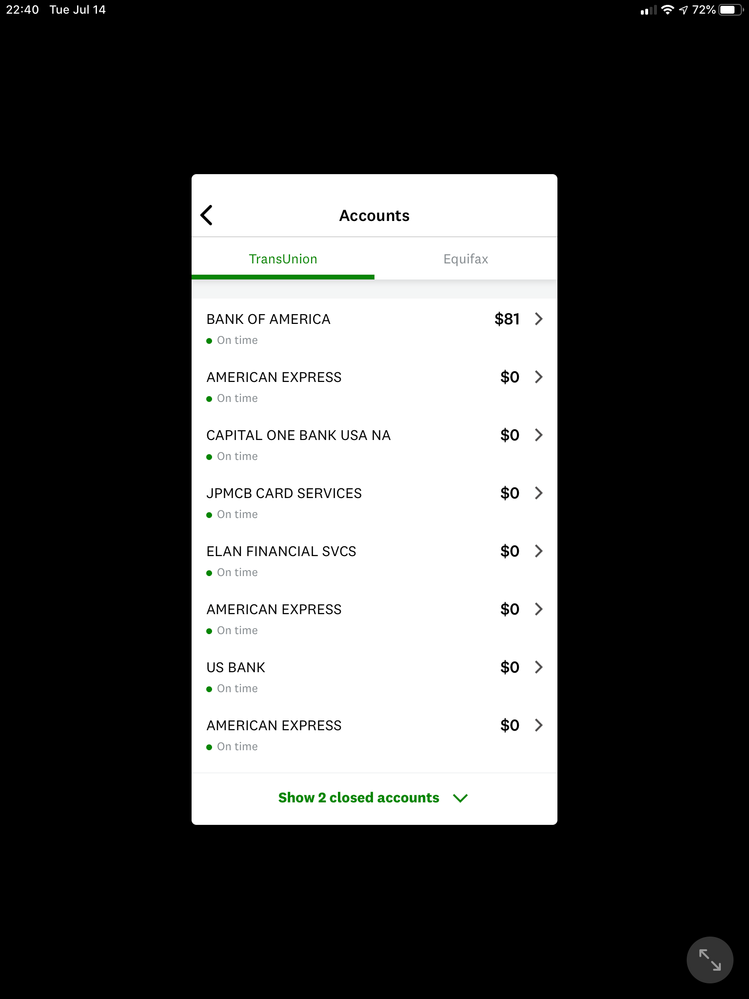

There is a 5-day difference between when Amex reports and when BoA reports. Last month I carried 0 balance on BoA and 3% on Amex Cash Magnet (Gold hasn't reported yet). This month I elected to carry 0 on CM but 5% on BoA. Right now Amex has already reported, but BoA hasn't, which means that on the credit report, both of my accounts have a balance of 0.

The score drop is pretty drastic (at least IMO): EX went from 730 to 717 (-13) and TU went from 750 to 738 (-12). I'll wait a few days and report the score gain after BoA reports. It's an interesting experiment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@hAr1x wrote:I have always wanted to figure out how an all-zero balance impacts a credit score; today I got the chance.

There is a 5-day difference between when Amex reports and when BoA reports. Last month I carried 0 balance on BoA and 3% on Amex Cash Magnet (Gold hasn't reported yet). This month I elected to carry 0 on CM but 5% on BoA. Right now Amex has already reported, but BoA hasn't, which means that on the credit report, both of my accounts have a balance of 0.

The score drop is pretty drastic (at least IMO): EX went from 730 to 717 (-13) and TU went from 750 to 738 (-12). I'll wait a few days and report the score gain after BoA reports. It's an interesting experiment.

1. If I'm not mistaken, your score drop was less drastic than most people experience.

2. I predict every point will be restored when BOA reports.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

I go up or down 16 points depending on my all zero status, you got it easy ![]()

It's been 100% recovered each time so far, so I'd anticipate yours to be the same.

In my other thread about what amount works, someone commented their drop was 18 points.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

I normally lose 22 points when all accounts report zero. All points are recovered as soon as one account reports a balance.

FICO8:

FICO9:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 38 yrs | AoYRA: less than 1 yr | New Accounts: 1/6, 2/12, 3/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

It's worth noting that the OPs file looks pretty young... AoOA under 2 years, AAoA under 1 year, for example. The AZ penalty can impact different profiles in different ways in terms of scoring ding. Perhaps on older files the sting is a tad more than young files?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@Anonymous wrote:It's worth noting that the OPs file looks pretty young... AoOA under 2 years, AAoA under 1 year, for example. The AZ penalty can impact different profiles in different ways in terms of scoring ding. Perhaps on older files the sting is a tad more than young files?

I find that fascinating. Intuitively, one would think that AZ would be less impactful on an older account. Perhaps there is some statistical evidence that indicates otherwise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@Phana24 wrote:I find that fascinating. Intuitively, one would think that AZ would be less impactful on an older account. Perhaps there is some statistical evidence that indicates otherwise.

