- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: EX AOYRA 1 year mark

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Conflated EX AOYRA 1 year mark

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

Just for the record I STILL have "length of revolving accounts" and "too many accounts with balances" as my only negative codes on TU. So the revolving reason code doesn't always go away. If the code going away is evidence than what does it mean when it doesn't?

@Birdman

Like SJ, I am not saying I disagree with your theory, my issue is with portraying a theory as fact. I am a research scientist, I have been designing, conducting and analyzing data to test theories for more than 20 years so I guess my standards on supporting data is higher than yours.

At one time the earth was believable to be flat because there was no data that said otherwise....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

@Anonymous wrote:Rev, how many points did you lose last April when you got the credit card? And how many inquiries did you have on your CR at that time?

How many inquiries did you have on the CR this time when it hit 12 months?

You know I was thinking about it. Was it version 2 or version 8 that had the oddity about the leap year, I was thinking it was 2 but maybe it was 8. Maybe it was version 8 and that’s what accounts for the discrepancy with the inquiry points.

As a matter fact, do we know binning is consistent across the cards? They could have different thresholds? How many points did you lose for the inquiry for the card last year and I’m assuming you got those points back in March? Were they the same? Or did you lose or gain points for that inquiry?

EX FICO 8: 820 -> 794 = -26 points on May 4th 2019 when the first revolver reported. At that point I had 5 scoreable inquiries, 1 auto, 2 CU, 2 national bank card. Experian doesn't make it easy to get to the other scores or reason code data but I think I might have a way to get it via direct URL which I'll check later, no time now.

It's seems fairly concrete to be counting only revolving when I had personal loan opened up (First Tech CU) in December 2018 and an auto loan from November 2018 that had both reported and I had a FICO 8 827 in January 2019 and didn't get anywhere close to that until I got to a year past the Chase/Citi opening. The last revolver I'd opened before that was in Jan 2017, and two different installment loans; explicitly the auto loan was from USBank and I think we can all agree there won't be weirdness with them like we saw with CU tradelines on EX FICO 2.

Age of revolving accounts is the reason code we're talking about here explicitly, seperate from AAOA / short credit history. Doesn't exist in any derogatory scorecards, does in the 30D and the rest of the top 8 ones.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

@dragontearsYes as a research scientist, I would imagine your standards for supporting evidence are extremely high. And I can appreciate that. Personally, one of my fields is law, where we have many standards and where are you therefore have to be able to consider different levels of standards, depending on the issue at hand. For instance, equal protection has three different standards depending on what the issue at hand is.

May I ask what evidence do you base your belief that the revolving account reason code does not go away upon?

With the compelling data of myself and a few others and with no data contradicting it, it is sufficient for me to accept until I have contradicting data. I’m aware it’s not a 99% situation, but I’ll work with it until we see something else come out thats more compelling. I believe there’s more evidence for it than against it, and since this is not an exact science and it’s all guesswork, that’s good enough for me for now. But I admit it’s not 100%.

And since were discussing it, would you mind telling me what your AoOA, AAORA, and AAOA are? Also, AoYA, if you don’t mind, I believe that was the HELOC I missed my first read. I’m assuming your file is clean and thick.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

@Anonymous wrote:

May I ask what evidence do you base your belief that the revolving account reason code does not go away upon?

The fact that it is listed as one of the 2 reason codes on my TU score....

If I can figure out how to take a screen shot with my new phone I will post the reason codes if you need it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

@dragontearsNo, I don’t need a picture just give me the exact language of the negative reason code (there are some that are similar), source, and answer my prior questions regarding your age metrics, if you don’t mind.

is it only on Trans Union? version eight?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

I need to calculate some of the aging metrics you want so will post those in a little while (I have a video call for work in 15 minutes so it might be a little while).

