- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: All Zero balance = 13 point score drop -- An e...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

All Zero balance = 13 point score drop -- An experiment report

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@hAr1x wrote:I have always wanted to figure out how an all-zero balance impacts a credit score; today I got the chance.

Nice data, @hAr1x !

Mine was:

- EQ 8: -17

- TU 8: -14

- EX 8: -16

With:

- AoOA: 1 yr 9 mo

- AAoA: 1 yr 1 mo

- AoYA/AoYRA: 9 mo

Link to my post about it, in a thread started by someone else who also lost -16pts on EX 8 with under 3yrs AoOA. The thread is full of other reports as well. Some losses are a bit higher.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@909 wrote:

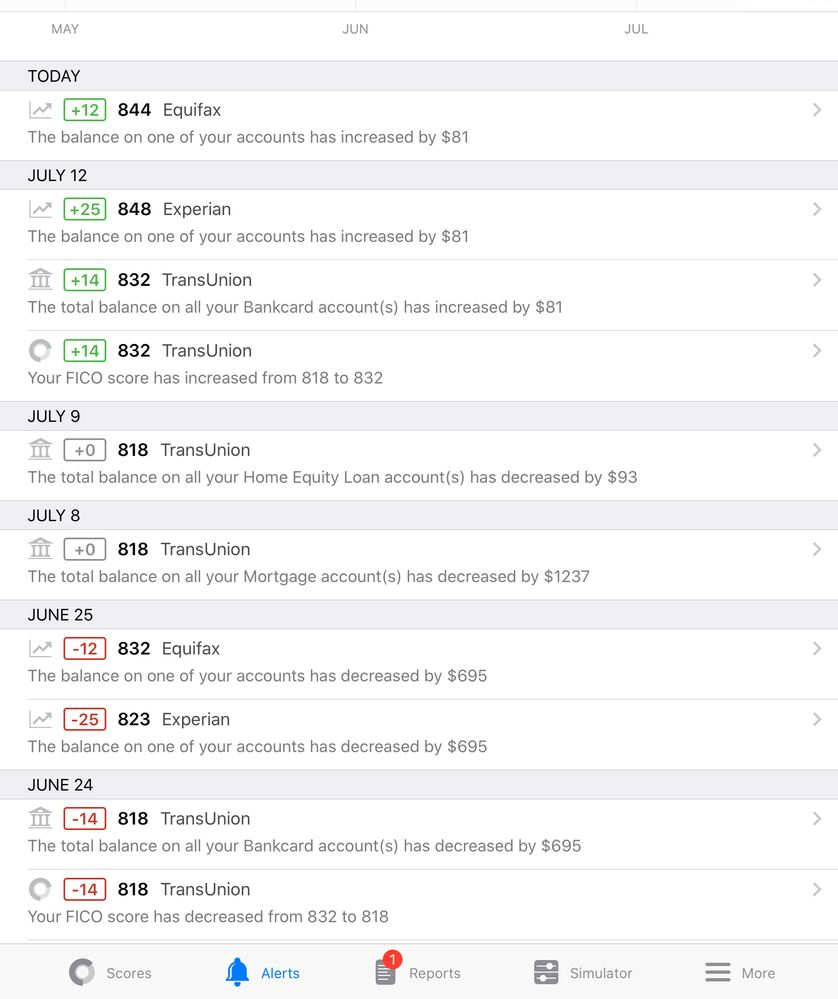

