- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Clean score cards s*ck

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Clean score cards s*ck

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

@Anonymous wrote:

In other words you were getting a bonus, when they closed it took back the bonus, then you reported new ones which did affect average age.

I certainly wasn't under 9% at all. I had each loan between 40 and 50%. The aggregate was in the 45% range.

BUSINESS; Amex | Citi

F8 Current F8s ~750 Best Ever F8s ~775

TOTAL PERSONAL CL > $350k and TCL > $365k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

@Caught750 I really was just poking fun at you. I don't feel your pain (Im a dirty non home owner) but i certainly can empathize with you. So you were just over 800 and dropped 35 points? Well, i suppose at 1 year you'll recover some points when inquiries stop impacting score and your mortgage is a little older. It would be interesting for you to continue chronicling your journey back up. Many of us are cleaning our files and hoping to get a mortgage -I'm also waiting for these crazy CA mortgage prices to come down ...so who knows when that'll be.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

@Anonymous wrote:@Caught750 I really was just poking fun at you. I don't feel your pain (Im a dirty non home owner) but i certainly can empathize with you. So you were just over 800 and dropped 35 points? Well, i suppose at 1 year you'll recover some points when inquiries stop impacting score and your mortgage is a little bolder. It would be interesting for you to continue chronicling your journey back up. Many of us are cleaning our files and hoping to get a mortgage -I'm also waiting for these crazy CA mortgage prices to come down ...so who knows when that'll be.

Sorry, I haven't updated my signature. I was in the ~760 range and am now in the 725-730 range. It's really pretty annoying. Although the main goal, of course, has been accomplished. Mortgage was number 1 and getting some lower rate/high SL "emergency" cards was number 2. Both are done so scoring penalties are really not a huge deal. As I said, just very frustrating.

BUSINESS; Amex | Citi

F8 Current F8s ~750 Best Ever F8s ~775

TOTAL PERSONAL CL > $350k and TCL > $365k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

@Caught750 wrote:

@Anonymous wrote:

In other words you were getting a bonus, when they closed it took back the bonus, then you reported new ones which did affect average age.I certainly wasn't under 9% at all. I had each loan between 40 and 50%. The aggregate was in the 45% range.

@Caught750Didn't have to be. I shouldn't have been presumptuous, but at that magnitude I thought it was the 9% threshold. About a third of the points actually come around 65%. Plus there's alsp bonus points for time open that's lost.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

@Caught750 wrote:

@Anonymous wrote:

@Caught750 wrote:Well of course the file looks, and is, better lol! I just preferred the old no penalties card!

In reality it's as much the new mortgage reporting and new installment loans, all with 99% balances.

@Caught750 No, not really. Score 8 doesn't really penalize you for having an installment loan, it just rewards you heavily when you have the aggregate 9% or under and then it claws it back when you pay off the loan(s).

My scores tanked as two installments (paid below 50%) were reported paid off and new ones at 100% were opened. No other changes reported at the time. Just those. To the tune of 25 points or so.

Lost another 10 or so when the mortgage reported.

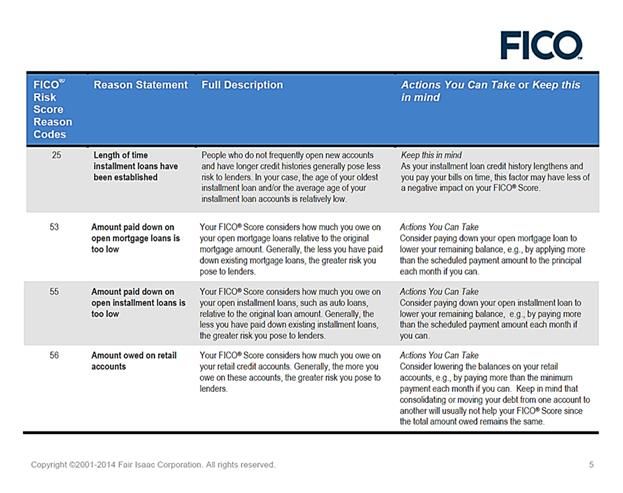

1. Fico looks at aggregate balance to loan ratio. You went from under 50% to nominally 100%. That hurt your score. There is a threshold above 50% (somewhere in the 65% to 69% based on data from a few years back). The belief that only one threshold exists - at 9% is incorrect.

2. Fico looks at age of OPEN loans as a scoring attribute (oldest open and average age of open). Dropping to zero hurt your score (code 36 - not in below paste).

3. Fico 8 looks for an active/open installment loan on file which might tie in to #2 above.

4. Fico 8 looks at age of installment loans (open + closed) as a metric with age of oldest on file being important. Your age of oldest did not change. Although closed, it is still on file (code 25).

5. Fico has specific reason statements that state mortgage or non mortgage.

The 25 point loss was due to #2 and #3 when the open loans closed (codes 36 and 55). The additional 10 point loss was potentially due to the mortgage showing up at near 100% B/L utilization (code 53).

The below paste is an excerpt from an Experian document: "Fico score Factors Guide - Experian" dated 2014. I saved a copy of the guide years ago but, can't find a link.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

Just as a DP, I lost most points on EX for fully utilized loan, EQ and TU only a few points.

Paying loan down to 90% resulted in 9 point gain on EQ, 7 points on EX, nothing on TU.

Really easy to isolate, because nothing reports within a week prior or week after the loan, MF and EX paid monitoring.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

@Remedios wrote:Just as a DP, I lost most points on EX for fully utilized loan, EQ and TU only a few points.

Paying loan down to 90% resulted in 9 point gain on EQ, 7 points on EX, nothing on TU.

Really easy to isolate, because nothing reports within a week prior or week after the loan, MF and EX paid monitoring.

@Remedios Wow that's crazy I would expect a lot more points. I wonder why you didn't get more points than that on paydown? Did you have any other loans or mortgage?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean score cards s*ck

@Anonymous wrote:

@Remedios wrote:Just as a DP, I lost most points on EX for fully utilized loan, EQ and TU only a few points.

Paying loan down to 90% resulted in 9 point gain on EQ, 7 points on EX, nothing on TU.

Really easy to isolate, because nothing reports within a week prior or week after the loan, MF and EX paid monitoring.

@Remedios Wow that's crazy I would expect a lot more points. I wonder why you didn't get more points than that on paydown? Did you have any other loans or mortgage?

Perhaps you misunderstood, I didn't pay 90% of the loan, I paid 10%

"Paid down to 90%"

Balance change from $5000.00 to 4499.00

I didn't expect any points to be gained