- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Could i expect a decent increase ?.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Could i expect a decent increase ?.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Could i expect a decent increase ?.

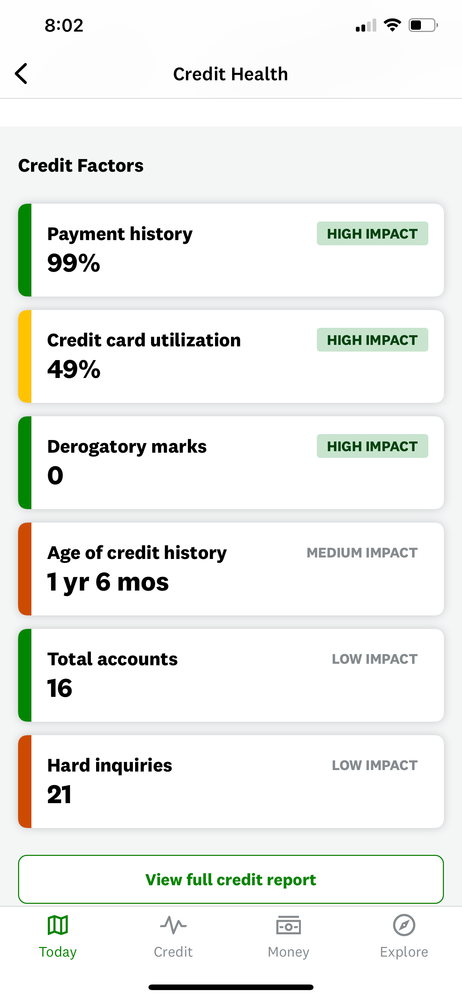

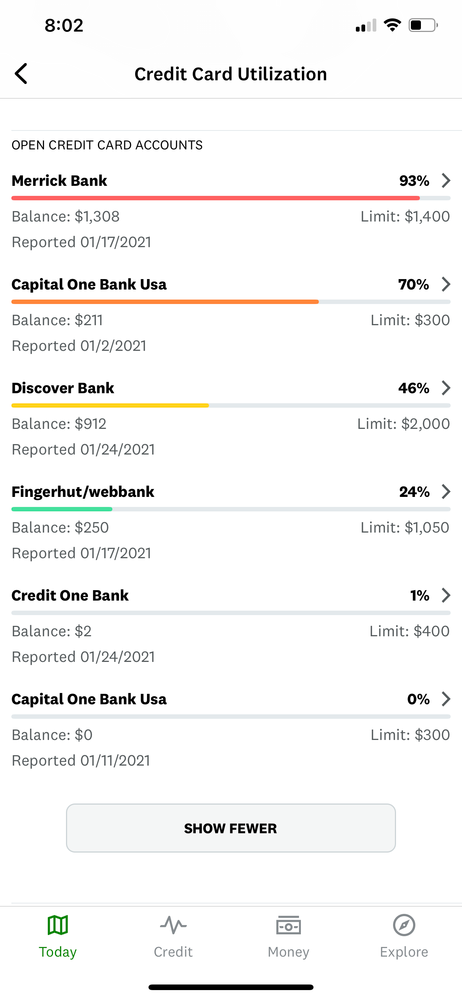

Currently at 49% of 5450$cl

if i was to drop it below 9%

of a estimate how many points could i exspect ?

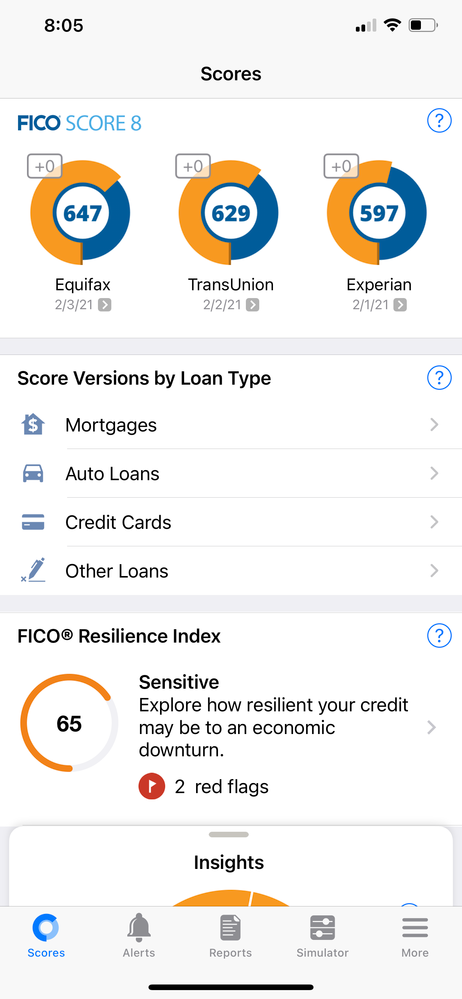

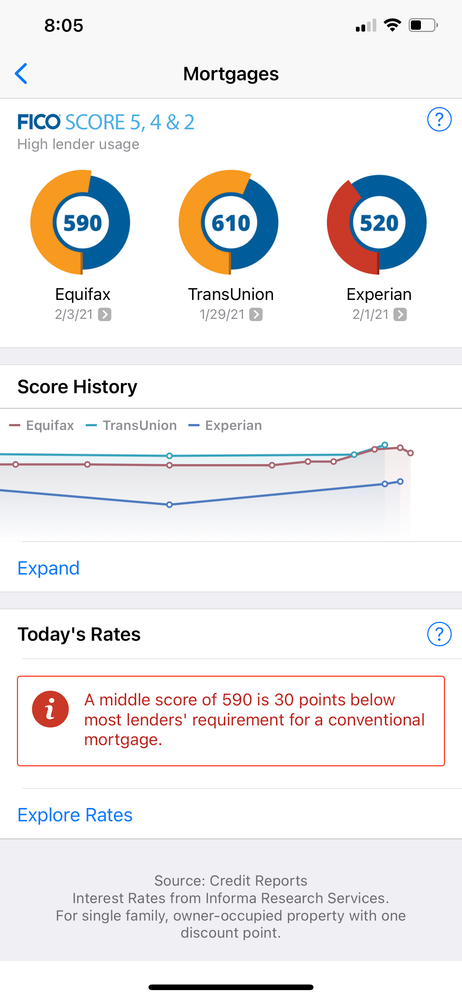

mainly hoping to boost fico 5 and mortgage scores

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Could i expect a decent increase ?.

And what would be the highest individually utilized card upon going under 9.5% aggregate? And how many cards would have a balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Could i expect a decent increase ?.

So if you were to go down to one account with a balance and both individual and aggregate utilization were under 9.5%, I would anticipate a nice increase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Could i expect a decent increase ?.

While it isn't related to your utilization question, keep in mind anything other than 100% payment history (meaning even a single late payment) can easily harm your scores as much or more than the utilization issue you are looking into. It may be worth focusing some of your effort on cleaning any dirty items from your CR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Could i expect a decent increase ?.

@amckee wrote:Currently at 49% of 5450$cl

if i was to drop it below 9%

of a estimate how many points could i exspect ?

mainly hoping to boost fico 5 and mortgage scores

Also, how old are your newest accounts?

I see 21 inquires and mortgage scores do not like new accounts.

If your newest accounts are nearing a year old, that would be good and stay away from apps for more credit in the meantime if you are wanting to get a mortgage.

How old is the most recent late?