- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- CCT/Experian Reporting and Score Questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CCT/Experian Reporting and Score Questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CCT/Experian Reporting and Score Questions

I haven't been checking my score much recently because I've not done anything that would result in much change. However, I got one of those "Review Alerts" emails that was compelling enough for me to check ![]() . I was pleasantly surprised to see my Experian score went up. It seems some late payments on two accounts (both Capital One) from 2015 are gone from my report (Yay!). The late payments on both accounts were from April 2015 so I was not expecting them to come off for a few ore months. So, This brings me to my question.

. I was pleasantly surprised to see my Experian score went up. It seems some late payments on two accounts (both Capital One) from 2015 are gone from my report (Yay!). The late payments on both accounts were from April 2015 so I was not expecting them to come off for a few ore months. So, This brings me to my question.

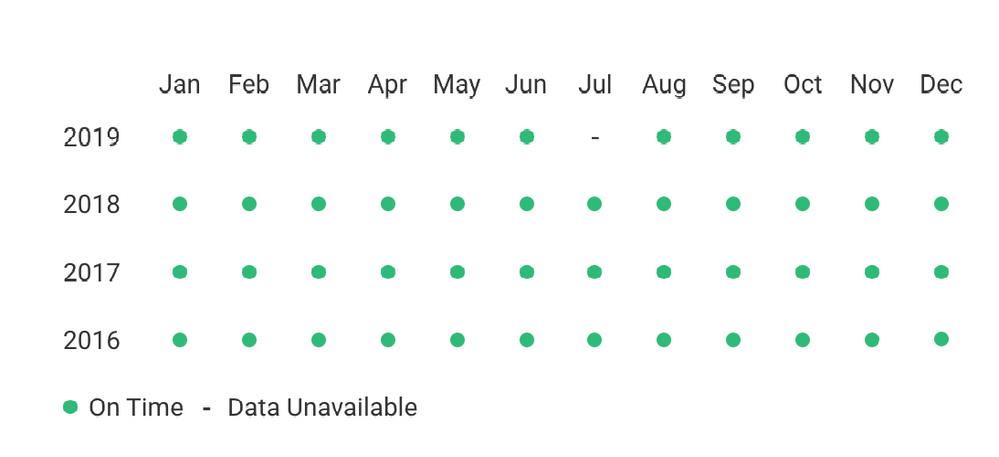

I'm trying to figure out if this is/was an Experian thing to remove them or if Capital One stopped reporting them from to all bureaus. I did a three bureau pull to check TU and EQ but the payment history chart on CCT only shows four years for TU and EQ (see pic). It shows seven years for EX only.

If anyone has insight I'd be grateful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCT/Experian Reporting and Score Questions

@Caardvark wrote:I haven't been checking my score much recently because I've not done anything that would result in much change. However, I got one of those "Review Alerts" emails that was compelling enough for me to check

. I was pleasantly surprised to see my Experian score went up. It seems some late payments on two accounts (both Capital One) from 2015 are gone from my report (Yay!). The late payments on both accounts were from April 2015 so I was not expecting them to come off for a few ore months. So, This brings me to my question.

I'm trying to figure out if this is/was an Experian thing to remove them or if Capital One stopped reporting them from to all bureaus. I did a three bureau pull to check TU and EQ but the payment history chart on CCT only shows four years for TU and EQ (see pic). It shows seven years for EX only.

If anyone has insight I'd be grateful.

I'm pretty sure it was an Experian thing.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCT/Experian Reporting and Score Questions

I don't know if it's relevant, but here are some additional DPs on weird payment history involving Experian:

Two months ago, I got added to an AU card with a 20+ year history. When it appeared on my reports, Experian showed 7 years of payment history, back to 2014. Equifax showed 4 years, back to 2017. Transunion showed 2 years, back to 2019.

That AU card made me scoreable, so I signed up for CCT and my FICO8's followed exactly the opposite of the pattern I would expect: TU > EQ > EX. Doubly strange, EX was the only one of the 3 bureaus that didn't have a hard pull. Everything else was identical.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCT/Experian Reporting and Score Questions

There has been a few posts for deleted negs on reports from some posters recently. Holiday gifts. Once the last late is reported. Its the CRA and not the creditor that removes it. Congrats!

BK Free Aug25