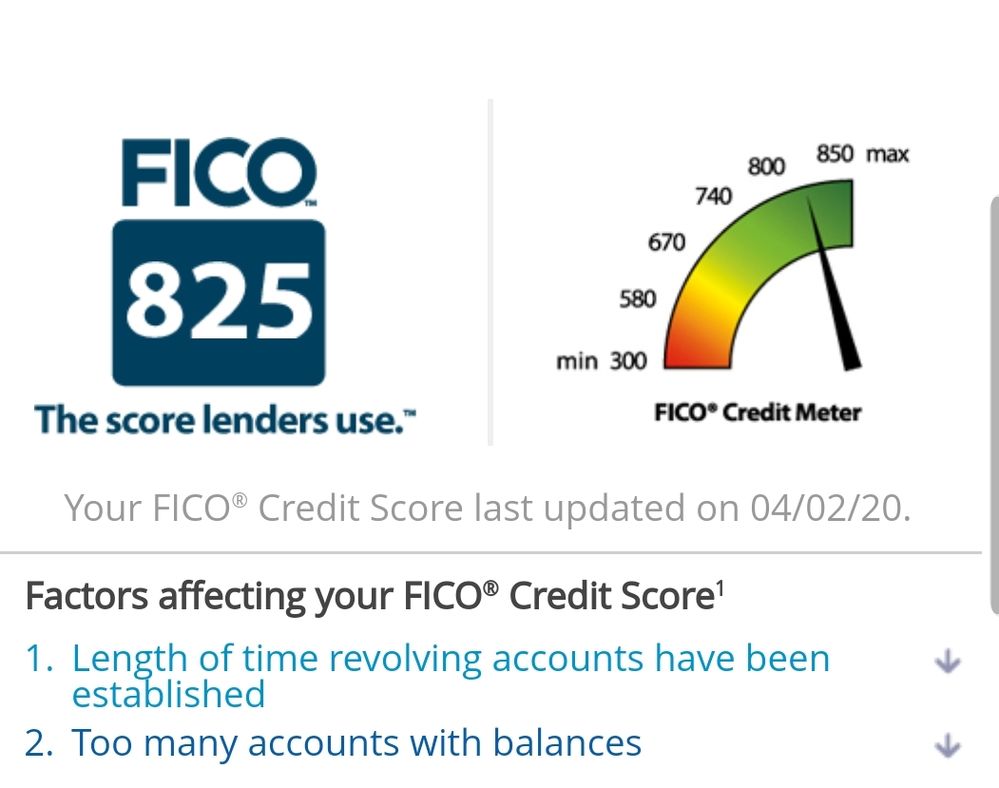

I am too lazy to type the reason code so instead (this is actually from my Barclay card as it is a more recent pull than Discover):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

@dragontearsI think (and if I weren’t on mobile I would italicize think) that code refers to average age of revolving accounts. I have no idea where the breakpoint lies for that. It was just last year we realized aging of revolving accounts solely was a thing like this, so its much its too early to have that data. I believe there’s a good chance it will disappear once your average age of revolving accounts reaches a certain threshold.

That code however is not the “revolver under 12 months” code. Obviously, you would’ve lost that code when the HELOC became 12 months of age and you got those points.

Negative reason codes are listed in order of precedence. So the first code is affecting your points the most. Some sources give two codes. I’ve seen up to four but even if you have four that doesn’t mean you don’t have more; they are potentially just not being displayed.

With that said, did you notice or do you still have access to your reason codes before and after the HELOC turned 12 months? If so, you should see the shift in negative reason codes.

I do find it interesting that that code is above "too many accounts with a balance." Do you mind sharing the percentage of accounts with the balance you have and the percentage of revolvers with the balance you have? Obviously charge cards and HELOCs count as revolvers in this context.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

Just an FYI I have been a member of this forum since 2014, I know all about reason codes and other aspects of known or theorized things that affect scores, I just don't post that much. So you can get off the teaching soapbox and converse with me as an equal. (It is possible that you don't realize it and I understand it can be hard to convey the right "tone" in writing but to me you are coming off very condescending).

For number of accounts with a balance on 4/2:

4/12 credit cards

1 HELOC

1 mortgage

1 auto

2 PL

Unfortunately, I don't seem able to go back and see previous reason codes.

All age factors I calculated in months and left the data with 1 decimal place as there have been theories on aging metrics are rounded down even though other aspects in the algorithm is rounded up.

AAoA: 72.3 months

AoOA: 270 months

AoOR: 77 months

With the HELOC as a revolver:

AAoRA: 48.7 months

AAoLoans: 104.5 months

With the HELOC as an RE account:

AAoRA: 51.4 months

AAoLoans: 96.8

Is there any other information anyone wants to know?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX AOYRA 1 year mark

@dragontears wrote:Just an FYI I have been a member of this forum since 2014, I know all about reason codes and other aspects of known or theorized things that affect scores, I just don't post that much. So you can get off the teaching soapbox and converse with me as an equal. (It is possible that you don't realize it and I understand it can be hard to convey the right "tone" in writing but to me you are coming off very condescending).

For number of accounts with a balance on 4/2:

4/12 credit cards

1 HELOC

1 mortgage

1 auto

2 PL

Unfortunately, I don't seem able to go back and see previous reason codes.

All age factors I calculated in months and left the data with 1 decimal place as there have been theories on aging metrics are rounded down even though other aspects in the algorithm is rounded up.

AAoA: 72.3 months

AoOA: 270 months

AoOR: 77 months

With the HELOC as a revolver:

AAoRA: 48.7 months

AAoLoans: 104.5 months

With the HELOC as an RE account:

AAoRA: 51.4 months

AAoLoans: 96.8

Is there any other information anyone wants to know?

@dragontears I apologize if you think my tone is condescending. It is in no way meant to be. I speak for the benefit of everyone on the forum to learn and follow the discussion. Many others are reading this and will read it in the future. That's how I learned a great deal of information is because many people had the forethought to explain things as they discussed them with other members (even though the other member may have already understood); therefore I try to afford the same utility for others in the future reading.

So please don't take offense, I mean you no disrespect in anyway. As a matter fact, I'm sure there's knowledge we both have the other may not. So I'm sure we can both learn from each other. This is not a competition to me and I'm not trying to make anyone feel any kind of way. I'm simply here to learn and help others.

IMHO, I think that reason code will disappear as you're AAORA increases (including the HELOC).