Yeah, I'm not sure. I'm sure there is data compiled out there that based on age of file individuals tend to hit AZ more/less often or carry balances more/less often. I have no idea what that data may look like, but I could see it being considered in signal strength of those factors on each score card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

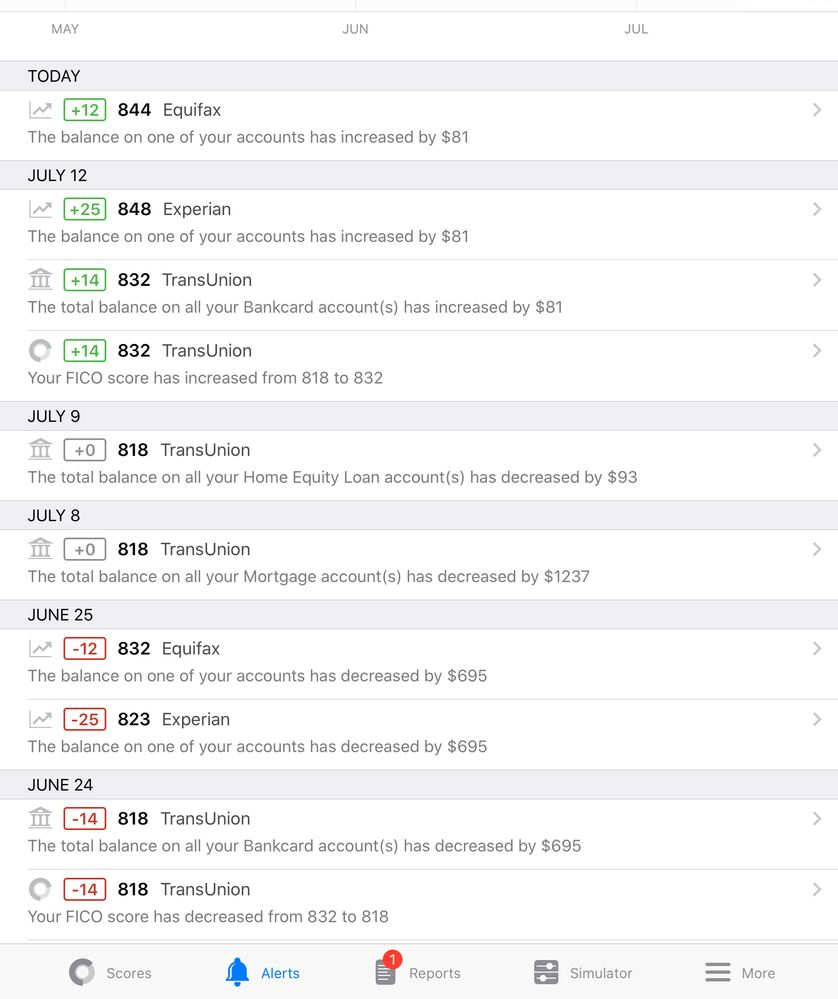

BoA updated, and here's the new (and surprising) update:

EX went back up to 730, as expected

TU went down by 1, now to 736 (before=750, allzero=737). Says "too many accounts with balance"

The only difference is that I double dipped BoA's CLI. There is no reason for such a drop. I guess I'll pull a report and see what's going on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

The only time you'll see a too many accounts with a balance negative reason code when at AZEO is if you also have an open installment loan or loans from what I've seen. And, if that's the case, there's obviously nothing that can be done about it. Closing all loans would get rid of this negative reason code, but the penalty associated with eliminating the open loan would definitely overshadow the too many accounts penalty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

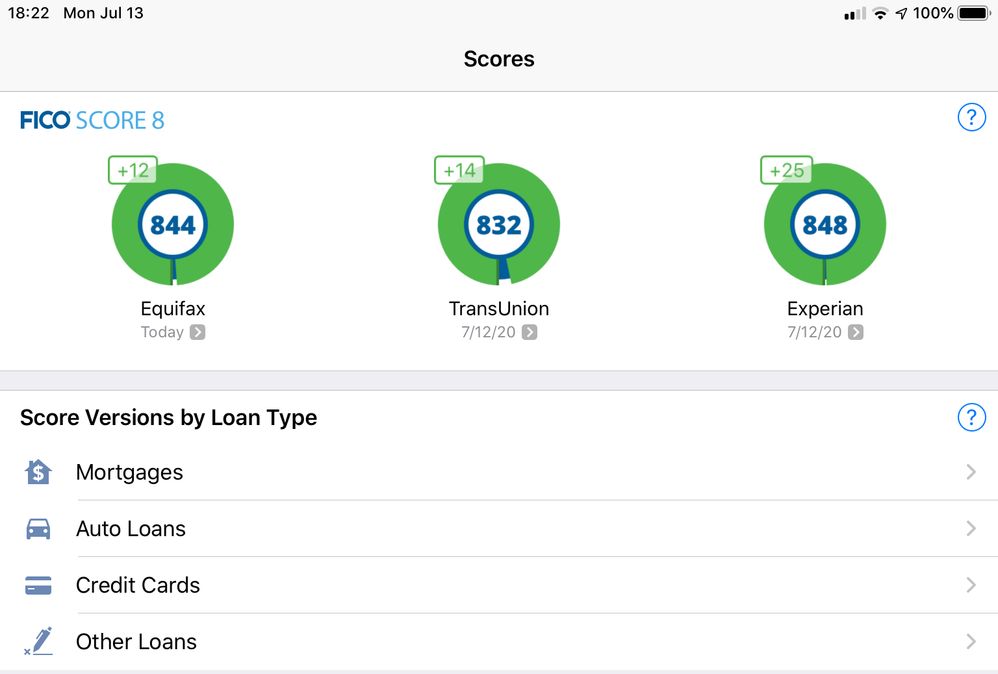

Sounds familiar...(12-25 point drops)...

And they're back!

After losing one - two dozen points for going ALL ZERO, I got all the points back by allowing $81 dollars ($81 of $177,700 available credit and $29,700 available credit on this card) to report on one card taking me back to AZEO. This is why FICO scoring is a bit ridiculous and makes people angry or frustrated. Nothing I did over the last three weeks warranted a 25 point decrease and then increase in my credit score but the hyper-sensitive FICO model reacted as if it did. A change in score would be reasonable, but a 25 point swing for a minor change in credit activity demonstrates a failure in the process.

The algorithim is kinda dumb this way and it sucks for people in a place where capricious shifts like this matter.

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011