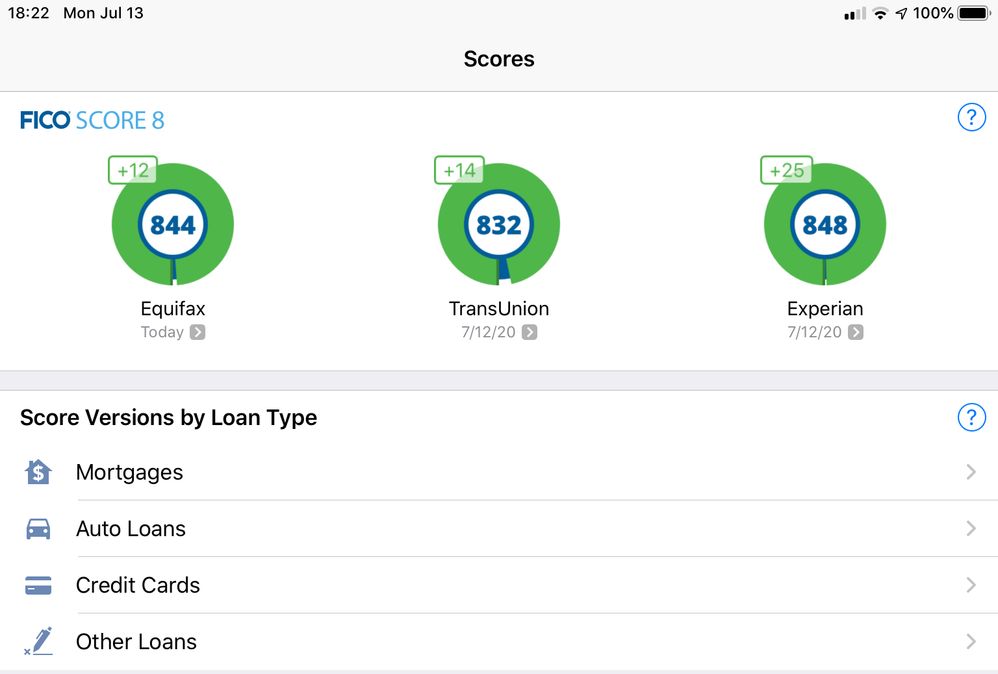

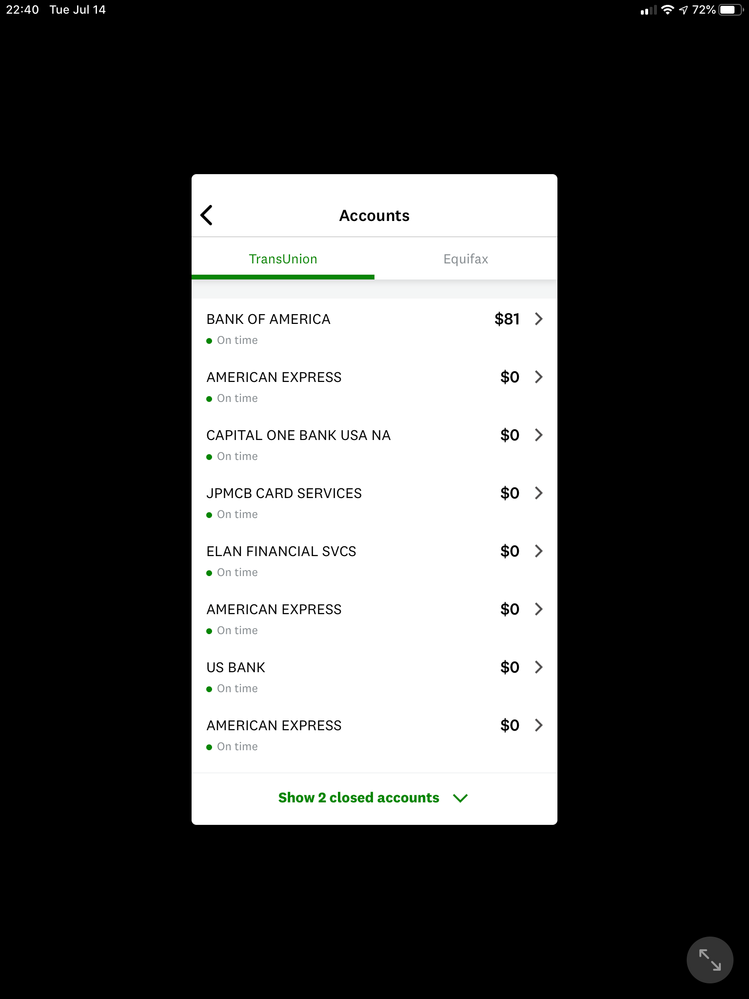

After losing one - two dozen points for going ALL ZERO, I got all the points back by allowing $81 dollars ($81 of $177,700 available credit and $29,700 available credit on this card) to report on one card taking me back to AZEO. This is why FICO scoring is a bit ridiculous and makes people angry or frustrated. Nothing I did over the last three weeks warranted a 25 point decrease and then increase in my credit score but the hyper-sensitive FICO model reacted as if it did. A change in score would be reasonable, but a 25 point swing for a minor change in credit activity demonstrates a failure in the process.

The algorithim is kinda dumb this way and it sucks for people in a place where capricious shifts like this matter.

