- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Collections and Score Volatility

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Collections and Score Volatility

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Collections and Score Volatility

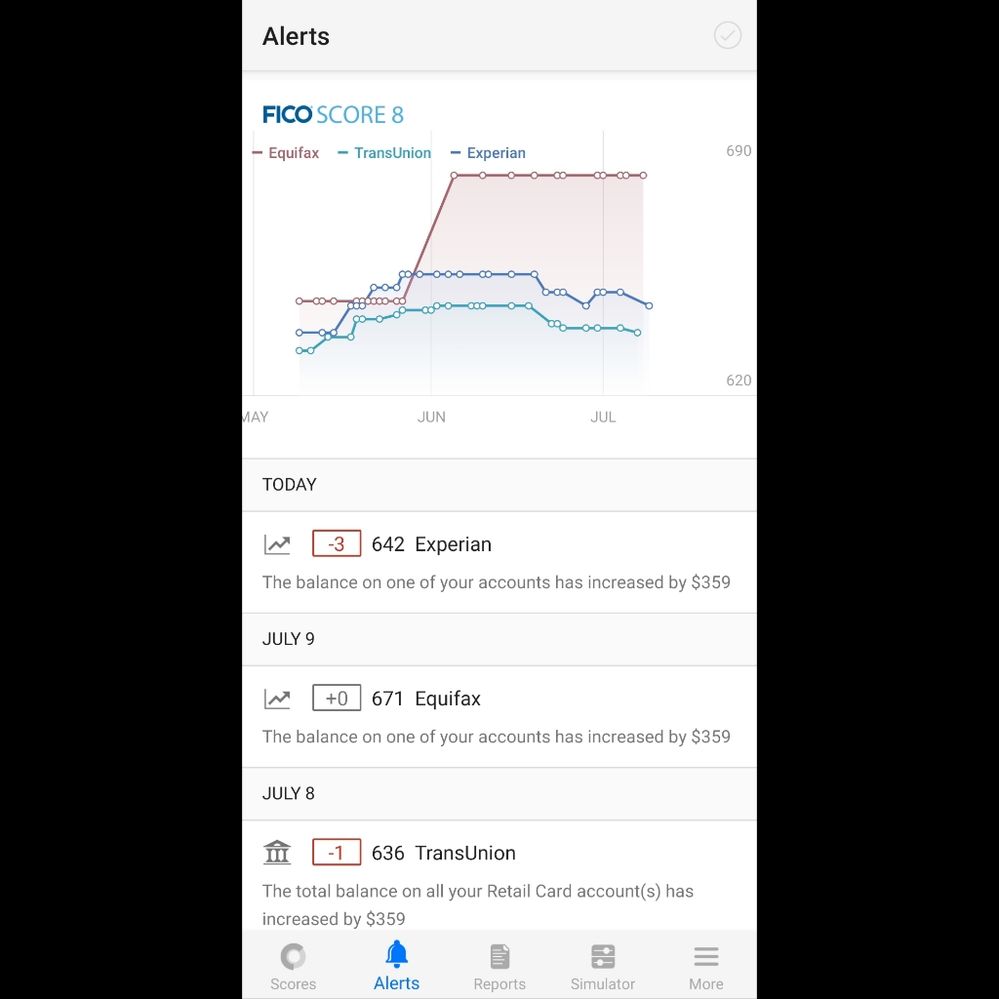

Just wanted to post something I've been watching for the last month. After paying off all my debt, I have been charging and letting balances post before paying them off. Both TU and EX have been dropping over very small amounts while EQ has held steady. The only difference is EQ does not have any collections. I have 1 chargeoff remaining and I'm curious if when I pay it off, if it will add some stability as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

@Brian_Earl_Spilner wrote:Just wanted to post something I've been watching for the last month. After paying off all my debt, I have been charging and letting balances post before paying them off. Both TU and EX have been dropping over very small amounts while EQ has held steady. The only difference is EQ does not have any collections. I have 1 chargeoff remaining and I'm curious if when I pay it off, if it will add some stability as well.

Are you saying that EQ is a clean scorecard, or are you saying that all 3 bureaus have the chargeoff while only TU & EX have collections too?

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

@SouthJamaica wrote:

@Brian_Earl_Spilner wrote:Just wanted to post something I've been watching for the last month. After paying off all my debt, I have been charging and letting balances post before paying them off. Both TU and EX have been dropping over very small amounts while EQ has held steady. The only difference is EQ does not have any collections. I have 1 chargeoff remaining and I'm curious if when I pay it off, if it will add some stability as well.

