- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Closing the Credit Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closing the Credit Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing the Credit Cards

This year I am planning closing some of my secured credit card accounts and collapse them into 2 account. I have $38k in 7 secured cards. I want slowly close them and collapse them into 2 X 20k credit cards for making it easy to manage. Util and Available credit is not going to change. 7 Cards I have are any where 2.4 yrs to 14 months in age. Technically I am closing 5 accounts and move the funds into remaining 2 accounts. The 2 cards I am going to increase the limits are 2+ years old. If I do this what is the impact on the scores. Simulator says I would loose some points. Not sure. It does not make sense for me to leave the secured cards with high interest rates and annual fees. I would rather have the money in couple of cards with low interest and no AF and also get some interest on my money and rewards for using the cards. Any suggestions.

Come to think of it I'll be closing only 3 cards. OpenSky $5k, Merrick $5k, First Progress $5k. US Bank Alt Go $5k, TD Bank Cas $5k, US Bank Cash+ $5k would graduate at some point and I would be getting the security deposit back and move the funds to secured card. Technically my limit will go up by $15k since they became unsecure. Any way I am going to take a chance and start closing OpenSky, Merrick and First Progress and move the deposit funds into SDFCU card which will grow to $20k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing the Credit Cards

@Red1Blue wrote:This year I am planning closing some of my secured credit card accounts and collapse them into 2 account. I have $38k in 7 secured cards. I want slowly close them and collapse them into 2 X 20k credit cards for making it easy to manage. Util and Available credit is not going to change. 7 Cards I have are any where 2.4 yrs to 14 months in age. Technically I am closing 5 accounts and move the funds into remaining 2 accounts. The 2 cards I am going to increase the limits are 2+ years old. If I do this what is the impact on the scores. Simulator says I would loose some points. Not sure. It does not make sense for me to leave the secured cards with high interest rates and annual fees. I would rather have the money in couple of cards with low interest and no AF and also get some interest on my money and rewards for using the cards. Any suggestions.

Come to think of it I'll be closing only 3 cards. OpenSky $5k, Merrick $5k, First Progress $5k. US Bank Alt Go $5k, TD Bank Cas $5k, US Bank Cash+ $5k would graduate at some point and I would be getting the security deposit back and move the funds to secured card. Technically my limit will go up by $15k since they became unsecure. Any way I am going to take a chance and start closing OpenSky, Merrick and First Progress and move the deposit funds into SDFCU card which will grow to $20k.

The simulators are meaningless.

I don't see any reason why you should lose points.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing the Credit Cards

Oh so you changed your name but not your tune on your secured cards. Thought your posting style looked familar. If its got fees. Kick em to the curb. Especially the subprimes. We've discussed this before on a few occasions. Remember theres no timeline when they'll graduate. YMMV as you know. Less movement the better on the prime banks secured cards.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing the Credit Cards

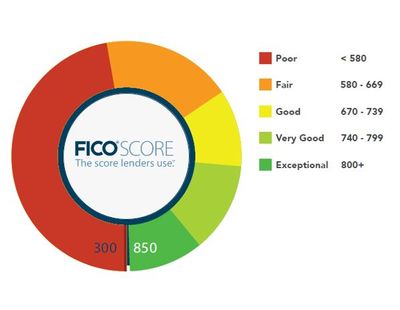

I really feel like I am walking on the egg shells. After long work finally my EX Scores reached 674/Good Rating. Yesterday, I did not realize balances on all my accounts went to $0 and AZEO took a byte at me and my scores dropped by 5 points. Now they are at 699 and rating dropped from Good to Fair. I know it will come back up again in the next few days. It just more Psychological than any thing.

I have decided to move forward with my decision and closing OpenSky/Merrick/First Progress Cards and move those funds to SDFCU and increase that secured card limit to $20k. As every one says Finance is more important than FICO. My scores might go up or down but I am going to do it so it is easier to manage my accounts and finances.

Flash back from 5 years how I felt before the things falling apart in my life. At least now, I have no debt and savings of $38K in secured cards and my destiny is more in my conrol. I do feel bummed out going from Good to Fair Credit. We will see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing the Credit Cards

Congrats on finally closing the trio out. Since you dont carry balances. If I remember in your other thread. They are at 5g's a piece. Take that 15g's and put it into your savings instead of placing in the present secured cards hoping they will graduate at the same amount. Remember once graduated. And I know your hoping so bad the CL will stay the same. They have your high secured CL amounts in their pockets knowing anything happens they're covered. Once graduated, thats gone and their's no guarantee any longer. So you might graduate as if you were never secured and that would be your new CL. Let that 15g's make money for you and not a bank.

Lenders go by scores. Not what range names are listed as. Gives the consumer an idea where they stand. The description is not the deciding factor. So its more of I cant wait to get back into the 700's.

BK Free Aug25