- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- AoYA threshold question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AoYA threshold question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AoYA threshold question

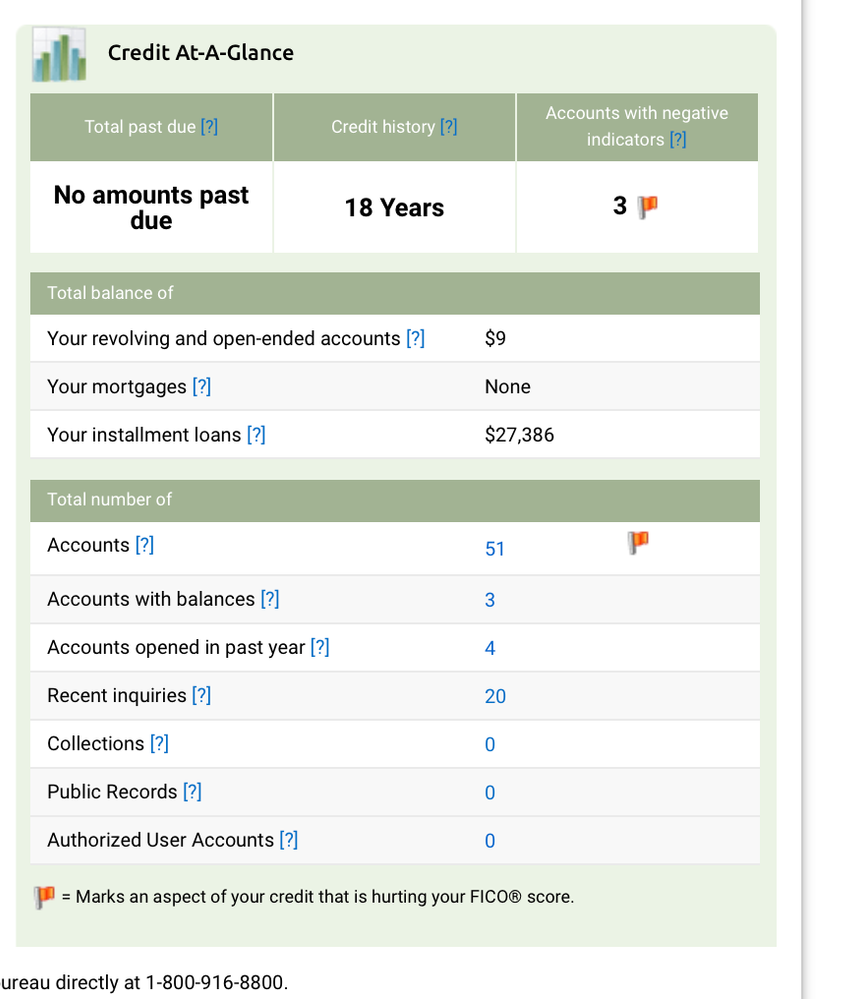

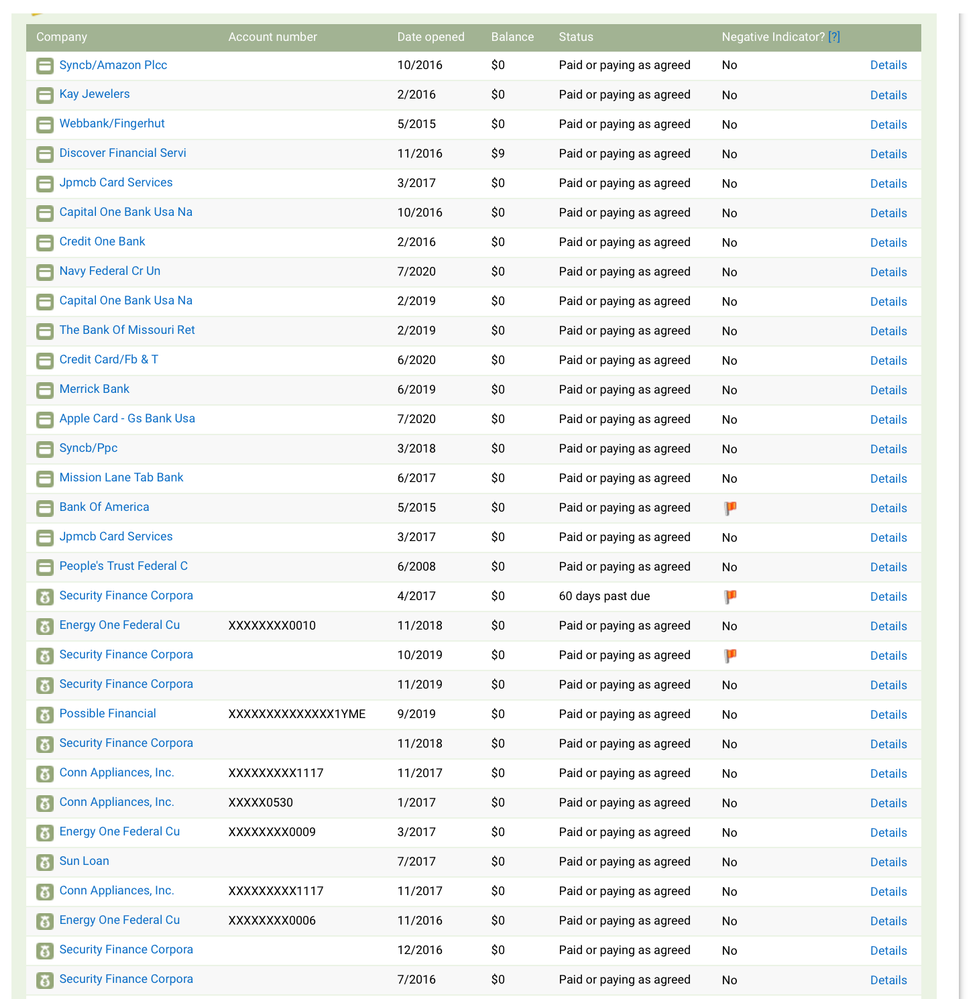

I have some anticipated improvement coming to my Mortgage Scores.. I have 4 accounts that are opened less than a year according to todays myfico pull. 1 in March 2020 One in June 2020 and 2 in July 2020. I felt the March one should be gone by now. It was opened March 19, 2020. Does it go away on the date of opening or on the month change? See below. I felt it should change at start of month.

Thanks,

Jeff

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

I hate to tell you, but for the mortgage Scores, the threshold for scorecard reassignment is greater than a year. Data points indicate the EX2 may be 17 months and we're not sure about the other two.

As for the interface telling you how many recent accounts you've opened within the last year, that's exactly what it's telling you and it has no bearing on segmentation in mortgage scores.

as for when the interface updates I'm not sure, likely when you pull your next 3B.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

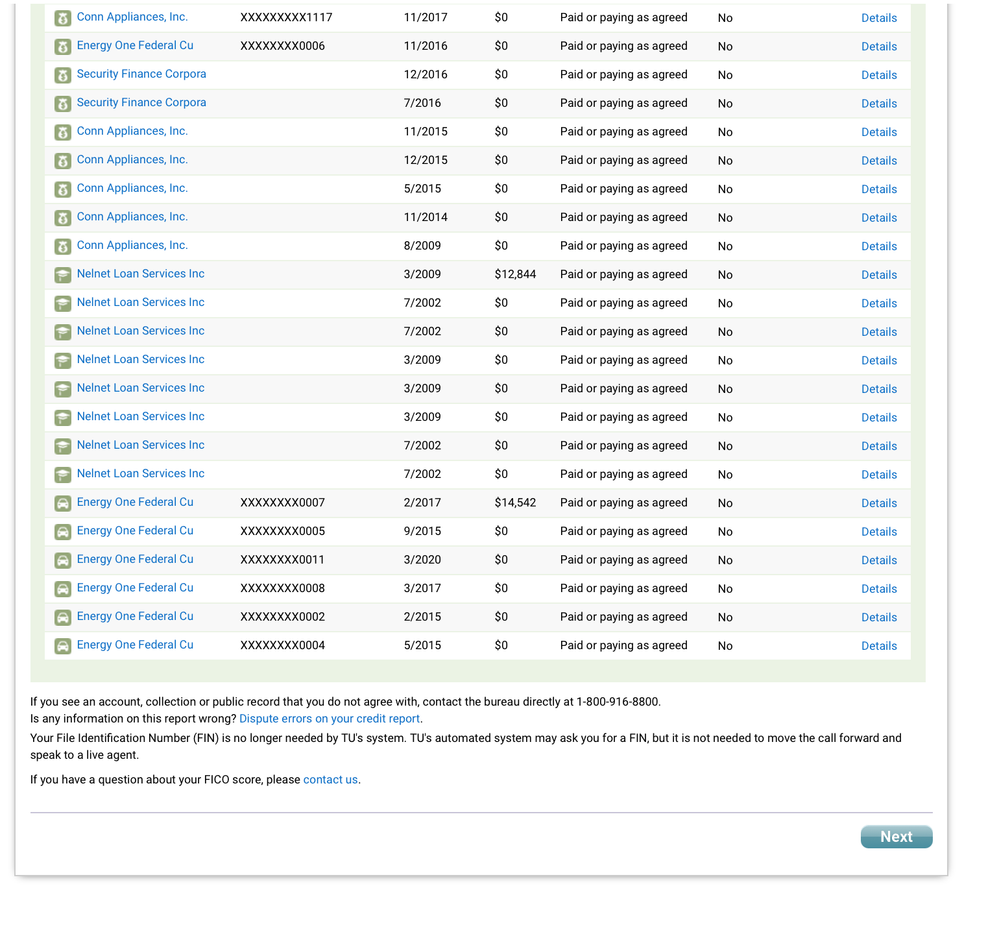

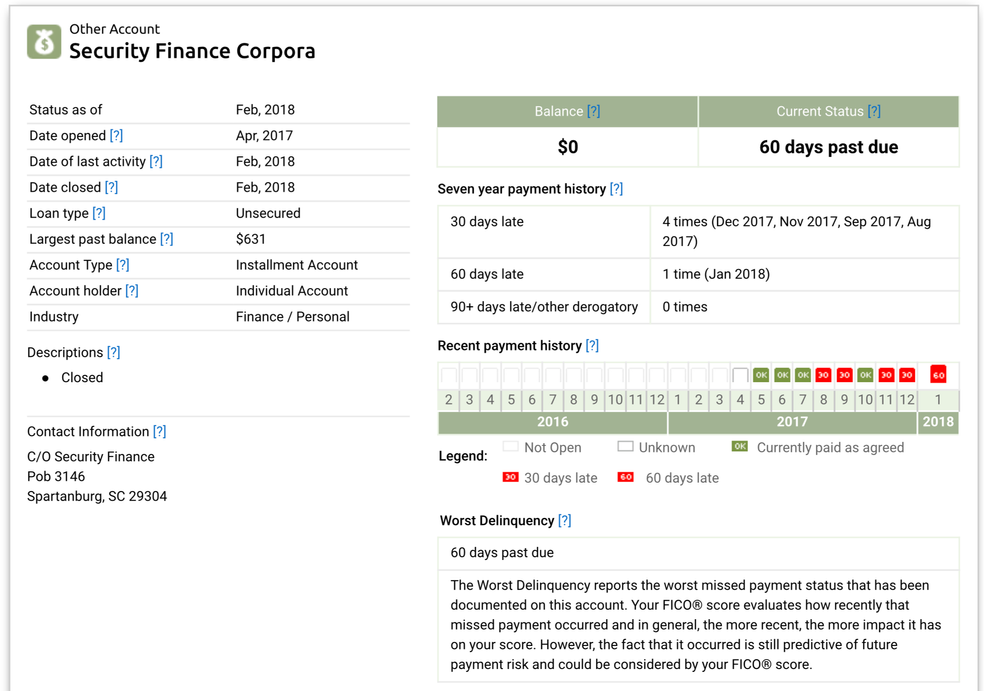

Another thing I just noticed is you have delinquencies. If you have a 60 day late or worse within the last 2 years, then you'll be in a dirty Scorecard on the mortgage scores anyway and would not experience new account reassignment. (If you have an unpaid chargeoff that is regularly updating, that will also keep you in a dirty card for other readers.)

if you do not have a 60 day late or worse within the last 2 years nor an unpaid chargeoff updating, then you would be in a clean card on the mortgage Scores and Would experience new account reassignment at the appropriate Threshold.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

@Anonymous wrote:I hate to tell you, but for the mortgage Scores, the threshold for scorecard reassignment is greater than a year. Data points indicate the EX2 may be 17 months and we're not sure about the other two.

As for the interface telling you how many recent accounts you've opened within the last year, that's exactly what it's telling you and it has no bearing on segmentation in mortgage scores.

as for when the interface updates I'm not sure, likely when you pull your next 3B.

THanks, 17 months eh? Okay good to know not to get expectations up and that by June I shall be at 700 then. Goal was 720 hoping that accounts would age a year. I do have a company working on the 2 accounts with lates that I have. Maybe if they can get those removed then I can get a bump.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

@Anonymous wrote:Another thing I just noticed is you have delinquencies. If you have a 60 day late or worse within the last 2 years, then you'll be in a dirty Scorecard on the mortgage scores anyway and would not experience new account reassignment. (If you have an unpaid chargeoff that is regularly updating, that will also keep you in a dirty card for other readers.)

if you do not have a 60 day late or worse within the last 2 years nor an unpaid chargeoff updating, then you would be in a clean card on the mortgage Scores and Would experience new account reassignment at the appropriate Threshold.

Interesting. Is this of concern then.I have no 60 da lates within 2 years. My 60 day is 3 years ago. But the Current status still reports as 60 Days late. THink this is currently reporting late?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

@UpAndComing74 wrote:

@Anonymous wrote:Another thing I just noticed is you have delinquencies. If you have a 60 day late or worse within the last 2 years, then you'll be in a dirty Scorecard on the mortgage scores anyway and would not experience new account reassignment. (If you have an unpaid chargeoff that is regularly updating, that will also keep you in a dirty card for other readers.)

if you do not have a 60 day late or worse within the last 2 years nor an unpaid chargeoff updating, then you would be in a clean card on the mortgage Scores and Would experience new account reassignment at the appropriate Threshold.

Interesting. Is this of concern then.I have no 60 da lates within 2 years. My 60 day is 3 years ago. But the Current status still reports as 60 Days late. THink this is currently reporting late?

@UpAndComing74 it's over two years, you're good on that aspect. Yeah it would definitely be better if you can get them removed because you will remain in a dirty card for seven years on 8/9 but on the mortgage Scores you returned to a clean card January 2020 I believe. Yeah the new account segmentation is 17 months or more on the mortgage Scores.

and Im sad to hear that you're paying somebody to do that when you could've done it yourself with our help as well as they could've, I guarantee you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

@UpAndComing74 by the way that 'current status' is actually showing the highest level of delinquency the account ever had.

also I may have overshot your question to begin with. You may or may not see gains for 12 months AoYA, but it will not be from scorecard reassignment relating to AoYA on the mortgage scores, if you do.

whether or not I understood your initial question correctly, I thought you were asking if you would receive points for going to a no new account scorecard on the mortgage Scores, so if that was your question, I answered appropriately.

If you were just wondering about regular AoYA Thresholds, then I just answered above: you may or may not see gains related to it. We haven't really nailed it down, but it seems like it may be tied to young/thin profiles, not really sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA threshold question

@Anonymous wrote:

@UpAndComing74 wrote:

@Anonymous wrote:Another thing I just noticed is you have delinquencies. If you have a 60 day late or worse within the last 2 years, then you'll be in a dirty Scorecard on the mortgage scores anyway and would not experience new account reassignment. (If you have an unpaid chargeoff that is regularly updating, that will also keep you in a dirty card for other readers.)

if you do not have a 60 day late or worse within the last 2 years nor an unpaid chargeoff updating, then you would be in a clean card on the mortgage Scores and Would experience new account reassignment at the appropriate Threshold.

Interesting. Is this of concern then.I have no 60 da lates within 2 years. My 60 day is 3 years ago. But the Current status still reports as 60 Days late. THink this is currently reporting late?

@UpAndComing74 it's over two years, you're good on that aspect. Yeah it would definitely be better if you can get them removed because you will remain in a dirty card for seven years on 8/9 but on the mortgage Scores you returned to a clean card January 2020 I believe. Yeah the new account segmentation is 17 months or more on the mortgage Scores.

and Im sad to hear that you're paying somebody to do that when you could've done it yourself with our help as well as they could've, I guarantee you!

Ah man!!! Dont tell me that! lol.. I have been trying since August to remove 1 30 day late from 01/2020 and 1 account wit the d60 day late. Im that close to the best position for a mid 720 for the best rate. It goes 660-719 then 720+. I have tried everything I could think of. in a panic I almost hired a hacker.. but the English was broken and it was FB so didnt trust it.. I settled for a "repair" company my mortgage lender reccommended!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content