Are you saying that EQ is a clean scorecard, or are you saying that all 3 bureaus have the chargeoff while only TU & EX have collections too?

Sorry, let me clarify, all 3 scorecards are dirty. 7 late payments and 1 unpaid chargeoff. The only difference with EQ is it doesn't have any collections, paid or otherwise

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

@SouthJamaica the score jump on EQ was when my last collection was removed from it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

@Brian_Earl_Spilner wrote:

@SouthJamaica wrote:

@Brian_Earl_Spilner wrote:Just wanted to post something I've been watching for the last month. After paying off all my debt, I have been charging and letting balances post before paying them off. Both TU and EX have been dropping over very small amounts while EQ has held steady. The only difference is EQ does not have any collections. I have 1 chargeoff remaining and I'm curious if when I pay it off, if it will add some stability as well.

Are you saying that EQ is a clean scorecard, or are you saying that all 3 bureaus have the chargeoff while only TU & EX have collections too?

Sorry, let me clarify, all 3 scorecards are dirty. 7 late payments and 1 unpaid chargeoff. The only difference with EQ is it doesn't have any collections, paid or otherwise

I can only guess, but in view of the striking difference in the graph between EQ and the other 2, and the fact that the only difference between EQ and the other 2 is that the other 2 have collections while EQ does not, it sure looks like the presence of collections has had a serious impact. So I'm guessing that if you can get the collections off of the other 2, you should see comparable score gains on those.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

@SouthJamaica wrote:

@Brian_Earl_Spilner wrote:

@SouthJamaica wrote:

@Brian_Earl_Spilner wrote:Just wanted to post something I've been watching for the last month. After paying off all my debt, I have been charging and letting balances post before paying them off. Both TU and EX have been dropping over very small amounts while EQ has held steady. The only difference is EQ does not have any collections. I have 1 chargeoff remaining and I'm curious if when I pay it off, if it will add some stability as well.

Are you saying that EQ is a clean scorecard, or are you saying that all 3 bureaus have the chargeoff while only TU & EX have collections too?

Sorry, let me clarify, all 3 scorecards are dirty. 7 late payments and 1 unpaid chargeoff. The only difference with EQ is it doesn't have any collections, paid or otherwise

I can only guess, but in view of the striking difference in the graph between EQ and the other 2, and the fact that the only difference between EQ and the other 2 is that the other 2 have collections while EQ does not, it sure looks like the presence of collections has had a serious impact. So I'm guessing that if you can get the collections off of the other 2, you should see comparable score gains on those.

I've been working on it as they're workers comp. I'm ready to call up my attorney so he can have my employer, Gallagher Bassett, Sedgwick, the hospital, and UHC figure it out before I sue someone.

I just don't understand how collections would impact utilization scoring changes.

But this has me curious. I'm going to pay off my chargeoff and see what happens to EX and TU. I expect EQ to finally jump above 700 for the first time in 6 years. I'm curious if there will be a similar effect on scoring once the chargeoff is paid.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

I guess that shows a PR card is more sensitive to utilization than a delinquency card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

By the way when was the collection opened?

Wondering if it’s recent or mature PR cards?

When you pay the chargeoff, that should move you to a recent delinquency card on EQ (assuming it’s not regularly reporting and you’re not already there).

I’m not positive what will happen on the others, I think you will stay in the mature PR card, if that’s where you’re at since the PR is more severe.

Edited: I mixed up which bureaus we're on which cards I corrected it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

@Anonymous wrote:

By the way when was the collection opened?

Wondering if it’s a recent or mature PR card?

When you pay the chargeoff, that should move you to a recent delinquency card on the other two (assuming it’s not regularly reporting and you’re not already there).

I’m not positive what will happen on the other, I think you will stay in the mature PR card, if that’s where you’re at since the PR is more severe.

What's a PR scorecard?

2 of the collections are for accounts from 2014, but they showed up a couple of years ago. Probably when the 1 from 2018 started reporting because they're all with the same CA.

The chargeoff updates every month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections and Score Volatility

@Anonymous is referring to the Public Record scorecard.

When I paid off my last CO that was reporting monthly my EQ went from 667 to 708. I had no collections and was AZE2 on my open revolvers. It seems that you would be similar on EQ and should expect similar results.

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681