- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Are some types of credit negative?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Are some types of credit negative?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are some types of credit negative?

I was reading a post today. There was a question about raising credit. Several people suggested a Shared Secure Loan for an installment loan. A poster said that an Alliant SSL was a consumer finance loan and they were getting dinged for it. They also said that it was hurting their credit like a subprime credit card. Is this true? I guess my question is are some types of credit considered negative to have on your report? I always thought that if you pay and pay on time any credit was good. Am I wrong?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

Credit unions shouldn't show up as consumer finance loans (like Propser, Lending Club, payday loan places, etc...). I'm not sure what the score ding is (if anything) but I know some people have had the "too many consumer finance loans" denials in the past. I do wonder if subprime lenders appearing on credit reports do actually matter. I bought something from Fingerhut back in the mid 90s and that account is still on my Experian! Looks like it got added as a new account in January 2003 when Axsys National Bank sold the account, but carried over my high balance (all $91 of it) from nearly a decade earlier. It's marked closed, but got updated in September 2013 for some reason (probably 17 or 18 years after the last/only time I used it) so I assume it's still going to be on there for another 6 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

most people including me try the Alliant SSL see about 30 points jump on their FICO

I read the whole thread with almost 1000 post, nobody mention score ding or negative impact on their CS (besides new account will shorten AAoA)

consumer finance loan would look bad upon manual review, but I do not think Alliant SSL is one of them

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

Now, for a manual review by an underwriter, they are probably more of a liability than an assert.

NFCU MR: $25K | Venture: $21K | Amex ED: $18K | NFCU CR: $18K | Amex BCE: $15K | IT #1: $17.5K | PNC Core: $15K | PPMC: $12K | Wells Fargo: $11K | Savor: 12K | Cap1 QS: $8.5K | Barclays Rewards: $7.75K | IT #2: $7.3K | MLife: $9.5K | Sportsman's Guide: $8.7K | PenFed PR: $5.5K | Elan Plat: $2.3K | TRV: $3.6K | BotW: $3K

Current FICO 8 Scores: EQ: 831| TU: 818 | EX: 809

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Creditplz wrote:

I've heard that getting loans from places like lending club, Sofi, prosper, newegg etc.... can harm your score but I'm not sure about it, (I've never had a personal loan) just CC and Auto leases.

Newegg? The tech superstore?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Anonymous wrote:I was reading a post today. There was a question about raising credit. Several people suggested a Shared Secure Loan for an installment loan. A poster said that an Alliant SSL was a consumer finance loan and they were getting dinged for it. They also said that it was hurting their credit like a subprime credit card. Is this true? I guess my question is are some types of credit considered negative to have on your report? I always thought that if you pay and pay on time any credit was good. Am I wrong?

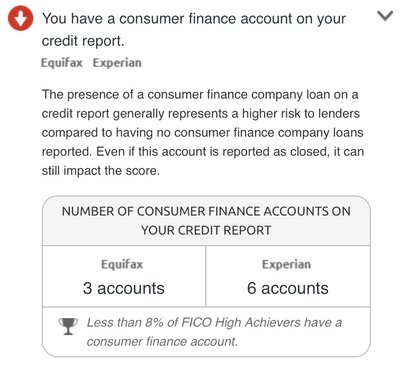

MyFICO states that a consumer finance loan can impact your score. What that impact can be is only known to them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Dalmus wrote:

For FICO scoring purposes, "sub prime" cards like CreditOne are no different than "prime" cards from Chase. I don't think a "consumer finance loan" has negative on your score, either.

Now, for a manual review by an underwriter, they are probably more of a liability than an assert.

When I had a loan from Prosper, a FICO score from TU always had the line "too many consumer finance loans" in the factors affecting your score. I just had the one Prosper loan, and I don't know if it really held down my score. Once I paid the laon off that message went away, replaced with "no recent installment loans" - I have a car loan, but it's through a small local credit union and they only report to EQ & EX. My TU, EQ, & EX scores are all pretty close, so I don;t thnk those things listed as "factors affecting your score" really affect your score, unless of course it's something major like BK, late payments, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Creditplz wrote:

Bestegg* LOL typo

OH lol