- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: CreditKarma - Tool Only

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CreditKarma - Tool Only

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CreditKarma - Tool Only

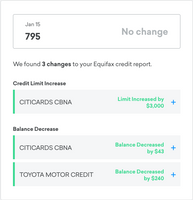

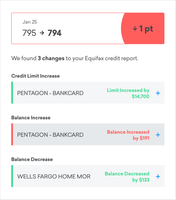

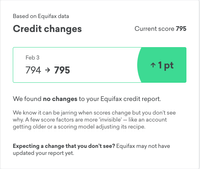

So this is why you don't really follow CK's scoring model. I found this hillarious so I took a few screen shots to share. Please don't rely on their scoring models. More than likely it will drive you insane in their MICRO adjustments. I use CK for quick references's only.

Good Luck!

Updated Feb 2023:

Citi Double Cash: $26,300

Citi Costco: $33,800

PenFed Power Cash: $50,000

Chase Freedom Unlimited: $33,400

NFCU Cash Rewards: $29,000

BoA Unlimited Cash: $99,900

Wells Fargo Active Cash: $50,000

Citi AAdvantage Executive: $30,500

Wells Fargo Mortgage 30yr fixed 3.625%

Business Cards:

BoA Business Advantage Unlimited Cash: $8,000

Chase Ink Business Unlimited: $75,000

Chase Ink Business Unlimited: $75,000

RIP: EECU PLOC | BBVA PLOC | Chase SP | Chase Amazon | Chase Freedom | WF Propel | Cap1 QS | AMEX Gold | BoA Custom Cash | Lowes | Barclays Aviator Red

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CreditKarma - Tool Only

Sure the VS 3.0 model is quite irrelevant since no lenders use it, but I'm not understanding your point with the images attached. It looks like your VS 3.0 score is remaining quite constant (+/- 1 point) due to balance changes, something that depending on your limits/utilization percentages could also very well be the case with FICO scores. If you were posting something like +85 points one month, then -92 points the next month for example I'd better understand the purpose of your post, but as of now I'm not really sure where you're going with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CreditKarma - Tool Only

It's not CK's scoring model. VS was created by the three major credit bureaus (Equifax, Experian, and TransUnion). VantageScore is managed and maintained by VantageScore Solutions and is jointly owned by the three bureaus....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CreditKarma - Tool Only

@Physh1 wrote:It's not CK's scoring model. VS was created by the three major credit bureaus (Equifax, Experian, and TransUnion). VantageScore is managed and maintained by VantageScore Solutions and is jointly owned by the three bureaus....

I don't think that's what he meant. I think he meant the scoring model used by CK.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CreditKarma - Tool Only

@CramEiko wrote:So this is why you don't really follow CK's scoring model. I found this hillarious so I took a few screen shots to share. Please don't rely on their scoring models. More than likely it will drive you insane in their MICRO adjustments. I use CK for quick references's only.

I think BBS has made a good point. Our OP seems to be criticizing Karma because it is giving updates of very tiny changes to the score -- or perhaps criticizing the model itself for fluctuating slightly due to slight changes in the report.

FICO based credit monitoring services do this too. The myFICO Ultimate for example often sends updates of tiny changes to its FICO 8 Classic score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CreditKarma - Tool Only

If you understand CK's business model, the OP's updates make perfect sense. They want you to purchase products (loans, credit cards) that they get commission on. The more often they attract you to their site, the more likely you are to see something that catches your interest and makes them money. They do that by alerting you to anything, no matter how minor. This is not really limited to CK.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CreditKarma - Tool Only

I do think there's some truth to what you said above about these free sites wanting to get people to sign in, hopefully luring them to a new product. I would think though if this were really the case of "more = more" they'd be coming up with all kinds of bogus alert "reasons" to bring people in... things like "Your Average Age of Accounts has increased!" or "An inquiry has reached 6 months in age!" or "An account fell off your report!"

There really are a million examples of alerts that could be provided to get people to sign in more often and attempt to rope them into credit products.