While your point is well received regarding the flaw of the algorithm in only being able to "see" a single point in time, allow me to play devil's advocate for a moment - How do you personally handle your CC payments? Do you micromanage them? The reason I ask is because if you have $177k in credit lines, chances are you have quite a few cards. If you were using them naturally and paying your statement balances in full monthly, chances are it would be next to impossible for you to arrive at AZ, thus you chances of ever incurring the penalty you saw would be very small. That's assuming you use quite a few cards regularly, which I'm more or less figuring going off of your credit limits. If you have someone that only has (say) 2 credit cards with $500 limits and doesn't even use them every month they would be more likely to naturally land with an AZ penalty... but in that case the argument that they aren't really "using" their credit would hold more water.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

Fair points. I have eight ccs, four of which I use regularly. I pay them regularly between statements but not consistently and I don't pay them or use them intentionally in a way to ensure a zero balance on any of the cards, i.e. I ensure the min. Payment is met every month and keep the balances low.

You're correct, the example I shared was very unusual. In that example I happened to pay off my lone balance (at reporting time) of $695 and then incurred a new balance of $81 (bringing me to AZEO) a few weeks later. It was also unusual in that the payments and point changes occur on the same screen shot.

We understand how scoring works, but my guess is that if we took all the users at AZEO and AZ we'd see the penalties for AZ are not indicitive of credit risk. Then again, maybe the computers would prove me wrong and I'm an outlier.

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@909 wrote:

We understand how scoring works, but my guess is that if we took all the users at AZEO and AZ we'd see the penalties for AZ are not indicitive of credit risk. Then again, maybe the computers would prove me wrong and I'm an outlier.

I think the majority of us on this forum are the outliers when you think about it... I mean, the majority on this forum are using CCs regularly and probably don't arrive at AZ often. Then I think of how many people in the country have credit cards, but literally never use them. My parents are examples of this, many of my employees have CCs with $0 balances and just use their debit cards and many people just keep them for emergencies. When you think about the entire population, I would say there are many more people like I described above (that are at AZ all the time, or the vast majority of the time) compared to the diehard CC users like us on this forum that are almost always at AZEO or greater and occasionally arrive at AZ by chance. That being said, it does make sense to me that there would be an AZ penalty, as the majority at AZ probably aren't using their credit most of the time. I do think the point in time snapshot does suck for people like us though and hopefully with trended data being used in Fico 10 this issue can be remedied.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@909 wrote:Sounds familiar...(12-25 point drops)...

And they're back!

After losing one - two dozen points for going ALL ZERO, I got all the points back by allowing $81 dollars ($81 of $177,700 available credit and $29,700 available credit on this card) to report on one card taking me back to AZEO. This is why FICO scoring is a bit ridiculous and makes people angry or frustrated. Nothing I did over the last three weeks warranted a 25 point decrease and then increase in my credit score but the hyper-sensitive FICO model reacted as if it did. A change in score would be reasonable, but a 25 point swing for a minor change in credit activity demonstrates a failure in the process.

The algorithim is kinda dumb this way and it sucks for people in a place where capricious shifts like this matter.

That's why knowledge is power.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

system is not consistent for sure.....ive had same scenarios happen with totally different results in scores....i have thin file with 2 accts so pretty easy to keep track of....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

@909 wrote:Sounds familiar...(12-25 point drops)...

And they're back!

After losing one - two dozen points for going ALL ZERO, I got all the points back by allowing $81 dollars ($81 of $177,700 available credit and $29,700 available credit on this card) to report on one card taking me back to AZEO. This is why FICO scoring is a bit ridiculous and makes people angry or frustrated. Nothing I did over the last three weeks warranted a 25 point decrease and then increase in my credit score but the hyper-sensitive FICO model reacted as if it did. A change in score would be reasonable, but a 25 point swing for a minor change in credit activity demonstrates a failure in the process.

The algorithim is kinda dumb this way and it sucks for people in a place where capricious shifts like this matter.

correct.....pay off your balance like responsible person and BAM get nailed......leave a balance (debt) and get rewarded with pts...makes no sense

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

it is programmed to look at your reported balances. A small balance shows responsible use. No balance fails to demonstrate responsible management. A large balance shows risk.

Could it have been programmed differently? Absolutely but we’re stuck with what it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

I also think the majority of people that have CCs are not like us in this forum. Many get a card or two and just tuck them away and never use them. Some have cards for just emergencies. My parents have CCs and I know tons of people that have CCs but all they use are debit cards. These type of people I believe are what the AZ penalty is intended to target, as they literally aren't using their credit... at all in many cases.

The penalty isn't designed to be a "gotcha!" for people that constantly have balances naturally reporting but at one moment in time have all $0 balances reported. People that are using multiple cards every month that are paying off their statement balances in full (or not in full) aren't likely ever to incur the AZ penalty. I guess my point is that there's a very VERY small percentage of people that incur the AZ penalty in the way that it wasn't intended when you look at the entire population.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: All Zero balance = 13 point score drop -- An experiment report

as of 1/1/23

as of 1/1/23Current Cards: