- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Data points on AoYA 11 months --> 12 months

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Data points on AoYA 11 months --> 12 months

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Data points on AoYA 11 months --> 12 months

Those that grabbed their credit scores just before their AoYA crossed from 11 months to 12 months and then grabbed them again after, I'm interested in hearing your score gains. Please indicate whether or not you believe your data points are clean, or if you had other factors that could have been going on impacting your score change.

It would also be extremely helpful for those that are going to chime in here to give a bit of profile data, such as whether or not your file is clean/dirty, thick/thin, your AoOA, etc. It's possible that the AoYA change from 11 months to 12 months could result in score card reassignment, which could of course impact score differently than if score card reassignment doesn't happen.

In another thread today, a member posted experiencing a 26 point gain on EX when his AoYA increased to the 1 year mark. I'd like to hear what others gained. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

I had the 26 point jump. I will include my data points here too for the sake of keeping this information in one place.

Before increase:

- Experian FICO8 score 783

- AoYA 11 months

- AAoA 4 years 11 months

- AoOA 11 years 2 months

- 3 helping reason codes

- 1 hurting reason code

After increase:

- Experian FICO8 score 809

- AoYA 12 months

- AAoA 5 years

- AoOA 11 years 3 months

- 4 helping reason codes

- 0 hurting reason codes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

Thanks for sharing your data in this thread.

As others will see, the data above also shows the poster reaching 5 years of AAoA at the same time, suggestive that there could be multiple variables at play here. In reading from at least 2 (maybe more) other members in the last few days on here that have also hit 5 years AAoA without any other factors changing, it doesn't seem that 5 years is an AAoA threshold. That being said, I'm somewhat confident that the data displayed above and snu hitting 12 months AoYA is what caused his 26 point score gain.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

@Anonymouswrote:Those that grabbed their credit scores just before their AoYA crossed from 11 months to 12 months and then grabbed them again after, I'm interested in hearing your score gains. Please indicate whether or not you believe your data points are clean, or if you had other factors that could have been going on impacting your score change.

It would also be extremely helpful for those that are going to chime in here to give a bit of profile data, such as whether or not your file is clean/dirty, thick/thin, your AoOA, etc. It's possible that the AoYA change from 11 months to 12 months could result in score card reassignment, which could of course impact score differently than if score card reassignment doesn't happen.

In another thread today, a member posted experiencing a 26 point gain on EX when his AoYA increased to the 1 year mark. I'd like to hear what others gained. Thank you.

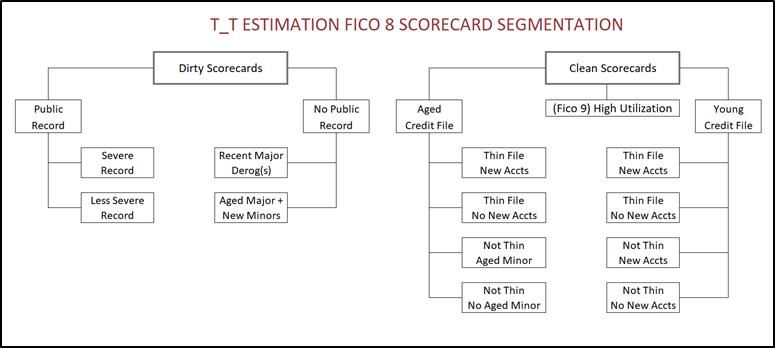

Pasted below is information on scorecards by Fico. As you can see, AoYA is a scorecard assignment factor for non-Derog files only. Also of note: for non-Derog files additional segmentation factors include: age of file (AoOA) and file thickness. AAoA is not a scorecard segmentation factor but it may impact score more/less depending on what the AAoA is and the profile's scorecard.

Another thing to consider is what scorecard a profile changes from and goes to. Going from new acct/ thin => not new acct/ thin may boost score more than going from new acct/ thick => not new acct/ thick. Same holds for going from new acct/young file => not new acct/young file vs new acct/established file => not new acct/established file.

This solictation of data will be most useful if enough detail is provided to guestimate associated scorecard.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

@rmduhonMy hubby got an 11 and 23 point jump on his EQ and TU scores respectively on the first. I can't pull a report until the 21st, but the only thing I can find us his youngest account hitting a year. He definitely didn't cross a utilization threshold and his AAoA is less than 2 years 7 months. Rwbiuld started in September of 2015 with no accounts older than that. All his reports are clean.

What was the source of those scores? Whenever I see TU and EQ listed without mention of EX, I automatically think VS 3.0 scores from CK.

I think I recall reading once that 12 months is hit at the 1st of the month once the month that the account in question is reached... is that accurate? For example, someone opened their last account on April 15, 2017. For AoYA purposes, is it April 1, 2018 that 12 months is reached and not actually April 15, 2018?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

@Anonymouswrote:

@rmduhonMy hubby got an 11 and 23 point jump on his EQ and TU scores respectively on the first. I can't pull a report until the 21st, but the only thing I can find us his youngest account hitting a year. He definitely didn't cross a utilization threshold and his AAoA is less than 2 years 7 months. Rwbiuld started in September of 2015 with no accounts older than that. All his reports are clean.What was the source of those scores? Whenever I see TU and EQ listed without mention of EX, I automatically think VS 3.0 scores from CK.

I think I recall reading once that 12 months is hit at the 1st of the month once the month that the account in question is reached... is that accurate? For example, someone opened their last account on April 15, 2017. For AoYA purposes, is it April 1, 2018 that 12 months is reached and not actually April 15, 2018?

Yes, that is accurate for aging . My first account was opened at the end of October, and it was month old on November first on all CRAs.

EQ and EX use 1st of the month as account opening date, TU lists the actual date, but aging is calculated the same.

The only reason I am mentioning TU, is if you're planning to apply for a Chase card, make sure you're under 5 on TU as they use a true date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

Good info, thanks. I opened 3 accounts on May 2 last year, so I suppose on May 1 my AoYA will hit 12 months. I'll probably pull my scores at the end of the day on the 2nd just to be sure, as it's only 1 more day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Data points on AoYA 11 months --> 12 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content