- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Credit score decreased dramatically!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit score decreased dramatically!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit score decreased dramatically!

Hi all,

I got my first credit card (Discover with $1000 C.L.) about 6 months ago.

For the past 2 months I carried a high balance and was only able to pay about $70-100 each month.

Now CreditKarma shows that my transrisk score went down by 70 points. My score is now in the "poor" category.

It was 710 originally.

Anyway, I paid my balance in full about two days ago.

My questions: did I screw up by paying my balance all at once? How long before I see a positive change in my score?

I knew carrying a high balance was a bad idea but I had to use my card to get through summer school.

Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score decreased dramatically!

Welcome!

I can't speak to FAKOs like the Vantage or TransRisk, but per FICO scoring, paying it down at once or over time will have the exact same impact, all else being equal.

If your FICO changed, it'll rebound once your CC updates next, which would be shortly after the next statement date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score decreased dramatically!

Thanks!

So will it be possible to get most of those lost points back?

At least for the most part?

I'm concerned about my score since I will be done with college in December.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score decreased dramatically!

With everything else being equal (e.g. you don't lose accounts, add accounts, be late, etc.), those points will return once the balances come back down. FICO has no memory of your CC util.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score decreased dramatically!

But your CR does track the highest bal you've ever had on that card. Is that factored into your score or only for lender knowledge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score decreased dramatically!

@Anonymous wrote:But your CR does track the highest bal you've ever had on that card. Is that factored into your score or only for lender knowledge?

Thehigh balance only matters for NPSL CCs like Amex, or WorldPoints or Signature CCs, and that doesn't impact every FICO version. If a CL reports, then it doesn't matter. Lenders would see it, but it still doesn't matter. It doesn't give a full picture of your credit situation. Maybe you had a super-high usage for a given month, or a major purchase. Or maybe the creditor gave a CLD (like so many did) resulting in a high high balance in relation to the reported CL. It doesn't mean anything.

ETA...fun with typos.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score decreased dramatically!

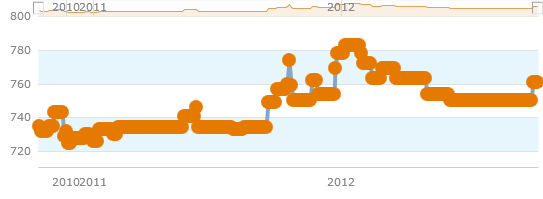

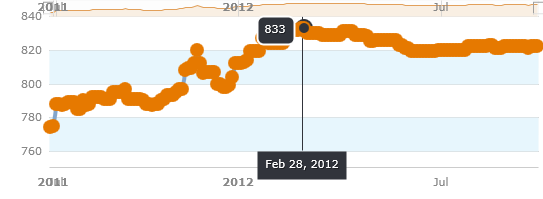

Don't wast your time tracking either of the CK Scores, they don't even agree with each other. I think it is interesting how often the consumer nonsense useless scores change compared to a score actually used by lenders.

Look at the two CK scores change over the same time period:

Compare those to actual FICO. This is a longer period. So be careful to look at date: